E Tax Payment Receipt Regeneration

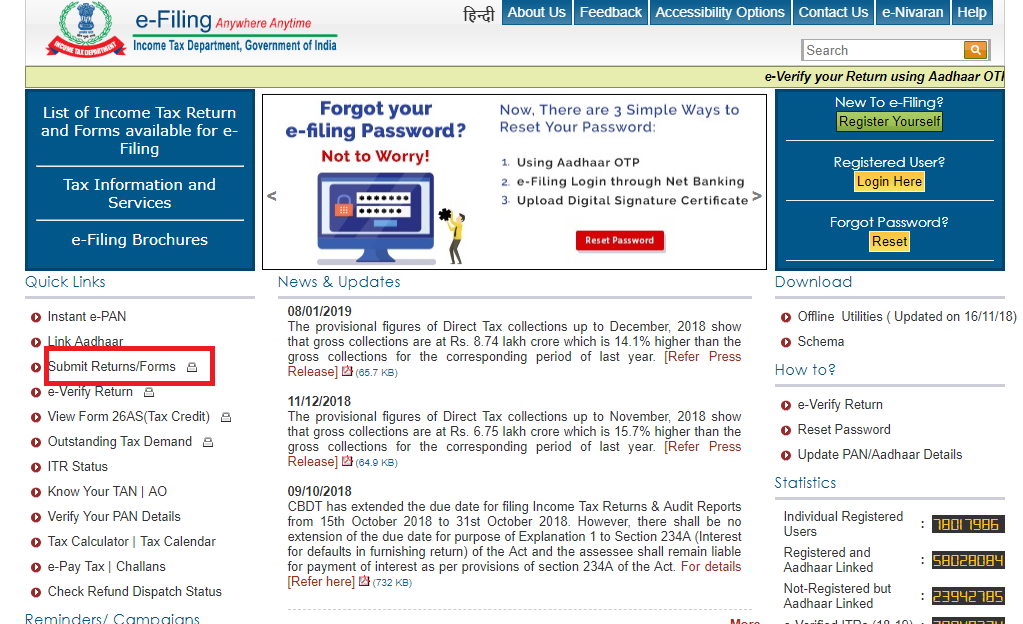

Income Tax Online Payment E Tax Payment Using Challan 280 Tax2win

Www Idbibank In Pdf Gst Inet Banking Manual Pdf

How To Regenerate Duplicate Online Tax Payment Receipt Using Syndicate Bank Internet Banking

Income Tax Online Payment E Tax Payment Using Challan 280 Tax2win

Taxes Paid Advance Tax Or Self Assessment Tax Add Entry

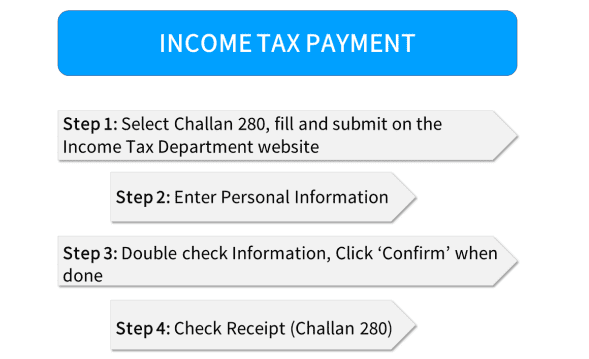

Pay Income Tax Online Taxwix Guide To Pay Taxes

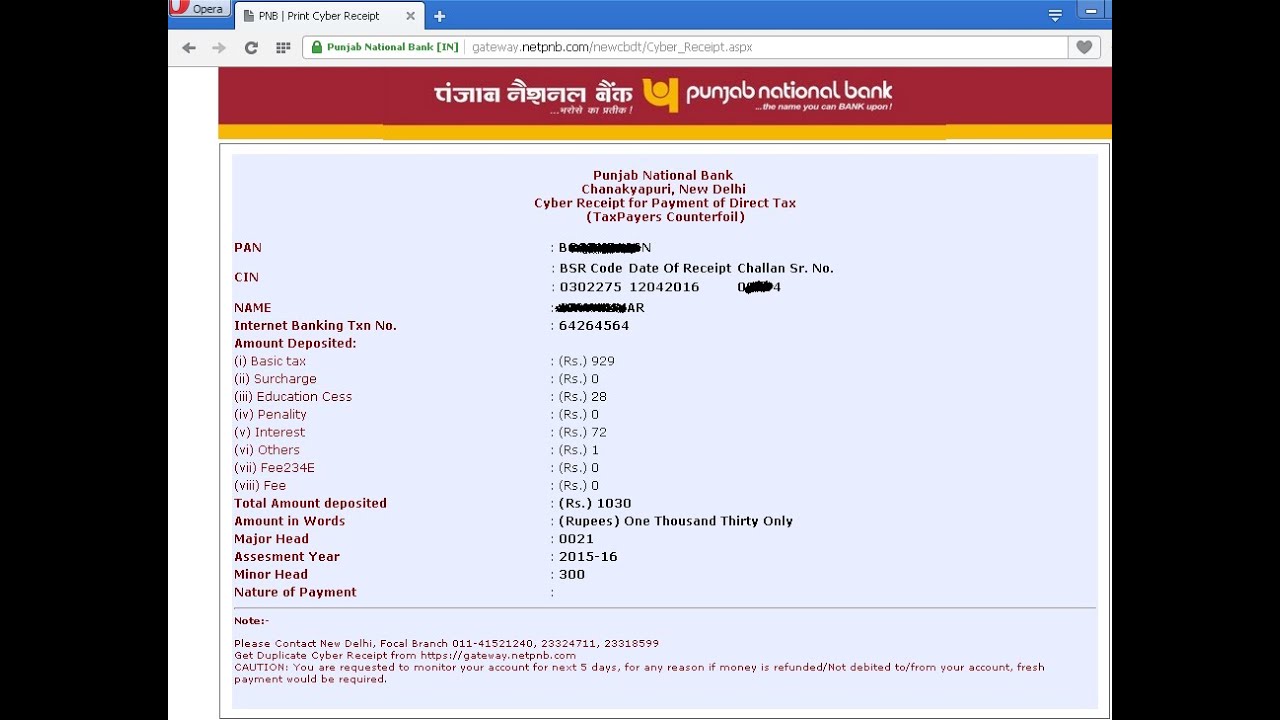

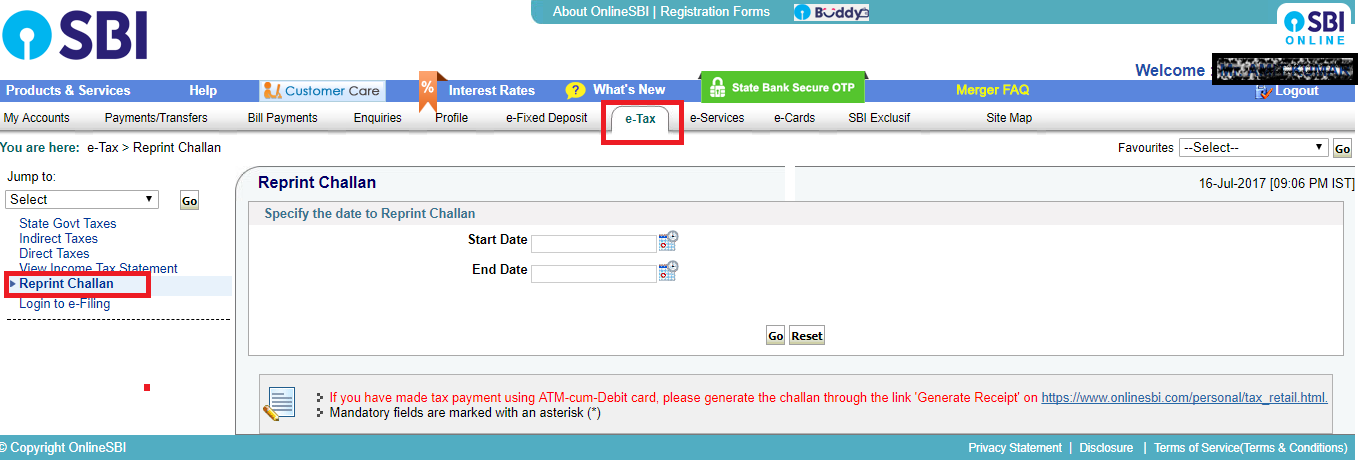

11.Tax payer can take cyber receipt print of earlier remittance by clicking the option "Regenerate Cyber Receipt".

