E Taxation Introduction

Introduction To Federal Income Taxation In Canada Canadian Income Tax Act With Regulations Robert E Beam Stanley N Laiken James P Barnett Amazon Com Books

Www Irs Gov Pub Irs Tege Eotopice90 Pdf

Introduction E Taxation

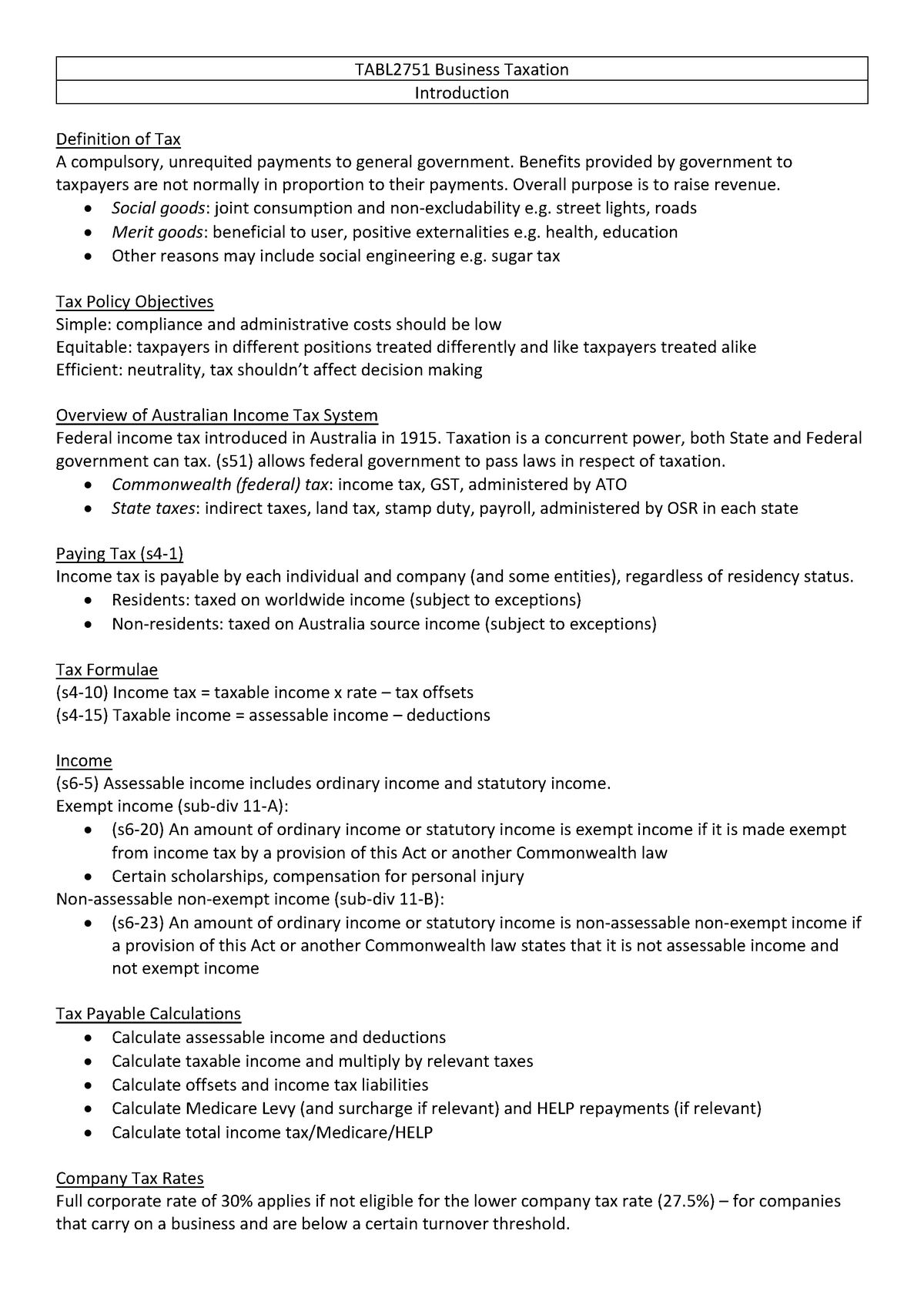

Tabl2751 Lecture 1 Introduction Business Taxation Studocu

Pdf Perceived Risk And The Adoption Of Tax E Filing

Income Tax E Filing Software Its Benefits

Ditions agreed in Ottawa in 1998.

E taxation introduction. It also states that e-commerce should be treated in a similar way to traditional commerce and empha-sises the need to avoid any discriminatory treatment. Kilowatt hour) rather than a tax based upon income or gross receipts. Tax is a compulsory extraction of money by a public authority for public purposes and taxation is a system of raising money for the purpose of governance by means of contributions from individuals or corporate bodies (Sayode & Kajola, 06).

This second edition of the Advanced Introduction to International Tax Law provides an updated and succinct, yet highly informative overview of the key issues surrounding taxation and international law from Reuven Avi-Yonah, a leading authority on international tax. For e-commerce conducted. This section contains free e-books and guides on Tax, some of the resources in this section can be viewed online and some of them can be downloaded.

The tax is usually a rate per unit (e.g. Stephen Smith is a Professor of Economics at University College London (UCL). Taxation, imposition of compulsory levies on individuals or entities by governments.

Taxation - Taxation - Principles of taxation:. A well-designed tax system can minimize efficiency loss and boost economic growth. Although they need to be reinterpreted from time to time, these principles retain remarkable relevance.