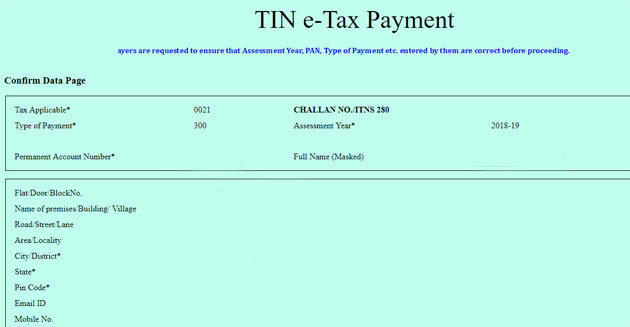

E tax payment receipt regeneration. While filing Income tax return there might be case that you need to pay additional tax. Maharashtra Sales Tax Payment. You can also request a payment plan online.

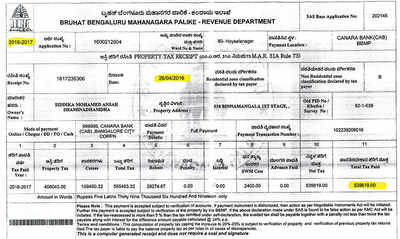

Maharashtra Sales Tax Payment. E Payment of Direct Taxes Eligibility On line :. Select the Head of Account (HOA) from the dropdown menu.

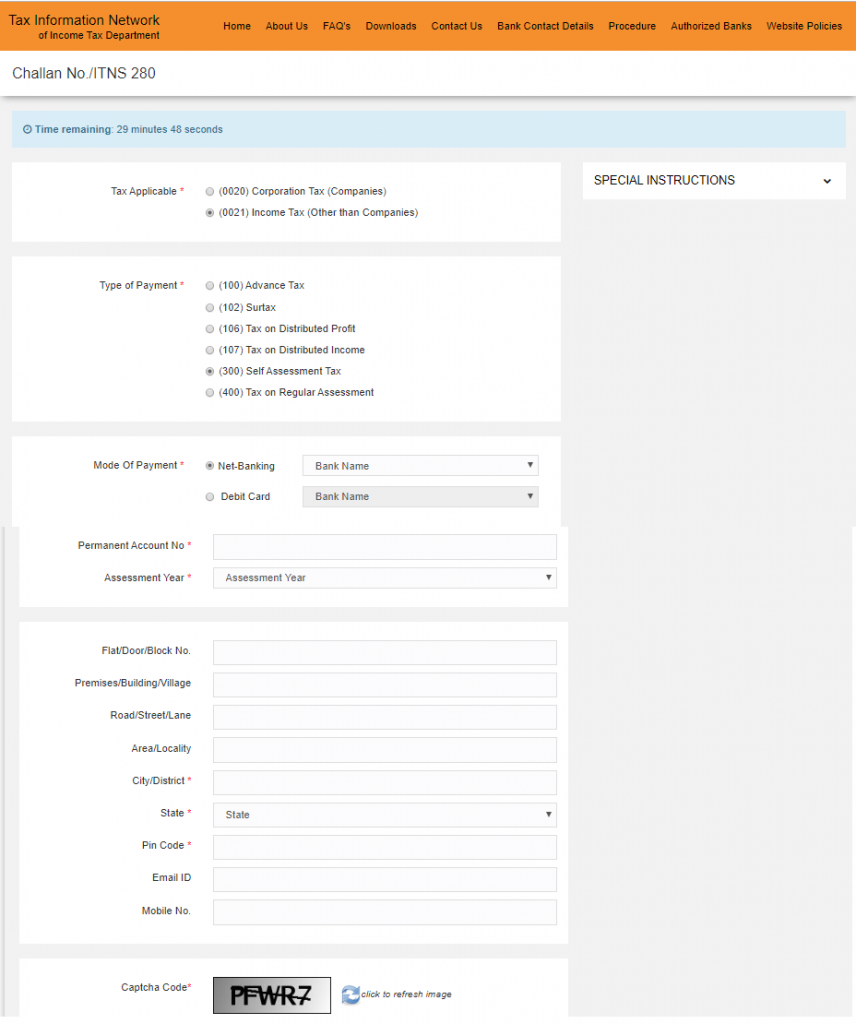

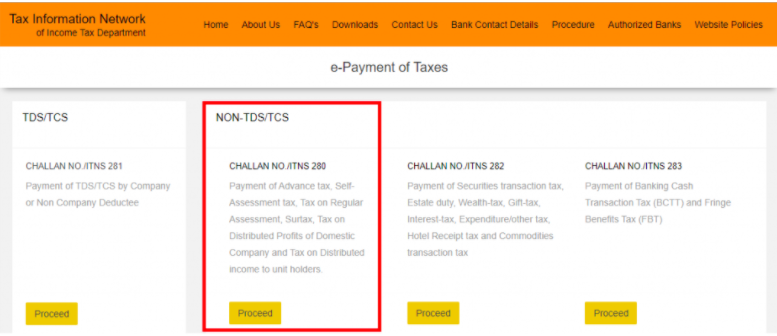

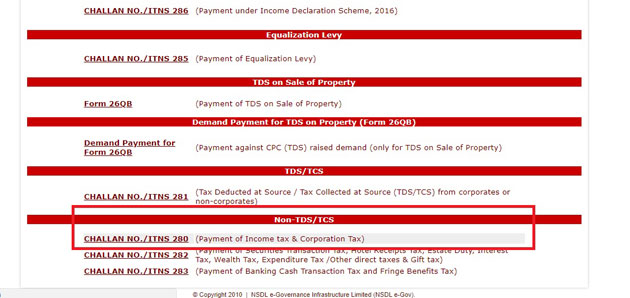

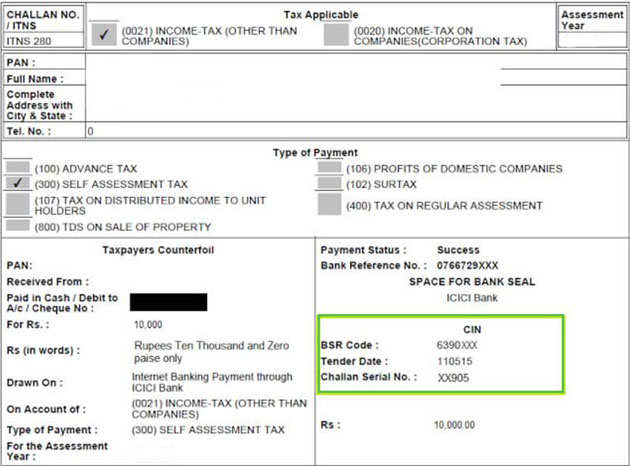

CIN is generated as reference number only for the transaction. At Bank Gateway, select Bank name. Payment of Security Transaction Tax, Hotel Receipts Tax, Estate Duty, Interest Tax, Wealth Tax, Expenditure Tax /Other direct taxes and Gift tax (CHALLAN NO.

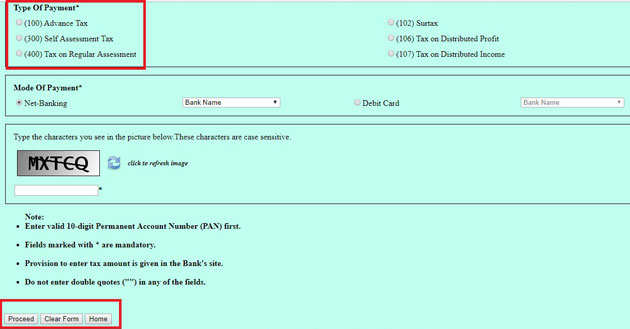

Type of Tax Locations Categories;. To avail of this facility you are required to have a Net-banking/Debit card of the selected Bank. Regeneration of challan receipt.

To file and pay Wake County Gross Receipts Tax, go to File Online Questions?. 1800-419-5959 SMS BAL to or + to get your Account Balance. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts.

Dena SMS Alert Services. Locate Us Explore More for Other Tax Regenerate Challan. If the receipt is not generated for any reason please opt for "Regenerate Receipt".

EPayment of Excise and Service Tax. This can be availed by customer of any Centralised Banking branch of the bank. Search Challan Payment History.

Make an Individual Income Payment. Explore More for Other Tax. Personal income tax preparers must file all Massachusetts personal income tax returns (i.e., Forms 1 and 1-NR/PY) electronically unless the preparer reasonably expects to file 10 or fewer original Massachusetts Forms 1 and 1-NR/PY during the calendar year or the taxpayer directs that filing be done on paper.

For using the facility the customers must be registered with Central Board of Direct Taxes (CBDT) as assessees and holding valid PAN/TAN number. Verify the details and click the confirm button. Payment Type options include:.

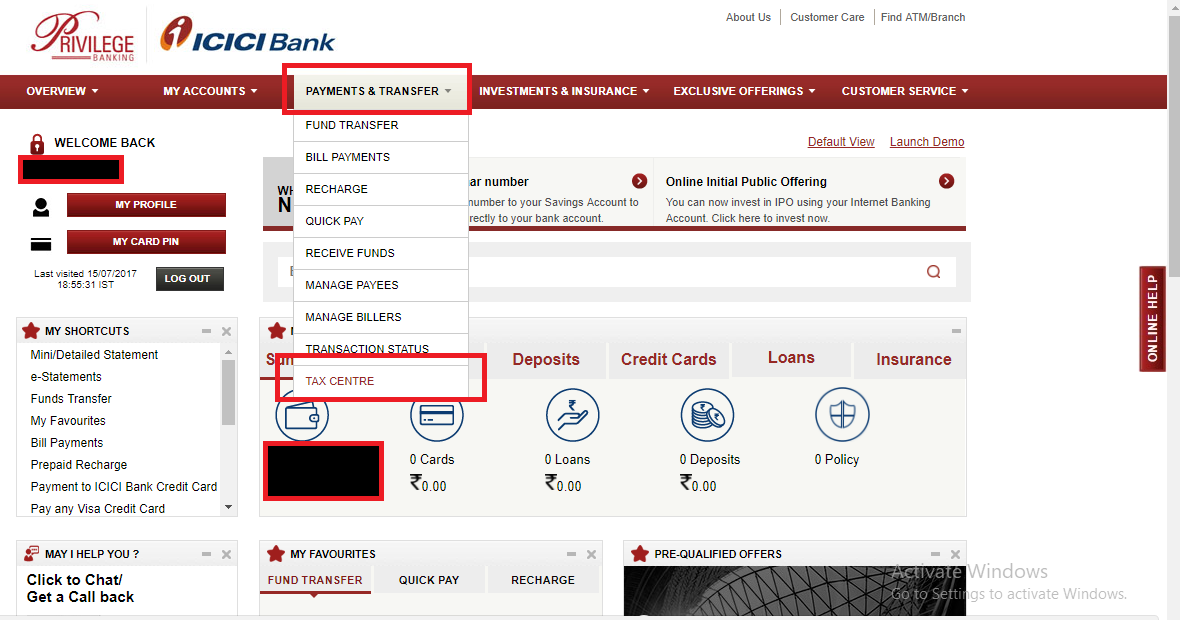

Post Login>>Click on Menu>>>Reports;. Then click on the “Make Payment”option. If payment initiated through NSDL website and then redirected to Axis Bank payment portal Click Here for CBDT e-Payments;.

For CBDT e-Payments Challan Generation. Please have your payment postmarked on or before the delinquent date. If payment initiated through Corporate Internet Banking (CIB) portal of Axis Bank Click Here.

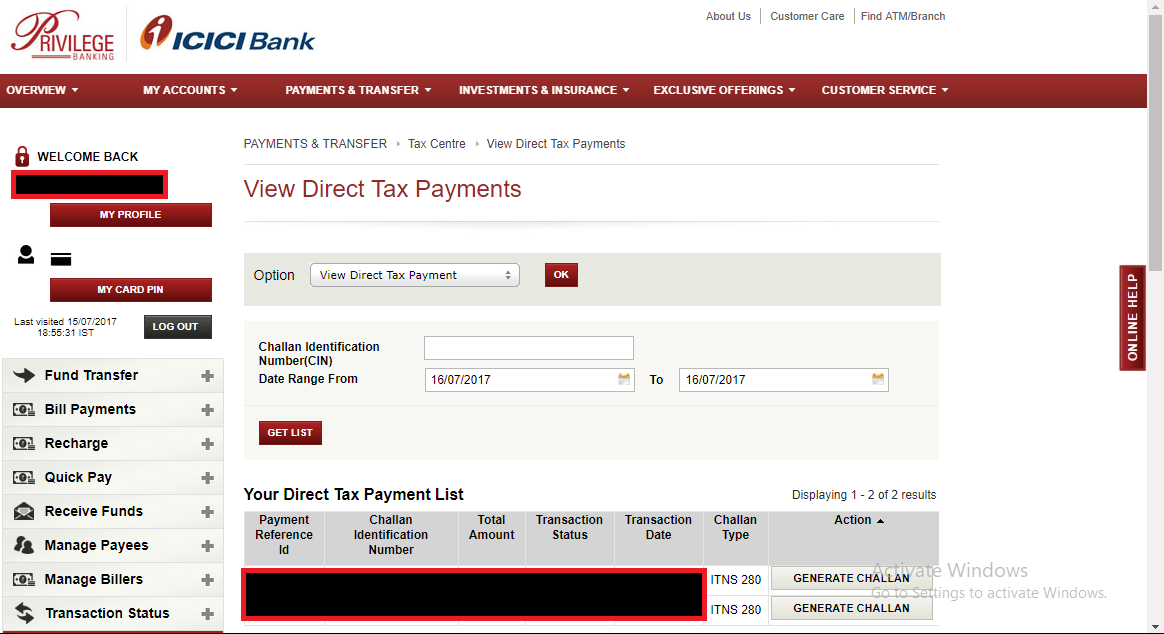

This facility is available only for the Vehicles registered and live in:-. You can get the copy of challan in Archived Payment History Tab. It depends on how you paid the taxes owed.

Challan No./ITNS 2:- Payment of Banking Cash Transaction Tax (BCTT) and FBT Fringe Benefits Tax (FBT) Form 26QB:- Payment of TDS on Sale of Property. Credit or Debit Card Payments:. Salient Features Customers can pay income tax through internet Other Requirements/Details * Visit the….

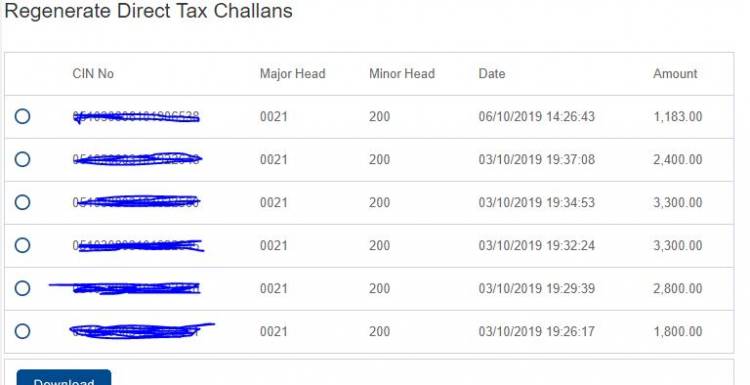

For depositing banking cash Transaction Tax and FBT:. Challan for transactions through e-payment can be re-generated where CIN has been assigned. A convenience fee is added to payments by credit or debit card.