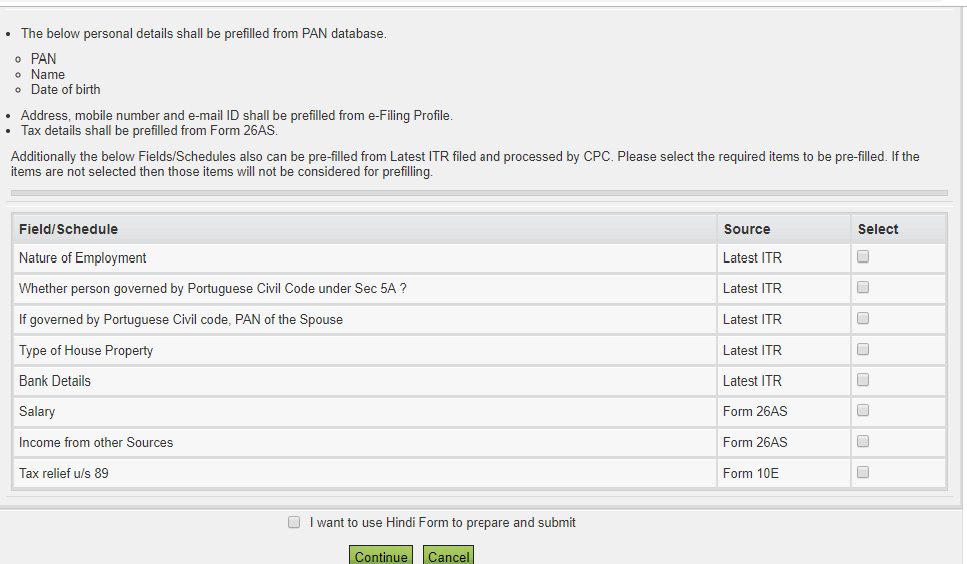

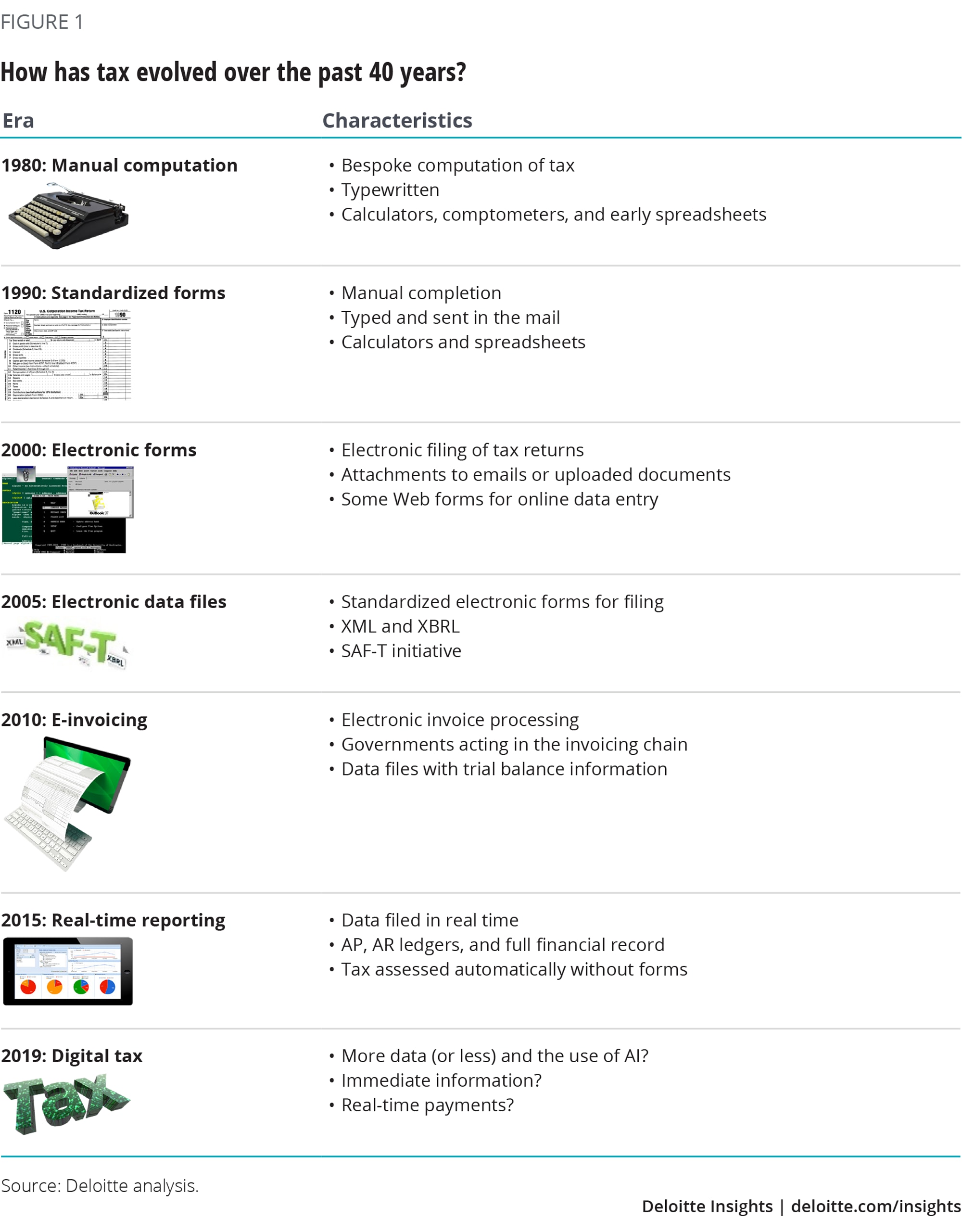

Taxes on people’s incomes play critical roles in the revenue systems of all developed countries. Introduction to taxation of e-commerce. Online tax systems are rapidly replacing paper-based tax reporting systems.

Learn more about taxation in this article. An Introduction | Find, read and cite all the research you need on ResearchGate. The Ottawa Taxation Framework Conditions provide the principles which should guide governments in their approach to e-commerce.

Other business's incomes are not taxed separately from the income(s) of their principal owner(s), such as a sole proprietorship. All businesses must pay federal income taxes.Some businesses are taxed as separate entities for income purposes, such as corporations or limited liability companies (LLCs). He is the author of Britain's Shadow Economy (OUP, 1986) , Environmental Economics:.

Therefore principles/canons of taxation are " signposts " in the economy, which should guide the. • Governments use tax revenues to pay soldiers and police, to build dams and roads, to operate schools and hospitals, to provide food to the poor and medical care. The book nicely relates the modern theories to current policy debates in the United States and Europe, and.

Written for students, this much-needed textbook simplifies complex concepts and avoids unnecessary jargon as it explains the key objectives and principles of taxation. Due tax as a result of applying the rate to the taxable amount;. According to Jugu etal (12), most economies of the world are based on one form of taxation or the other.

A direct tax is a tax paid directly by an individual or organization to the entity that levied the tax, such as the Internal Revenue Service (IRS). This course begins with an introduction to the basics of the US income tax rate schedule. This guide outlines certain key UK tax considerations for a company conducting electronic business in the UK.

After defining a tax and providing some background information on the income tax, this chapter introduces those taxable persons that pay income taxes—individuals, C corporations, and fiduciaries. Federal tax system as it relates to individuals, employees, and sole proprietors. The tax normally is imposed on the company that makes final delivery to the end consumer within a state.

“ The compulsory payments made to governments associated with certain activities are called Taxes”. The concepts of gross income, taxable income, tax rates, gross tax liability, and tax credits are introduced in the context of both the corporate and individual tax models. Taxation topics based on the Effect of Tax Evasion on Government Revenue.

Mintz and others published Wealth Taxation in Canada:. The federal income tax, upon which this text focuses, is collected by the Internal Revenue Service (IRS), part of the Department of the Treasury.The rules for collecting income taxes are set in the Internal Revenue Code (IRC), Title 26 of the United States. Who's who in the tax system.

How to overcome the loopholes that exist in present taxation system. INTRODUCTION TO TAXATION Unlike most transfers, which are voluntary, taxation is compulsory. This course is the first course in a five-course US Federal Tax Specialization.

Objective of this book is to explain the income tax administration in India. According to the Internal Revenue Service, the agency tasked with administering and enforcing the tax laws of the United States, a tax is an enforced contribution exacted pursuant to legislative authority in the exercise of the taxing power, and imposed and collected for the purpose of raising revenue to be used for a public or governmental purpose and not as a privilege granted or rendered. You will study the alternative minimum tax (AMT) which ensures that the taxpayers pay at least a minimum and recalculates income tax after adding certain tax preference items back into adjusted gross income.

For those seeking to embark on a journey to unravel the mystery of income taxes, the necessary guide has arrived. Taxation is more sensitive to U.S. It considers the key issues:.

Tax rates than FDI from countries that attempt to tax foreign-source income on a residual basis. The word Tax came from Latin word “Taxo, Taxare” which means ‘To Asses Or Estimate’. The significance of the study is that it will bring to light the relevance of an e-taxation system that will facilitate the operations of Federal Inland Revenue Services, Uyo in the collection and updating of tax records.

Taxation is a way for the government to collect a percentage of revenues from individuals and businesses and spend it on programs and structures or any other services that would benefit the whole society. Detailed lesson plans guide your instruction from the introduction of a given tax concept, through its development, to the lesson conclusion. Business income tax is a pay-as-you-go tax -- businesses usually must pay the tax as income.

Introduction to Electric Industry Taxation. Government tax is used for providing essential public amenities, that otherwise would not be provided by private sector. The type of taxation system used can vary from country to country.

Tax is the compulsory financial charge levy by the government on income, commodity, services, activities or transaction. Taxation is, by and large, the most important source of government revenue in nearly all countries. It will be especially useful for a graduate course in public economics, because the analytics are both sophisticated and well explained.

Taxation • system of raising money to finance government. Several administrative divisions also impose tax. This small but powerful book surveys the nuances of the varying taxation systems, offering expert insight into the scope, reach and nature of international tax regimes, as well as providing an excellent platform for understanding.

Read the course leaflet with more information. The 18th-century economist and philosopher Adam Smith attempted to systematize the rules that should govern a rational system of taxation. Income Tax by Rai Technology University.

E-Taxation means trans-organizational processes with data transfer (upload and download) between the IT systems of the professionals and those of the tax authorities. A tax is a compulsory charge or fees imposed by government on individuals or corporations. The introduction of income tax in Britain was due to the Napoleonic War in 1798.

For example, in England, King John introduced an export tax on wool in 13 and King Edward I introduced taxes on wine in 1275. Taxation has always been with man and it will continue to be with him. Introduction to Taxation By:.

A Very Short Introduction explains the role that taxes play in a modern economy and describes some of the main taxes used by most developed and developing countries. He was previously Deputy Director of the Institute for Fiscal Studies, the UK's leading independent economic research institute. Hong Kong (SAR), China - Overview and introduction Taxation of international executives Share.

Taxation The most important source of revenue of the government is taxes. Typically, a commodity tax is imposed on and included in the price. The word ‘tax’ derived from the Latin word ‘Taxo’.

Tax can be defined in the following ways:. In The Wealth of Nations (Book V, chapter 2) he set down four general canons:. The earliest known tax was implemented in Mesopotamia over 4500 years ago, where people paid taxes throughout the year in the form of livestock, which was the preferred currency at the time.