Punjab National Bank (PNB) Duplicate Cyber Receipt. Debit Card Transaction. Click on the Link for EPayment of Direct Taxes.

To get challan Choose appropriate Challan number (ITNS 280, ITNS 281. Login to your Syndicate Bank Internet Banking or click here;. Print e- Receipt for e-PAYMENT ACT :.

All you need is your tax account number and your checkbook or credit card. 140ES - Individual Income Estimated Payments;. Fields marked with * are required.

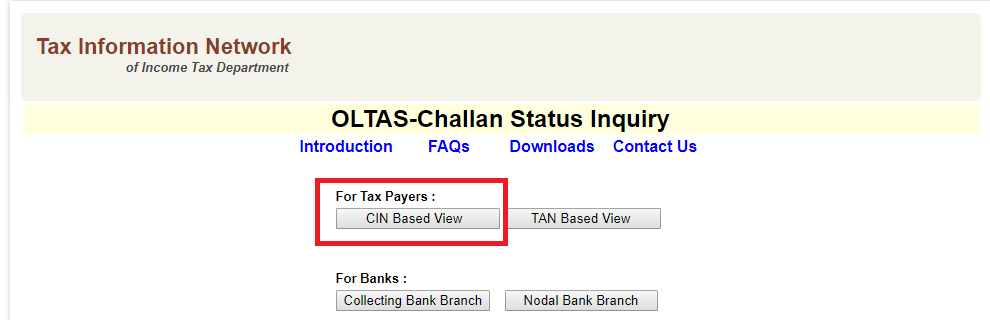

To make an e-payment for Commercial Tax, click on the link "Commercial Tax" under the "E-Payment" category. IMPORTANT NOTE • Cyber Receipts/Challans can be re-generated for all successful transactions through TIN-NSDL, where CIN been assigned. Using this features, tax collecting branches and the nodal branches can track online the status of their challans deposited in banks as follows :.

Select the date and submit;. Yes, I know my Liability Number Yes No. Challans Between 1 April 08 to 31 march 17 are archived.

Pay your taxes the smart way, on time and avoid being a defaulter. ITNS 2) PROCEDURE IN BRIEF. Select VAT CST TOT VAT/GST Entertainment Tax Profession Tax Luxury Tax Entry Tax - Vehicles Entry Tax - Goods HRBT RDCESS Select ACT.

Cyber receipt for transactions (account debited but receipt not generated) can be regenerated on the same day before cut-off (8:00 PM) otherwise such transactions will be treated as missing transaction and the amount will be credited back to the account next working day. To pay e-Tax, select the relevant challan i.e. The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail.

Assessees who want to pay their indirect taxes. The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card, bank and other financial accounts. You must either mail your payment or pay by credit card on our phone payment system at (619) 696-9994 or (855) 9-3773.

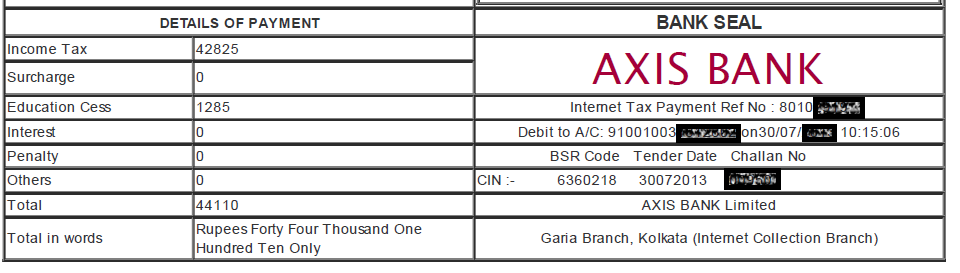

Archived Payment History Pyament Hisotry. If account is debited and receipt is not generated such transactions will be treated as missing transaction and the amount will be credited back to the account next working day. This challan acts as a receipt of payment of the tax done by you.

Businesses are required to keep receipts for proper record-keeping in order to pay taxes every quarter or at the end of each year. You may purchase duplicate tax bills for $1 at any Tax Collector's office. Then select the Link for E-Payment (Pay taxes online) 3.

To make payment visit www.mahagst.gov.in >> e-Payments. Pay, including payment options, collections, withholding, and if you can't pay. However, you can leave surcharge, education cess, interest and penalty blank.

Once the payment is cleared, Challan 280 will be generated. We have stated in an earlier post about how to pay this Self-Assessment tax using Challan 280.The problem is sometimes people forget to save the receipt and later cannot find the details to fill up in the ITR Form. Challan No./ITNS 2:- Payment of Securities transaction tax, Estate duty, Wealth-tax, Gift-tax, Interest-tax, Expenditure/other tax, Hotel Receipt tax and Commodities transaction tax.

Select the challan type as per the type of Tax required to be paid. Here, you need to enter your tax payment details like Tax, Surcharge, Interest etc. 140V - Payment Voucher for E-Filed Returns;.

The Income Tax Department NEVER asks for your PIN numbers, passwords or similar access information for credit cards, banks or other financial accounts through e-mail. You can check your balance or view payment options through your account online. Follow the Steps To download the duplicate receipt of the Syndicate Bank Online Tax Payment.

Online Tax / Payments. Download the Duplicate e-Challan. By Maharashtra Sales Tax Department (MSTD) are started from SAP based system.

19, the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California Government Code Sections 7405 and , and the Web Content Accessibility Guidelines 2.1, or a subsequent version, June 22, 19. Payment by e-check is a free service. This Website belongs to Directorate of Accounts.

EPayment of State Government Taxes. Salestax GRAS Receipt GRAPH. Pay all types of taxes - direct or indirect, income or service, state or central You no longer need to stand in queues or fill up multiple copies of tax challans or write out cheques.

Payment of most taxes needs to be originated from the government website, while some taxes can be paid directly through OnlineSBI. Click here to pay GST online Click here to pay your direct tax online. CBDT - Direct Taxes(Corporate Internet Banking) CBEC - Indirect Taxes(Shopping Mall) CBEC - Indirect Taxes(Corporate Internet Banking) GST - Gujarat VAT / Sales Tax.

The IRS does not issue receipts for tax payments. ABOUT e-Receipt 10 eReceipt module facilitates collection of tax/non-tax revenue in both online (through NetBanking & Credit/Debit Card etc.) as well as offline mode (through Challans). Distribution of Mutual Funds.

List of Branches for e-Tax Pay. Pay your taxes conveniently through us The Reserve Bank of India and the Central Board of Direct Taxes have authorised us to collect all direct taxes (Corporation Tax and Income Tax). 27 April 12 Mr Chopra, For making each payment successfully a unique sl.no.will be generated and it will appear on the receipt.By using that number either by yourself or at your VAT office it should be possible to reopen the same page of your payment receipt and then take its print.If you do not have that unique reference no get your account opened at the LVO office and get the receipt also.

In case, if you don't have user-id and password, then login with user-id as guest and password as guest. E-Payment of all Acts (Except GST) governed. • In case your account has been debited but you are not able to generate the Cyber Receipt/Challan, the same can be generated online anytime after 8.30 pm of the transaction date.

Indiana Department of Revenue is launching a new e-services portal to manage your corporate and business tax obligations. Or if you requested direct debit from your bank account, a debit on your bank statement. Pay Excise Duty, Service Tax, State tax and other Indirect Taxes through Axis Bank.

Press on the Link ‘Please Click here’. Or if you paid by credit card, a payment on your credit card statement. E-payment of indirect Taxes(Excise & Service Taxes) On-line Canara Bank provides the facility to pay Indirect taxes online.

Based on the type of payment(s) you want to make, you can choose to pay by these options:. For depositing Securities transaction tax, Estate duty, Wealth-tax, Gift-tax, Interest-tax, Expenditure/other tax and Hotel Receipt tax:. Beginning September 8, DOR is encouraging all current customers to migrate to the new and enhanced Indiana Tax Information Management Engine, INTIME.

Profession Tax - PTRC. Directly from your bank account (direct debit) ACH credit initiated from your bank account;. 4 - Individual Income Extension Payments;.

In today’s environment, receipts are mostly stored electronically and the use of a physical receipt is only used when the customer does not provide an electronic option such as e-mail. ITNS 280, ITNS 281, ITNS 2 , ITNS 2, ITNS 284, ITNS 285, ITNS 286, ITNS 287, Form 26QC, Form 26QB, Form 26QD, Demand Payment. Customers having net banking facility with us.

Liability - Payment for Unpaid Individual Income Tax;. Select the Department from the "E-Payment" menu. Choose the option ;.

Online tax payments get seamless with IndusNet. Sugarcane Purchase Tax. Challan Status Enquiry for Banks.

E-Payment of Customs Duty. We save you from paperwork and running around. E-Tax Payment facilitates payment of direct taxes online by taxpayers.

On entering the actual tax amount, a pre-confirmation page with the tax payment details will be displayed. For vehicles registered in other states,please contact with RTO of the concerned state. Post confirmation page displays a link to print or download the receipt.

Gift card, Reloadable card and Travel card. ITNS 2) Payment of Banking Cash Transaction Tax and Fringe Benefits Tax (CHALLAN NO. New users must create an e-services center account to make an EFT payment.

Pay tax online, track the tax payment and get receipts. Pay all business taxes including sales and use, employer withholding, corporate income, and other miscellaneous taxes. If the tax payer enters the amount against a CIN, the system will confirm whether it matches with the details of amount uploaded by the bank.

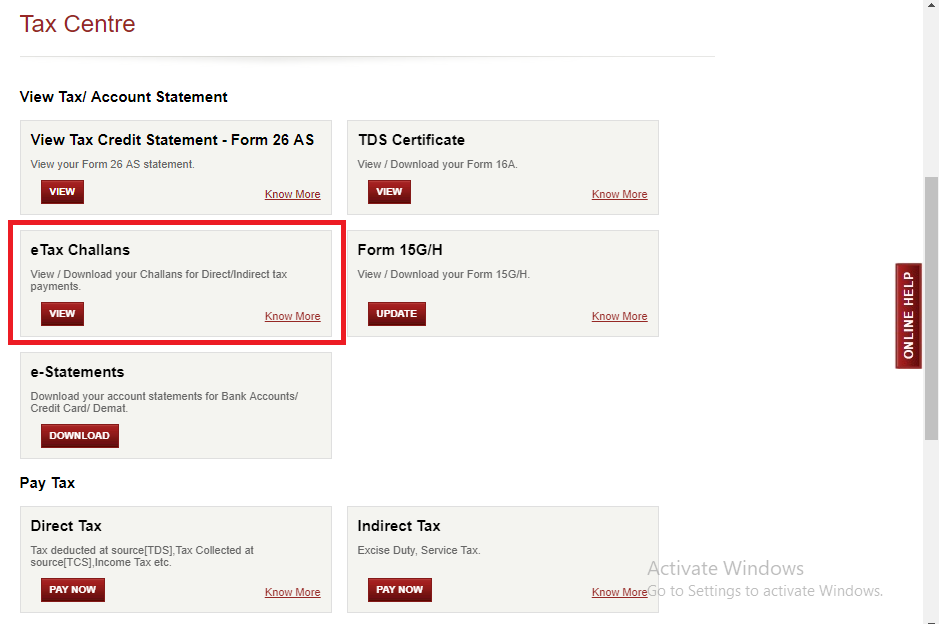

CBDT- e-payments Punjab National Bank renders its customers the facility to make CBDT payments Online. The deadline to pay 19 income taxes was July 15. You can now pay your income and corporate tax without any hassels.

Now, enter the PAN / TAN and tax details. Select details like district, office address, assessment year and tax period. Profession Tax - PTEC.

You will have a cancelled check if paid by check with a payment voucher. Generate Receipt for taxes paid through ATM cum Debit Cards. A List of all Banks offering E-Payment service (including Dena Bank) is displayed.

Direct Taxes (Click here to pay) All India (except Shillong) Tax deducted at Source (TDS), Tax Collected at Source (TCS), Income Tax, Corporation Tax, Dividend Distribution Tax, Security Transaction Tax,Hotel Receipts Tax, Estate Duty, Interest Tax, Wealth Tax, Expenditure Tax / Other direct taxes and Gift Tax, Fringe Benefits Tax, Banking Cash Transaction Tax.

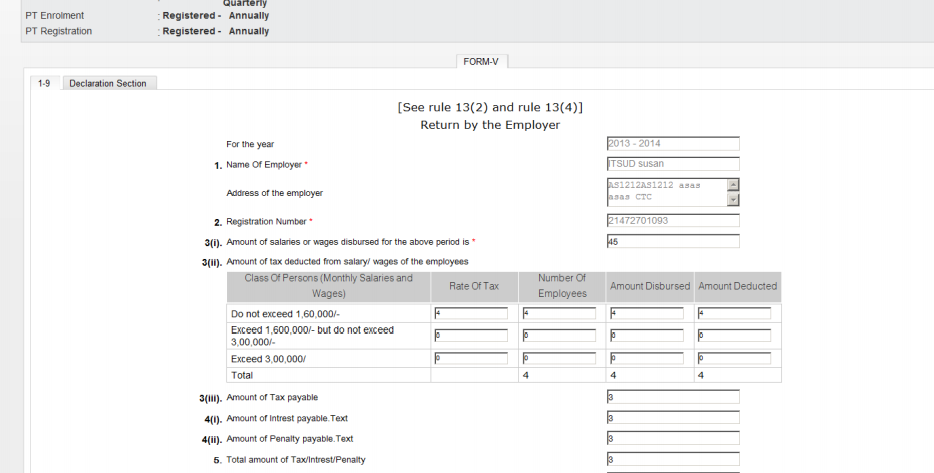

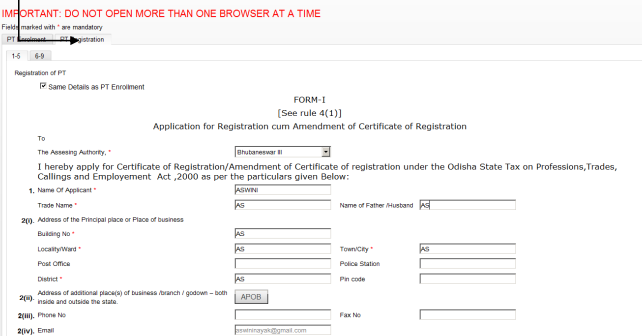

Odisha Professional Tax Registration Payment Indiafilings

Payment Receipt Template Pdf Templates Jotform

How To Track Gst Payment Status Gst Payment Failures

Get An Invoice Statement Or Payment Receipt Google Ads Help

Section 80g Deduction For Donation To West Bengal State Emergency Relief Fund

Reprint Challan 280 Or Regenerate Challan 280

Reprint Or Regenerate Challan 280 Receipt

Reprint Or Regenerate Challan 280 Receipt

On Line Tax Accounting System Oltas General Challan Used Tax Deposit E Tax Payment Faq Accounting Taxation