Taxes are levied in almost every country of the world, primarily to raise revenue for government expenditures, although they serve other purposes as well. Different types of rates and the conditions under which they apply;. Taxation Papers are intended to increase awareness of the work being done by the staff and to seek comments and suggestions for further analyses.

This Framework was welcomed by. Key concepts covered include gross income and items that are statutorily included or excluded in it, personal and business expenses that qualify. Taxation is constrained by the fiscal and legal capacities of a country.

In the United States, income taxation has been the current method used for. A Very Short Introduction (OUP, 11), and many research reports and academic papers on tax policy and. Study of the Income-Tax, Heads of Income, Tax audit.

Promising many advantages over the traditional method of hard copy tax filing. The Economics of Taxation is a useful and concise guide to the modern economic theory of taxation. That’s needed because of free-rider problem (no one will have injective to contribute) Modern taxes are monetized (individuals provide just money) Tariffs are taxes imposed on imported goods.

Tariffs protect domestic producers. Hong Kong (SAR) became The Hong Kong Special Administrative Region (SAR) of the People’s Republic of China (PRC) on 1 July 1997 and has operated since that date under the terms of the Basic Law. E-commerce presents a major challenge for tax administrations, given the often multi-jurisdictional nature of the transactions and the potential anonymity of the parties.

Prior to the formation of the United Kingdom in 1707, taxation had been levied in the countries that joined to become the UK. The question of where the burden of taxation really lies, how taxation affects the economy, and the effects of tax evasion and tax avoidance. In the United States, personal income taxation is the single largest source of revenue for the federal government.

These essential public services provided by the government include security and physical infrastructure. An Introduction deals with the fundamentals of income tax in a practical and clear manner that makes this book an ideal tool for tax teachers. Best way to come up with new ideas through research for improving taxation policies.

When taxes are imposed, certain conditions must be fulfilled and these conditions are known as principles/canons, guidelines of taxation. EN, BG, NL, DE, EL, IT, HU, LV, LT, PL, RO, SL, ES, SV, MK, PT, HR. Taxation Papers are written by the staff of the European Commission’s Directorate-General for Taxation and Customs Union, or by experts working in association with them.

Permitted reduced rates and their. The research study will also serve as a useful reference material to other scholars and. The data analysis does not show a clear differential responsiveness between these two groups, suggesting either difficulties in accurately measuring effective rates of.

Taxation is a term for when a taxing authority, usually a government, levies or imposes a tax. PDF | On Feb 1, 1991, Jack M. Each lesson plan serves as an instructional guide on how to incorporate tax theory, history, and application into your classroom.

Taxation is the principle means through which the government collects revenue. Get these essays for writing your dissertation on Taxation assignments. Income taxes in the United States are levied by the federal government and by state and local governments.

In the United States, federal, state, and local governments all collect taxes. As this is the first publication on accounting for income taxes under the International Financial Reporting Standards (IFRS), it will serve such travellers well on this journey. US first introduce income tax during Civil War.

The term "taxation" applies to all types of involuntary levies, from income to capital gains to estate. Minimum taxation levels and option frames. The persons who are taxed have to pay the taxes irrespective of any corresponding return from the goods or services by the government.

DESIGN AND IMPLEMENTATION OF AN E-TAXATION SYSTEM. A financial charge or other levy imposed upon a taxpayer (an individual or legal entity) is termed as Tax, collected by a state or the functional equivalent of the same, such that failure to pay, or evasion of or resistance to collection of tax, is punishable by law. • All governments require payments of money—taxes— from people.

The act of levying taxes is called taxation. Countries of the world have different fiscal policies that enable them. It covers and focuses on the U.S.

E-Taxation-An Introduction to the Use of TaxXML for Corporate Tax Reporting:. Fiscal and legal capacities also complement each other. Tax History - An Introduction Taxes in general have been around since the beginning of civilization or history.

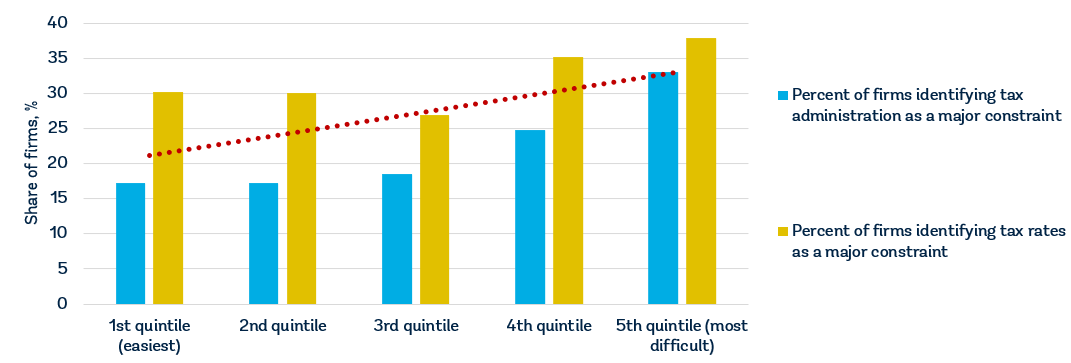

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Collection Prespective Management Accounting Studocu

03 Kpmg Taxes E Taxation Opportunities For Multinational Enterprises Status And Issues Geneva 6 June 03 Reiner Denner Tax Partner Gilles Ronchi Ppt Download

Taxn1 Introduction To Taxation Victoria University Studocu

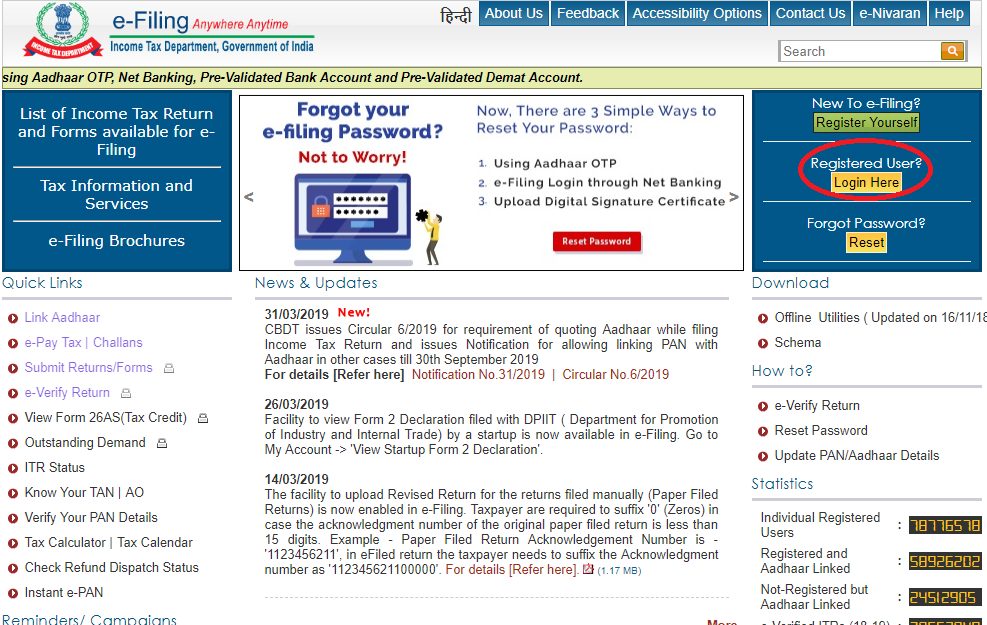

Efiling Income Tax Return 19 For Free Guide On E Filing Itr

Estonian E Residency No More Tax

Introduction To Federal Income Taxation In Canada 39th 18 19 Edition With Study Guide Robert E Beam Stanley N Laiken James J Barnett Accounting Amazon Canada

03 Kpmg Taxes E Taxation Opportunities For Multinational Enterprises Status And Issues Geneva 6 June 03 Reiner Denner Tax Partner Gilles Ronchi Ppt Download

All About Gst E Invoice Generation System On Portal With Applicability

2

Value Added Tax Vat Implementation In Uae Mofuae

The Impact Of Income Tax Rates Itr On The Economic Development

Digital Tax Around The World What To Know About New Tax Rules

Bu 357 Intro To Taxation Bu357 Wlu Studocu

Pdf Indian Tax Structure An Analytical Perspective

Http Www Manuscriptsystem Com Global Showpaperpdf Aspx Doi 10 5923 J Ijfa 01

Impact Of Fiscal Decentralization On Motor Vehicle Taxation In The Slovak Republic Topic Of Research Paper In Economics And Business Download Scholarly Article Pdf And Read For Free On Cyberleninka Open