Reprint Challan 280 Or Regenerate Challan 280

E Fbr Gov Pk Sop Sidelinks Detailed Guides Epayments taxpayer guide Pdf

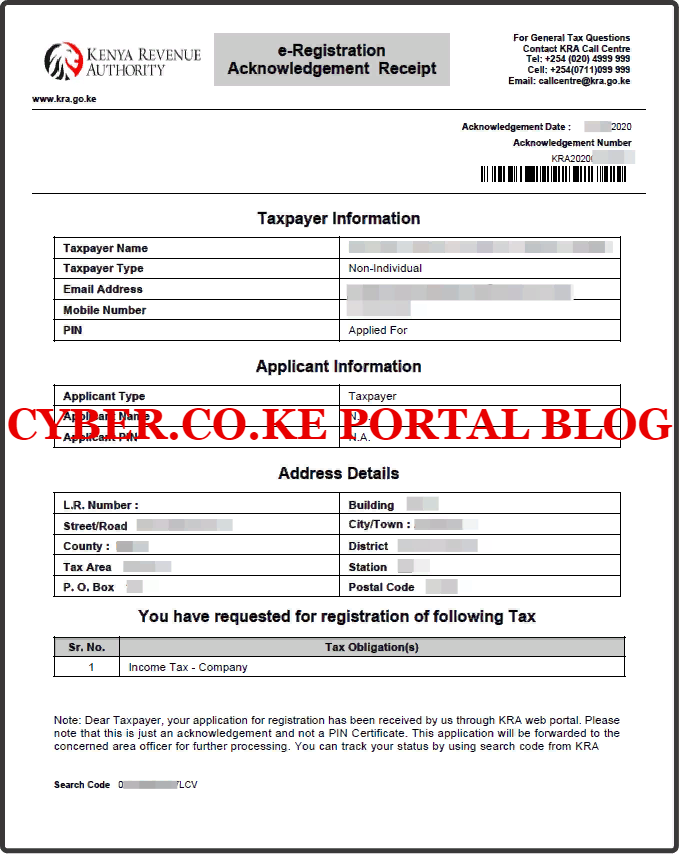

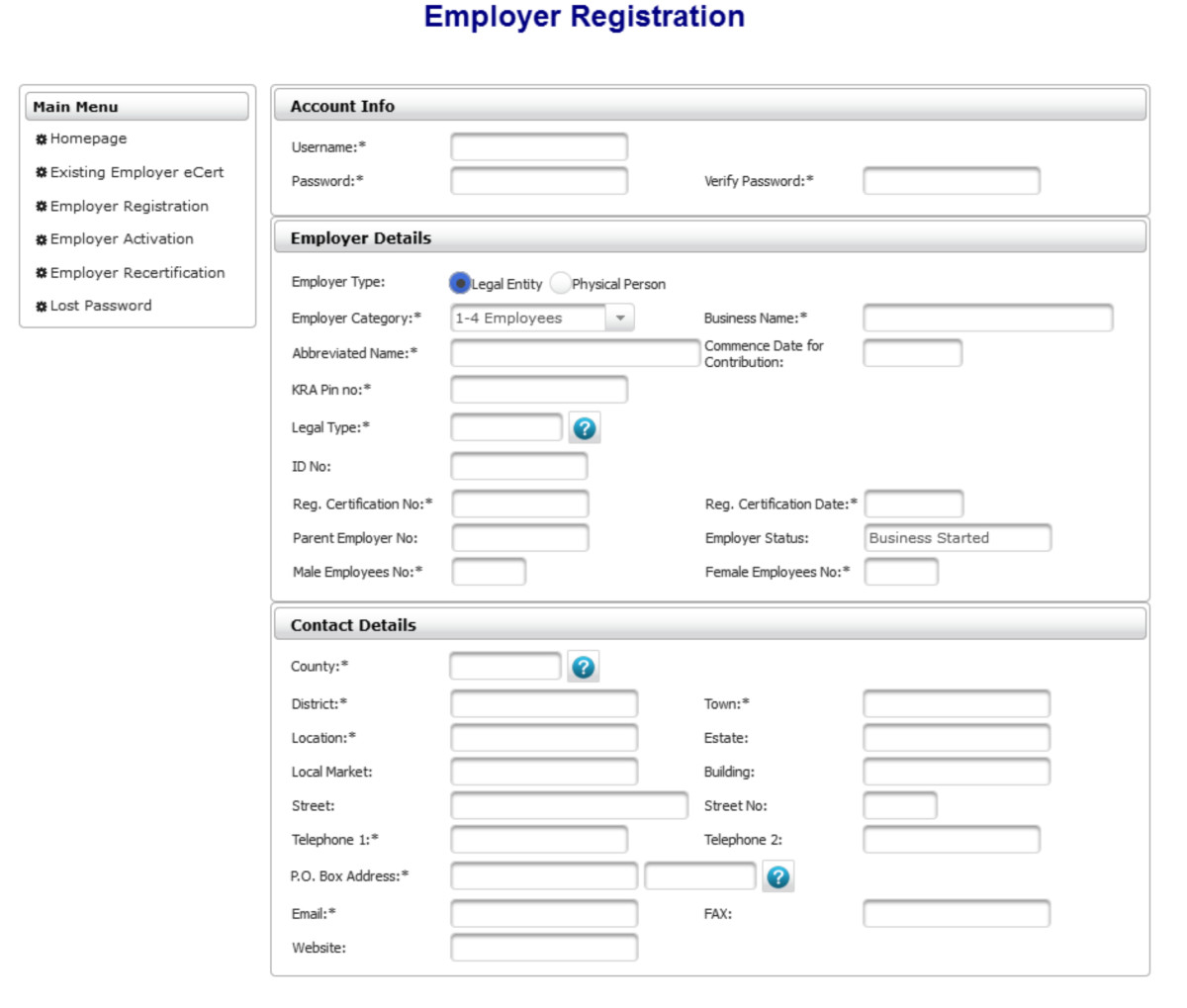

How To Reprint Kra Acknowledgement Receipt Using Kra Itax Portal Cyber Co Ke

Challan 280 Income Tax Online Payment Using Challan 280 Itns 280

Www2 Deloitte Com Content Dam Deloitte Pk Documents Tax Budget 21 Highlights Comments Deloittepk Noexp Pdf

How To Make Online Payment Of Income Tax Youtube

How To Regenerate Tds Or Income Tax Payment Challan From Hdfc Bank Net Banking Profzilla

Cheque Lost But Tax Paid That S How mp Collects Revenue

Income Tax Payment How To Pay Taxes Online And Offline

Income Tax Payment How To Pay Taxes Online And Offline

Pay Income Tax Online Taxwix Guide To Pay Taxes

Government Of Maharashtra Department Of Sales Tax Payment Of Profession Tax Luxury Tax Sugarcane Purchase Tax And Entry Tax On Goods Through Government Ppt Download

Receipts

How To Pay Taxes

V1 Hdfcbank Com Assets Pdf Retail Process Pdf

How To Assign Customer Receipts Against Invoices While Customer Payment Sap Blogs

Pdf E Return Acknowledgment Receipt Personal Information And Return Filing Details Wiki Wendoh Academia Edu

Income Tax Payment How To Pay Taxes Online And Offline

How Can I Pay My Income Tax Online Taxaj

How To Download Lic Premium Payment Receipt Certificate Online

_banner_v3-(1).jpg)

Cbdt Re Generate Cyber Receipt Axis Bank

Online Payment Of Profession Tax In Maharashtra Vakilsearch

Challan 280 Income Tax Online Payment Using Challan 280 Itns 280

How Do I Get A Receipt Or Invoice How Can We Help

Reprint Or Regenerate Challan 280 Receipt

How To Pay Taxes

How To Get A Copy Of A Challan For Income Tax Paid Via A Debit Card Quora

Hsbc Net Banking Registration Login Reset Password Download Bank Statement Tax Payment E Verify Itr

Your Council Tax Bill Explained

How To Pay Your Income Tax Using Challan 280 Articles Globallinker

3

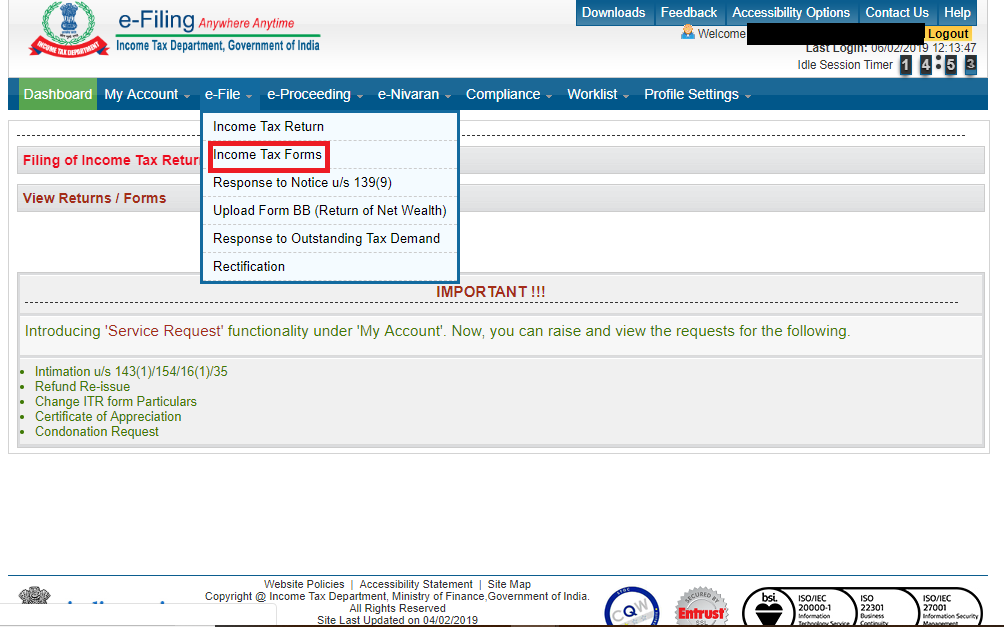

Section 12a Income Tax Act How To File Form 10a Online Paisabazaar Com

Income Tax Payment How To Pay Taxes Online And Offline

Steps To Download Lic Premium Payment Receipt Online Basunivesh

How To Pay Direct Taxes Online By Union Bank Of India

How To View Saved Challan Gst Challan Format

V1 Hdfcbank Com Assets Pdf Process Pdf

Income Tax Challan 280 In Word Format Download

How To Print E Receipt For Sbi Ppf Account

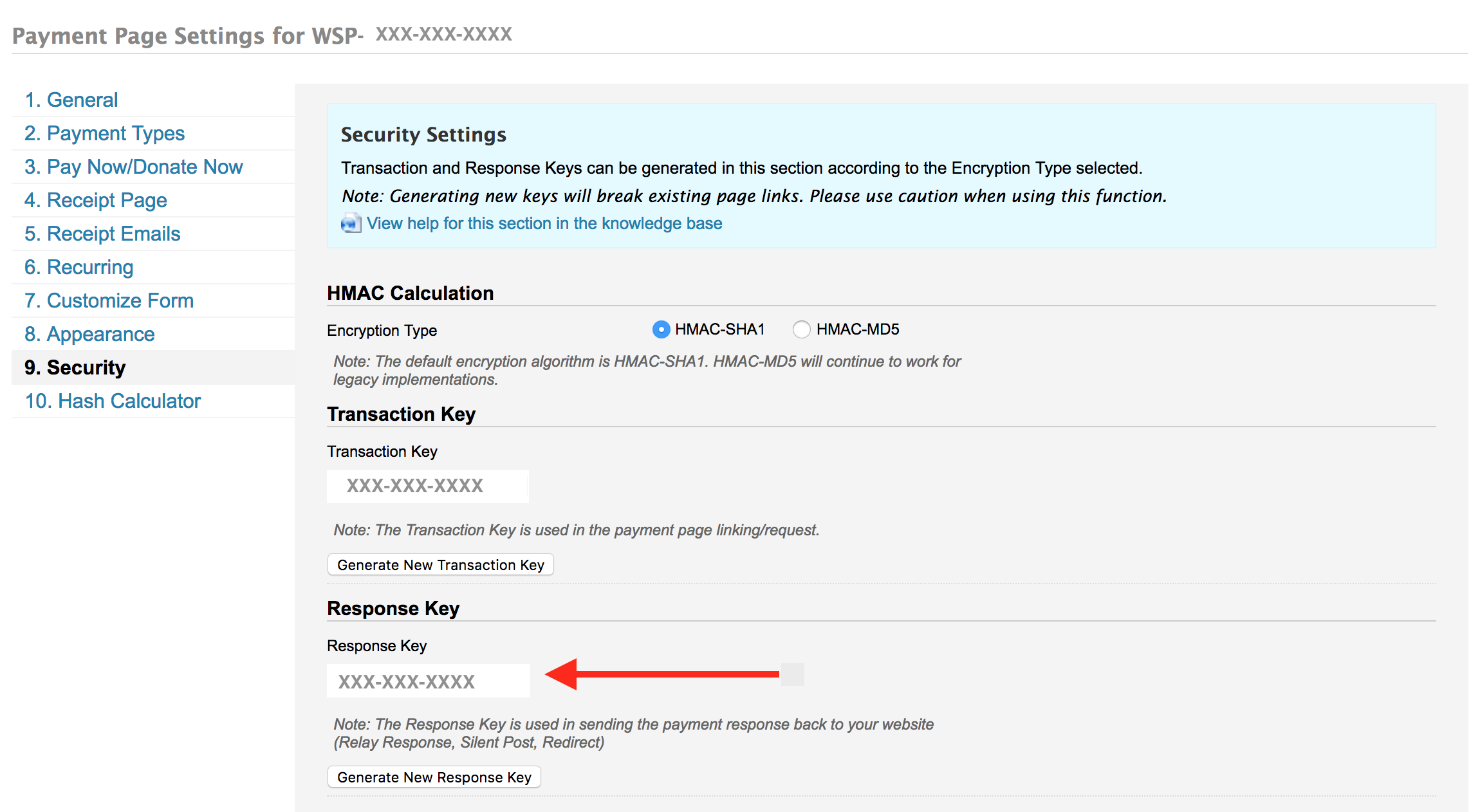

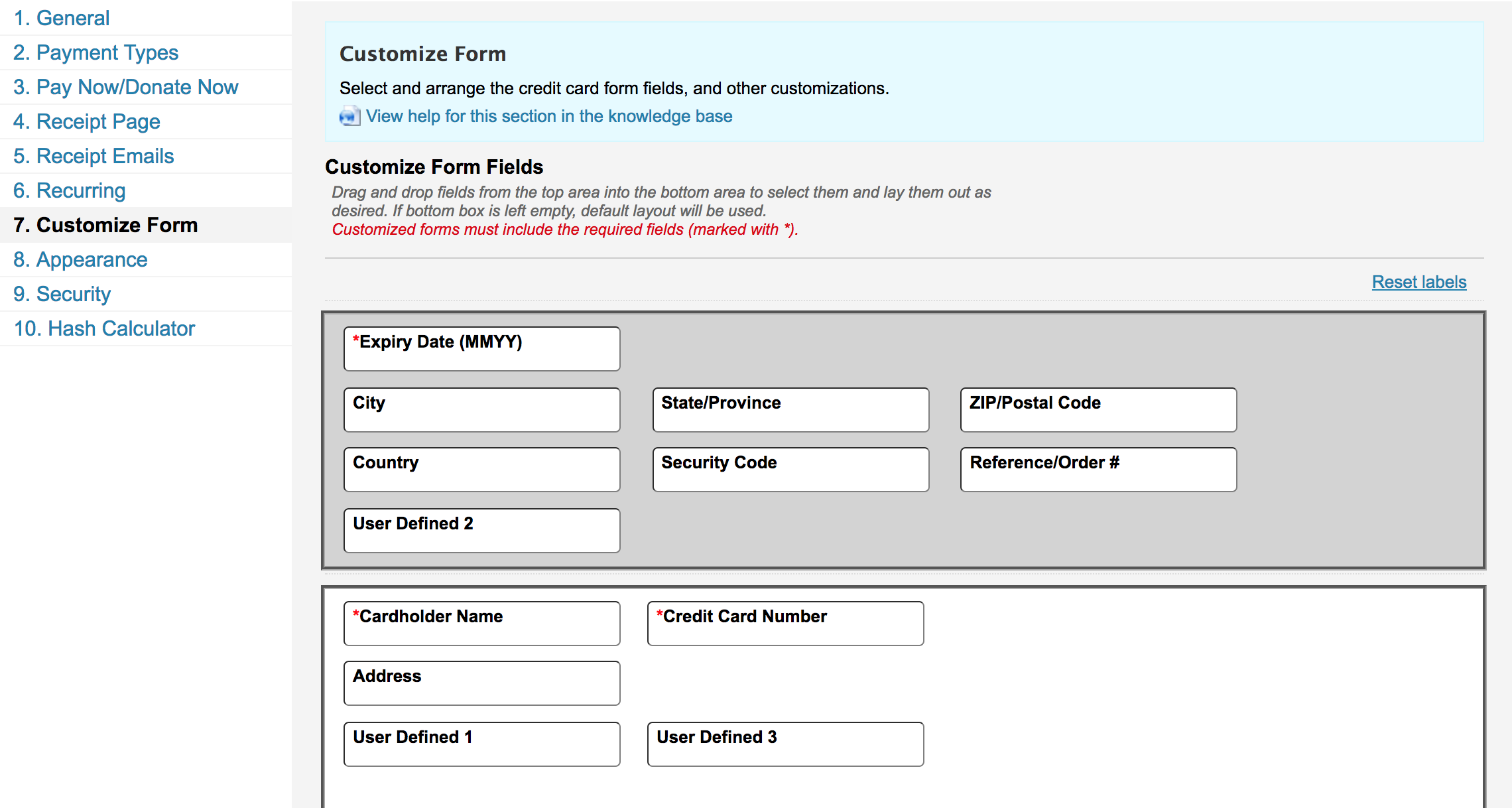

Hosted Checkout Payment Pages Integration Manual Payeezy Knowledge Base

Home

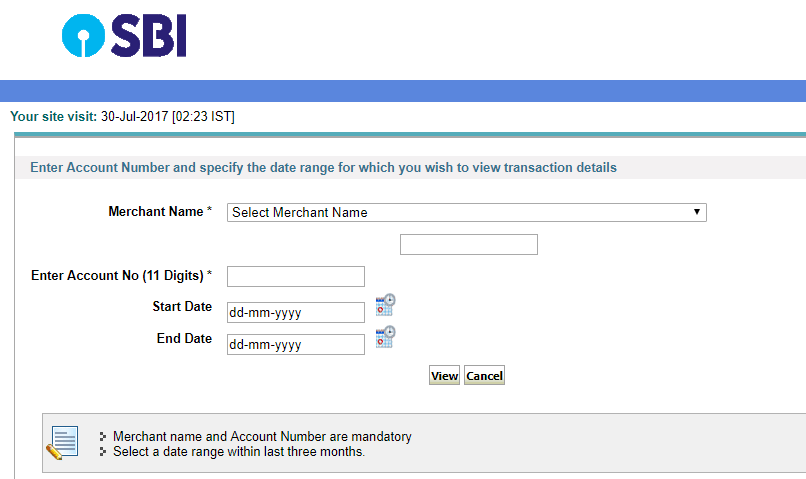

Itr Filing Here Is How To Pay Tax Via Challan 280 On Sbi E Tax The Financial Express

Steps To Download Lic Premium Payment Receipt Online Basunivesh

Www Idbibank In Pdf Gst Inet Banking Manual Pdf

How To Prepare An Nssf Payment Slip For An Employer Toughnickel Money

Income Tax Online Payment E Tax Payment Using Challan 280 Tax2win

Steps To Reprint Syndicate Bank Income Tax E Challan Receipt Online

Q Tbn 3aand9gcrec8tbk Fllpex Hef3kobpedgifmhwujgrewit72tknfis59 Usqp Cau

Q Tbn 3aand9gcs1dfshpapppi3el3rnceszrkgnghbrdu2g5z1wh6glfr Eyz W Usqp Cau

Relis Now Paying Land Tax Is On Your Fingertips Kerala Land Tax

How To Pay Your Income Tax Using Challan 280 Articles Globallinker

Payment Receipt Template Pdf Templates Jotform

Simplifying 80g Receipts For Ngos With Razorpay Payment Pages

Reprint Or Regenerate Challan 280 Receipt

How To Pay Direct Taxes Online By Union Bank Of India

Reprint Challan 280 Or Regenerate Challan 280

How To Get A Copy Of A Challan For Income Tax Paid Via A Debit Card Quora

Reprint Income Tax Challan 280 Sbi Icici Bank Hdfc Bank Axis Bank Ask Queries