The Impact Of E Commerce On Taxation Tanzania Development

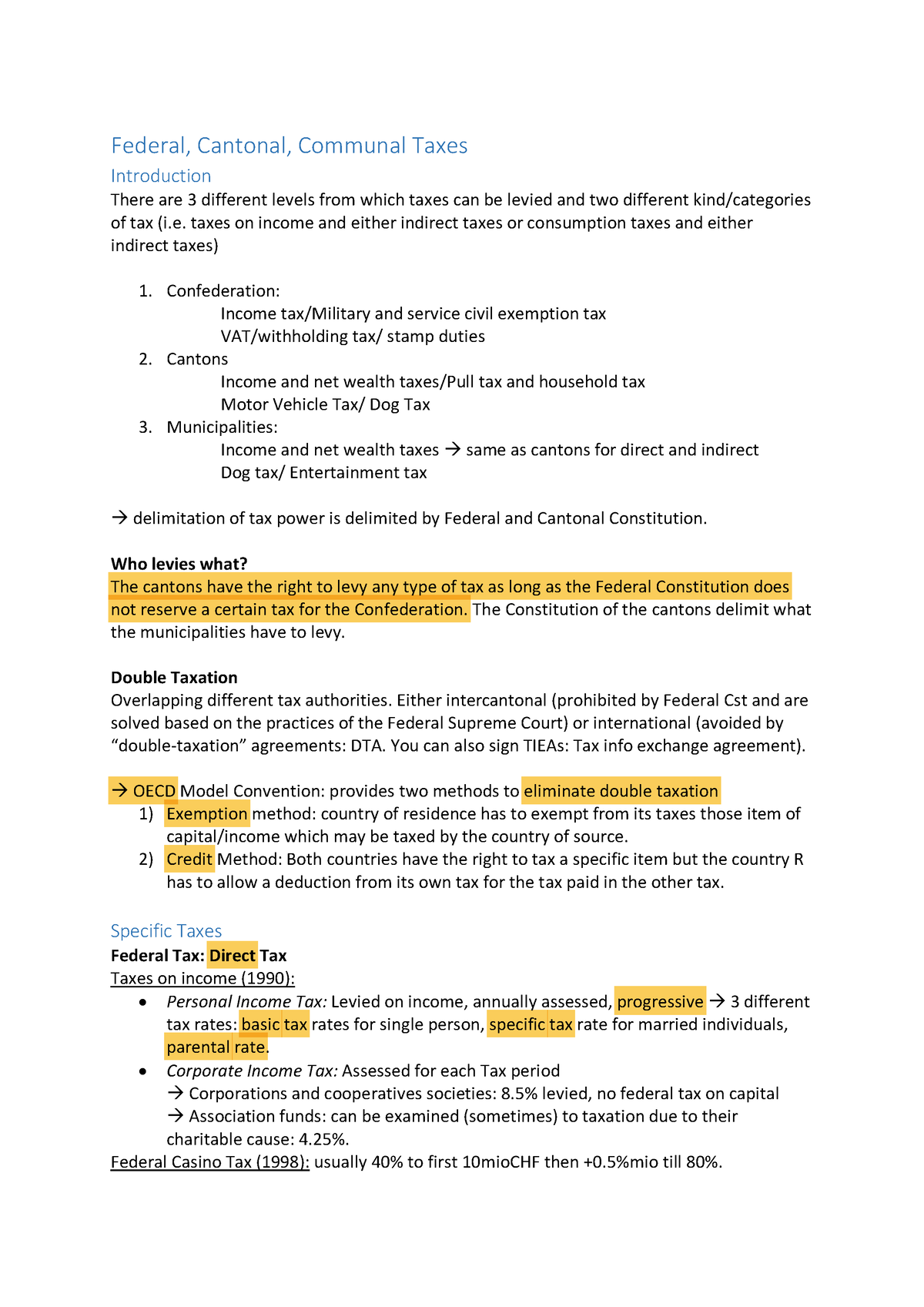

1 Fiscal Law Federal Cantonal Communal Taxes Fiscal Law Studocu

Pdf Pros And Cons Of E Commerce Taxation

Pdf E Taxation An Introduction To The Use Of Taxxml For Corporate Tax Reporting

Taxation Issues Involving E Commerce Shaun Mcgorry Executive Briefing July 2 Ppt Download

Turkish Tax Law And Introduction 2 Docsity

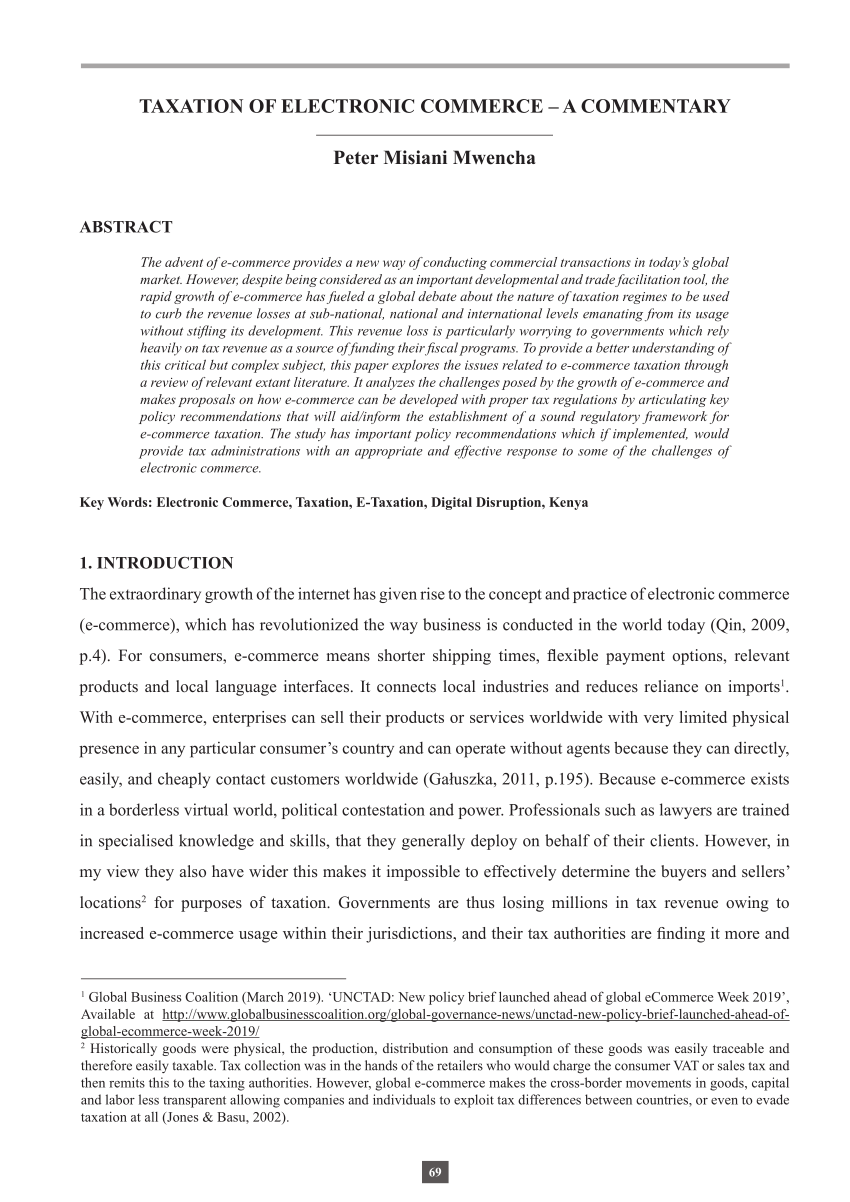

Pdf Taxation Of Electronic Commerce A Commentary

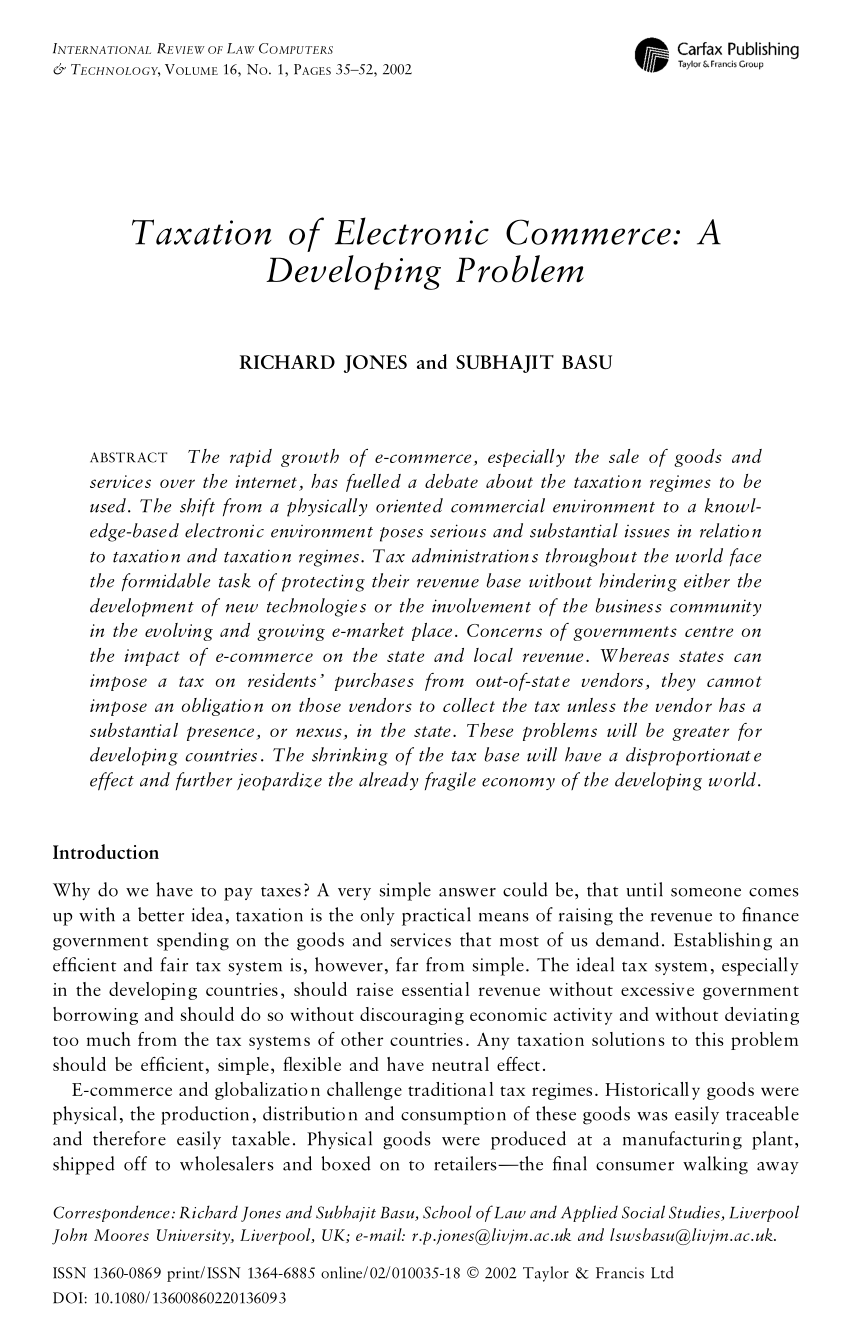

Pdf Taxation Of Electronic Commerce A Developing Problem

New Rules Of Filing Tax Returns Times Of India

Http Www Ejeg Com Issue Download Html Idarticle 415

Impact Of E Commerce On Taxation Pdf Free Download

Itr Filing 5 Benefits Of Filing Income Tax Returns You May Not Be Aware Of The Financial Express

Tuengr Com V10a 10a16i Pdf

Income Tax In India Wikipedia

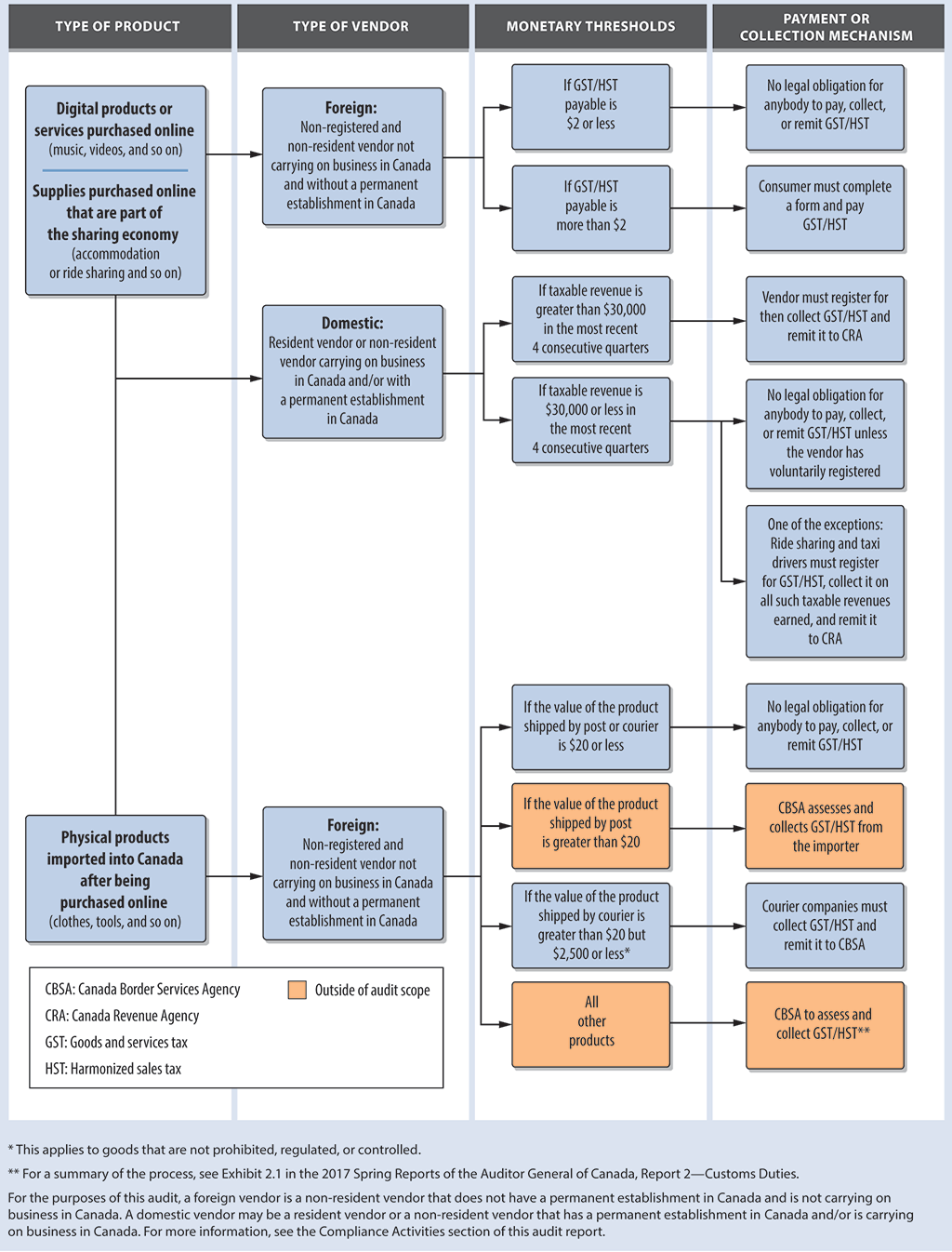

Report 3 Taxation Of E Commerce

E Commerce And Taxation Final Editing

Fav 365 Guidelines On Taxation Of Electronic Commerce Facebook

Abolition Of Ddt And Introduction Of Tax On Dividends In The Hands Of The Recipient

Introduction To Federal Income Taxation In Canada 38th Edition 17 18 Robert E Beam Stanley N Laiken James J Barnett Accounting Amazon Canada