1

Www Bankofbaroda In Writereaddata Images Pdf Direct Taxes User Guide Bvs Pdf

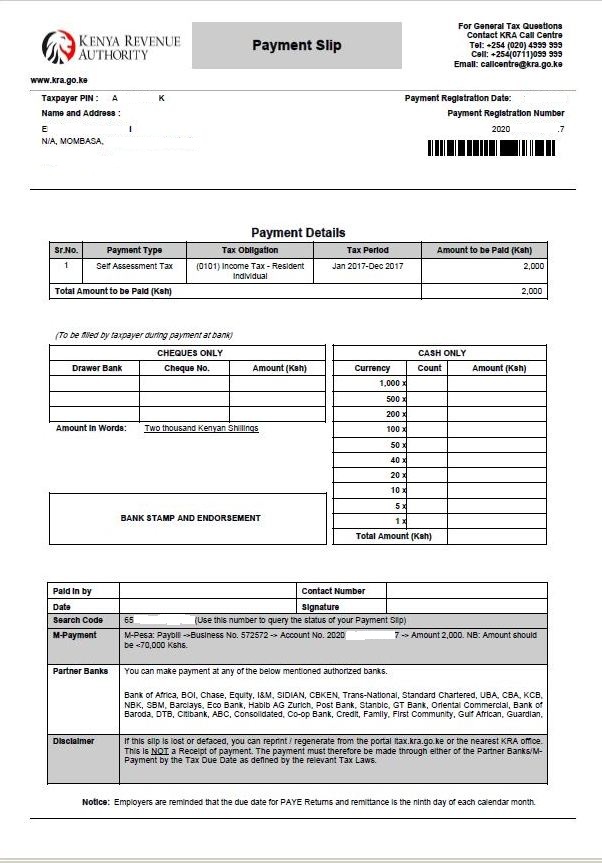

How To Generate Kra Payment Slip Via Itax Cyber Co Ke

Bank Of Baroda Net Banking Registration Login Reset Password Download Bank Statement Tax Payment E Verify Itr

Section 12a Income Tax Act How To File Form 10a Online Paisabazaar Com

Income Tax Payment How To Pay Taxes Online And Offline

Reprint Or Regenerate Challan 280 Receipt

V1 Hdfcbank Com Assets Pdf Retail Process Pdf

Axis Bank Iconnect Payment Id

Tax Payments Under Gst 25 Important Questions Answered

Taxes Paid Advance Tax Or Self Assessment Tax Add Entry

Reprint Or Regenerate Challan 280 Receipt

Steps To Reprint Syndicate Bank Income Tax E Challan Receipt Online

Www2 Deloitte Com Content Dam Deloitte Pk Documents Tax Budget 21 Highlights Comments Deloittepk Noexp Pdf

Pay Income Tax Online Taxwix Guide To Pay Taxes

Hosted Checkout Payment Pages Integration Manual Payeezy Knowledge Base

How To Generate Online Payment Tax Receipt In Just 5 Steps Youtube

Reprint Challan 280 Or Regenerate Challan 280

Tin

Payment Options

The Big Family Bank Cin Number Format

User Guide E Payment Of Uttar Pradesh Commercial

How To Track Gst Payment Status Gst Payment Failures

How To Get A Copy Of A Challan For Income Tax Paid Via A Debit Card Quora

Income Tax Payment How To Pay Taxes Online And Offline

Odisha Professional Tax Registration Payment Indiafilings

Reprint Income Tax Challan 280 Sbi Icici Bank Hdfc Bank Axis Bank Ask Queries

Reprint Challan Reprint Tax Payer Counterfoil Download Copy Of Tax Receipt Challan 280 281 Youtube

Income Tax E Payment Step By Step Procedure Challan 280

Reprint Or Regenerate Challan 280 Receipt

How To Download Lic Premium Payment Receipt Certificate Online