Itr Filing Fy 21 How To File Itr Online India Paisabazaar Com

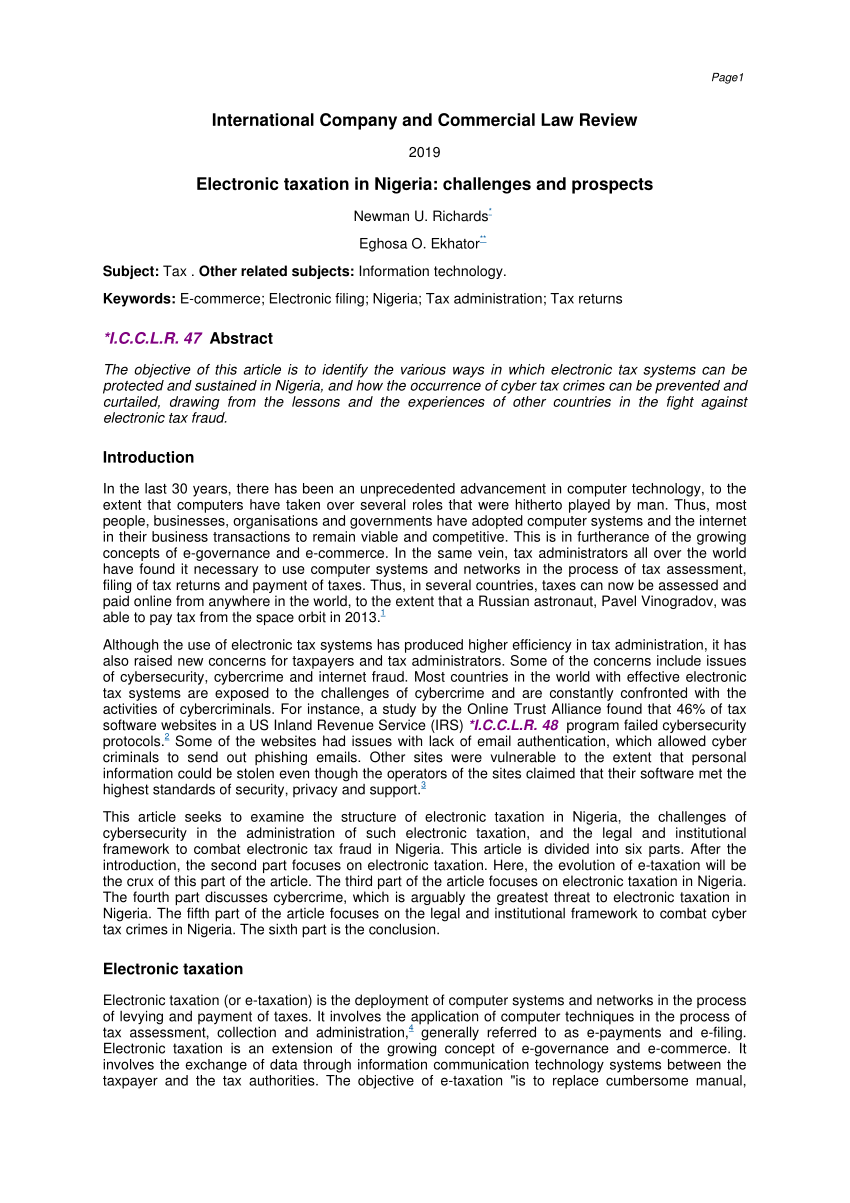

Pdf Electronic Taxation In Nigeria Challenges And Prospects

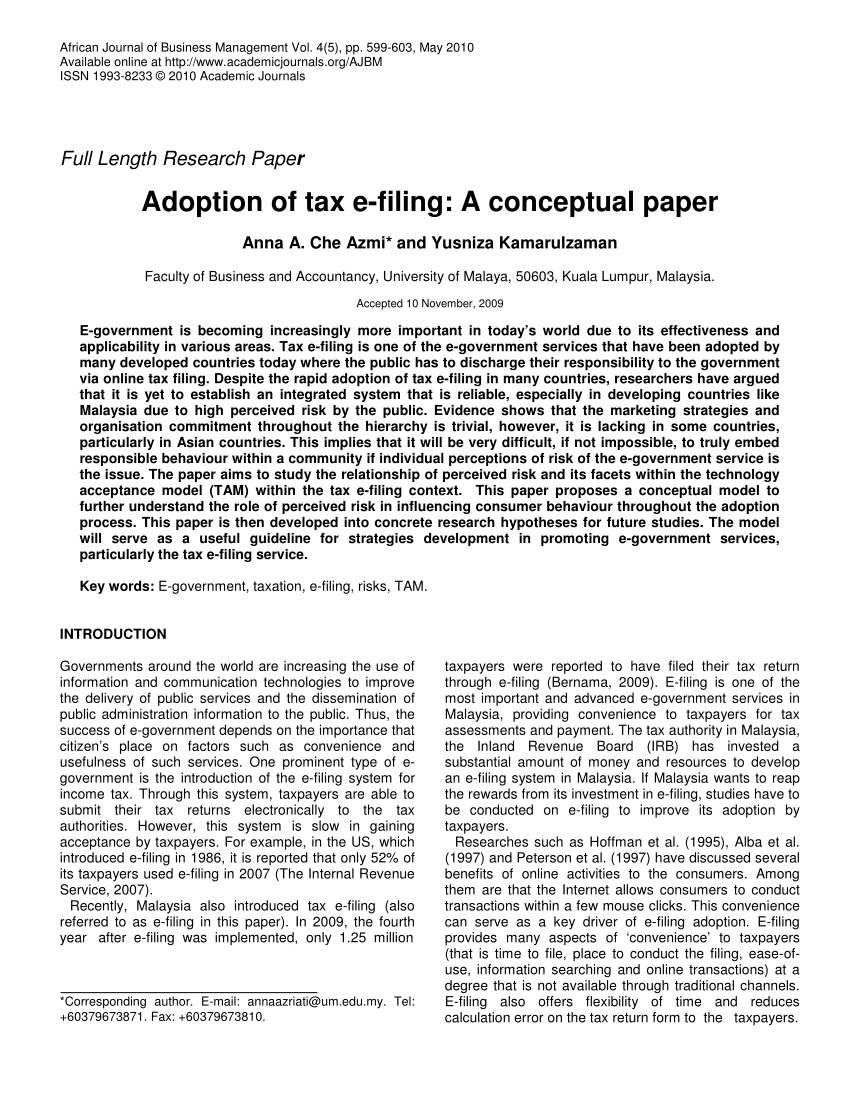

Pdf Adoption Of Tax E Filing A Conceptual Paper

E Filing Of Income Tax Returns Ppt Download

Www Iras Gov Sg Irashome Uploadedfiles Irashome E Tax Guides Etaxguide Income tax Avoidance of double taxation agreements Dtas 2nd Pdf

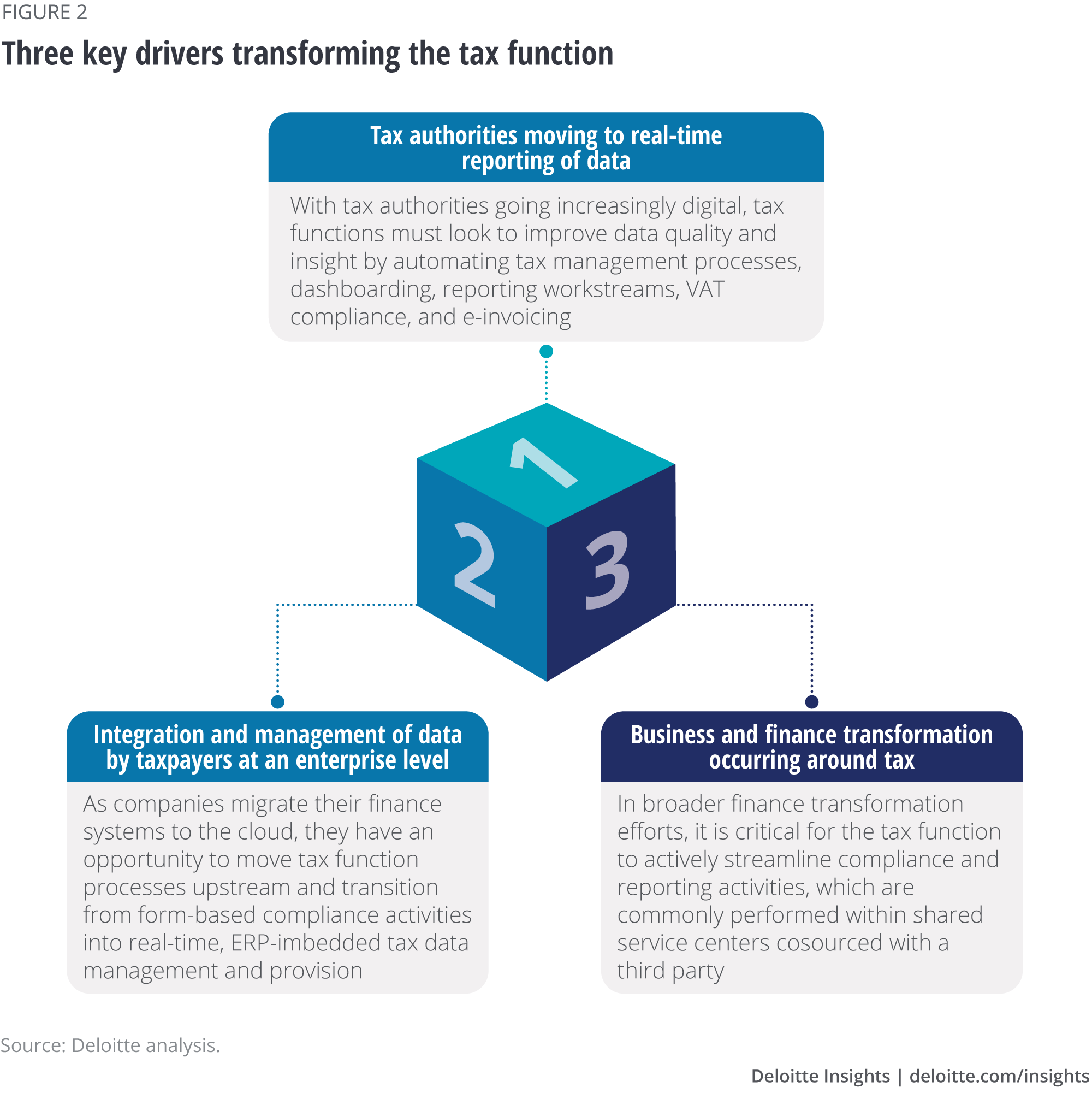

Building The Tax Function Of Tomorrow Today Deloitte Insights

Pdf The Effect Of E Taxation System On Tax Revenues And Costs Turkey Case

Oracle Receivables Golden Tax Adaptor For Mainland China User S Guide

Pdf E Tax Services And Their Evolution The Case Of Slovenia

Value Added Tax Wikipedia

Www Sciencedirect Com Science Article Pii S Pdf Md5 fbe8bf349c4ca59fe1e Pid 1 S2 0 S Main Pdf Valck 1

Taxation Of E Commerce A Task For Jugglers Mujlt Masaryk

Taxation Our World In Data

Http Citeseerx Ist Psu Edu Viewdoc Download Doi 10 1 1 3 4096 Rep Rep1 Type Pdf

2

Taxation In The Republic Of Ireland Wikipedia

Pdf Study On The Impact Of E Commerce On Tax And Accounting Activities

Uganda Should Tax Covid 19 Winners To Fill Revenue Gaps The International Centre For Tax And Development Ictd

2

Pdf Effect Of E Tax Filing On Tax Compliance A Case Of Clients In Harare Zimbabwe

Chapter 1 Introduction To Taxation Pdf Free Download

Sales Taxes In The United States Wikipedia

E Commerce And Taxation Final Editing

Doc Electronic Commerce International Policy Implications For Revenue Authorities And Governments Adrian J Sawyer Academia Edu

Http Heinonline Org Hol Cgi Bin Get Pdf Cgi Handle Hein Journals Vrgtr17 Section 13

Itr Filing Fy 21 How To File Itr Online India Paisabazaar Com

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

Http Www Un Org Esa Ffd Wp Content Uploads 14 09 8stm Crp11 Introduction 11 Pdf

International E Taxation Of E Commerce Using Systemic Analysis Pdf Free Download

Design And Implementation Of An E Taxation System Complete Project Material Blazing Projects

Trust Challenges And Issues Of E Government E Tax Prospective E Government Trust Emotion

Building The Tax Function Of Tomorrow Today Deloitte Insights

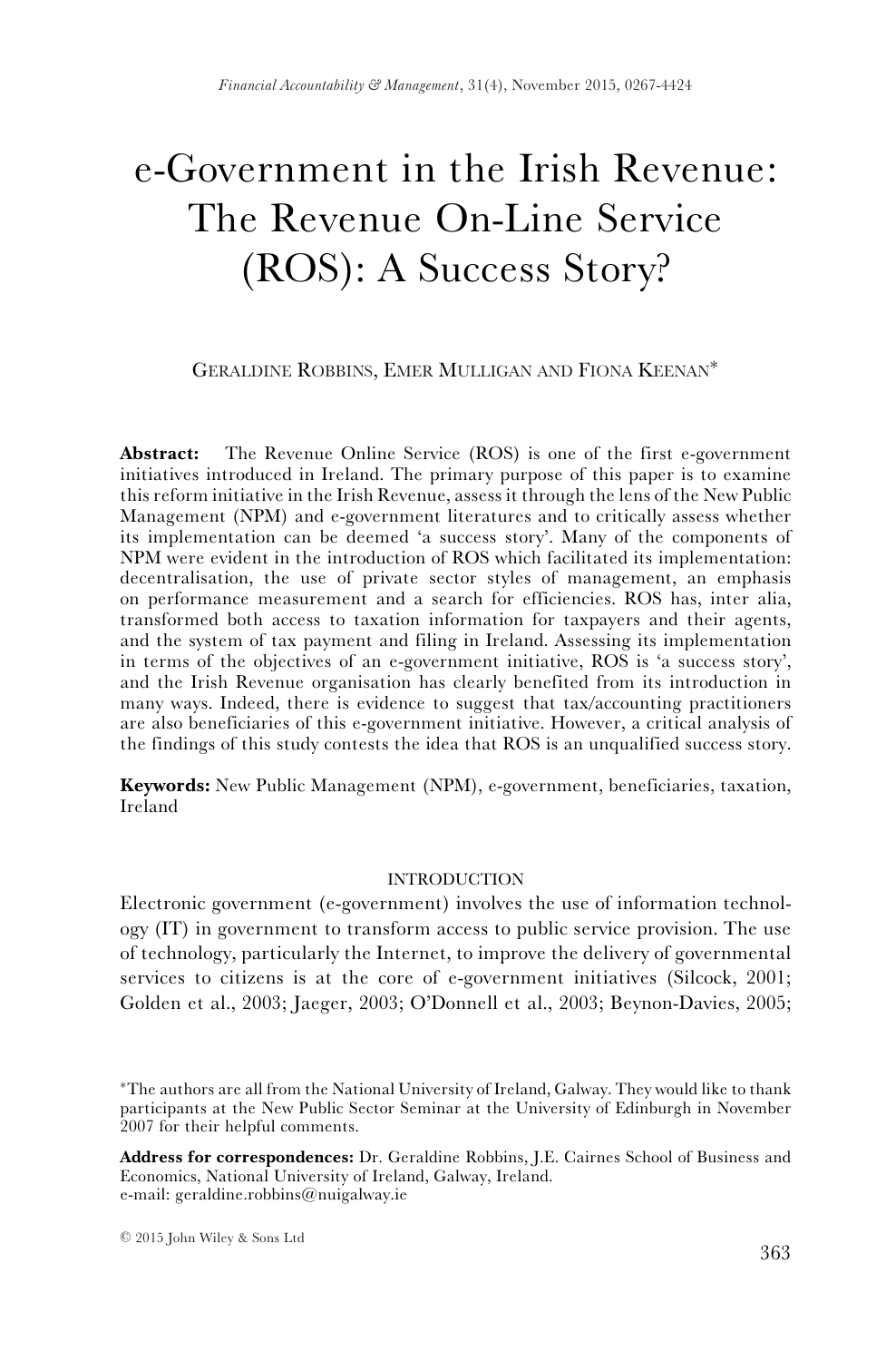

E Government In The Irish Revenue The Revenue On Line Service Ros A Success Story Topic Of Research Paper In Educational Sciences Download Scholarly Article Pdf And Read For Free On Cyberleninka Open

Www Sjsu Edu People Annette Nellen Website Boaltut6 01 Pdf

E Filing Home Page Income Tax Department Government Of India

E Commerce And Taxation Final Editing

Kenya S Tax On Digital Trade And Services What S Known And Not Known

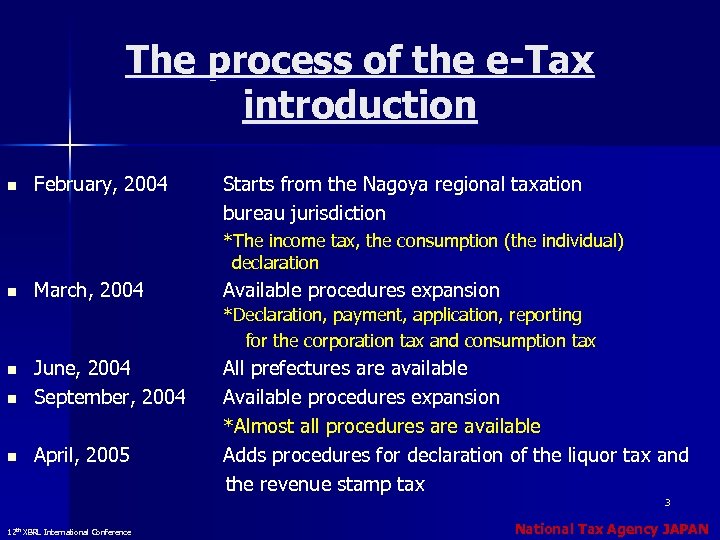

National Tax Agency Japan 3 19 18 12 Th Xbrl

Www Iiste Org Journals Index Php Rjfa Article Viewfile

E Commerce And Taxation Final Editing

Introduction To Federal Income Taxation In Canada 41st Edition 21 With Study Guide Robert E Beam Stanley N Laiken James J Barnett Accounting Amazon Canada

Full E Book Taxation A Very Short Introduction Complete Video Dailymotion

Pdf Design And Development Of An E Taxation System

Pdf Taxation Of Electronic Commerce A Commentary Misiani Mwencha Academia Edu

Introduction To Federal Income Taxation In Canada 40th Edition 19 With Study Guide By Robert E Beam

Pdf The Importance Of E Taxation On E Commerce And Evaluation Of Value Added Tax Applications On E Commerce In Turkey

2

Www Jstor Org Stable Pdf Pdf

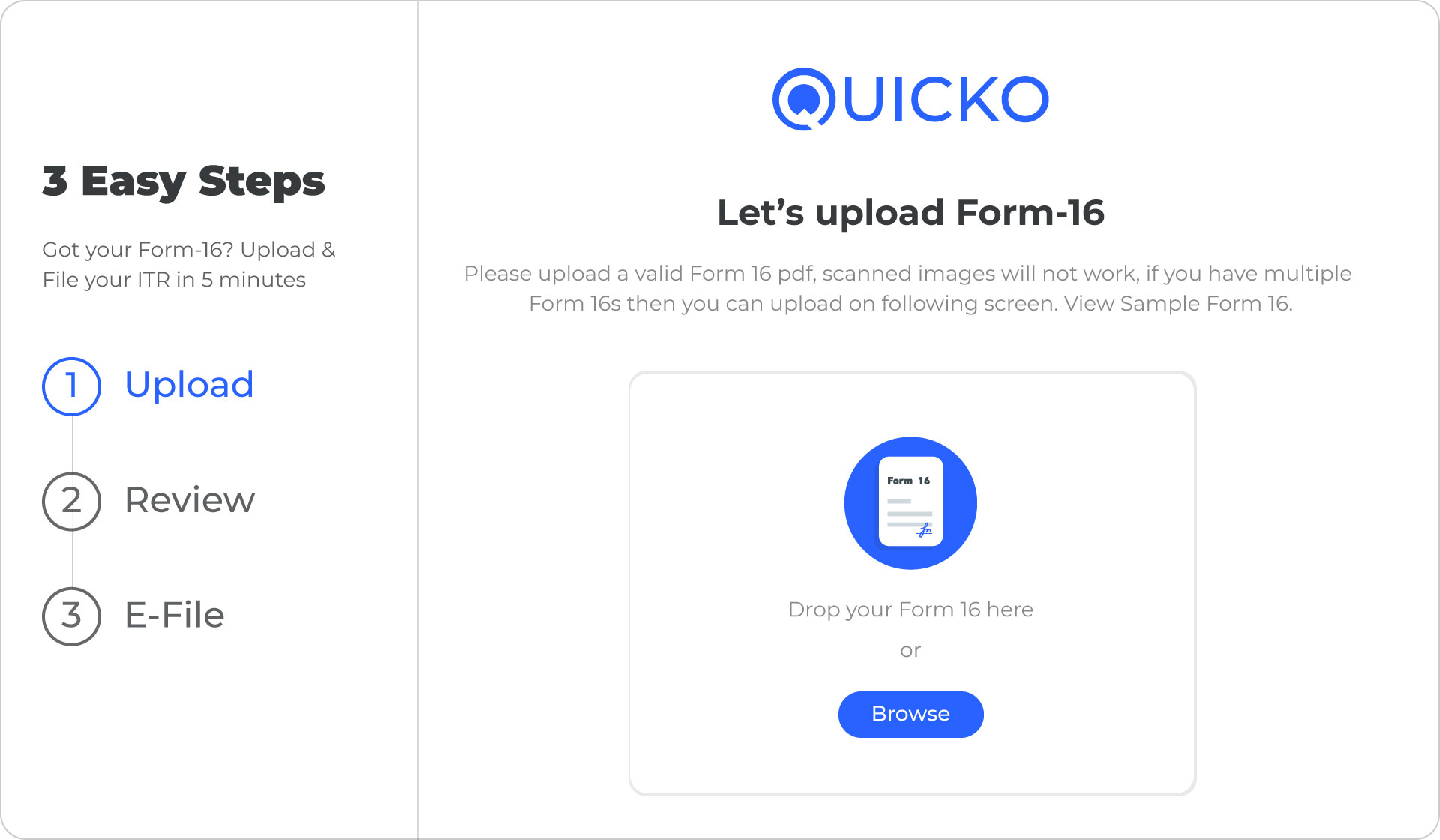

Introducing Quicko Z Connect By Zerodha Z Connect By Zerodha

Tax System

Pdf Download Aspen Student Treatise For Introduction To United States International Taxation Pdf New E Book By Paul R Mcdaniel Gtfd5fgygtfrdesdrtyg

Pdf Evaluation Of E Service Quality Through Customer Satisfaction A Case Study Of Fbr E Taxation

Impact Of E Taxation On Nigeria S Revenue And Economic Growth A Pre Post Analysis

Methods For Classifying Taxes Introduction To Taxation Exam Docsity

Tax Wikipedia

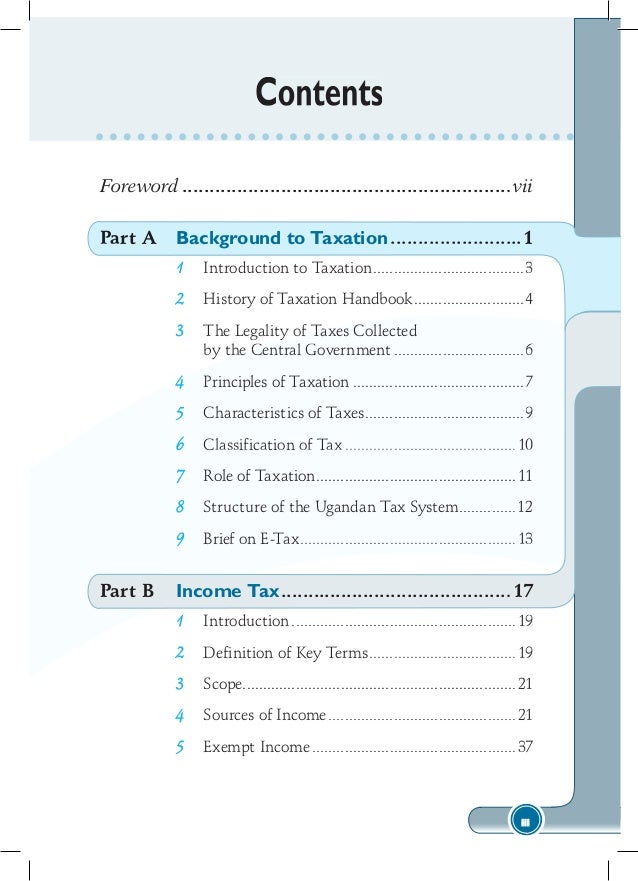

Ura Taxation Handbook

Llamado Income Taxation Expanded Capital Gains Tax Tax Deduction

Ch1 Introduction To Uk Tax System 19