E Taxation And Its Benefits Notes

Www Gov Je Sitecollectiondocuments Tax and your money Id pension scheme administrator tax notes Pdf

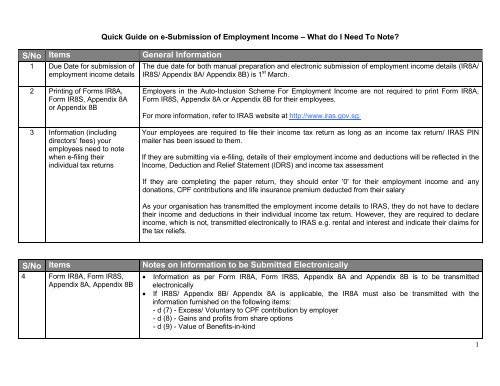

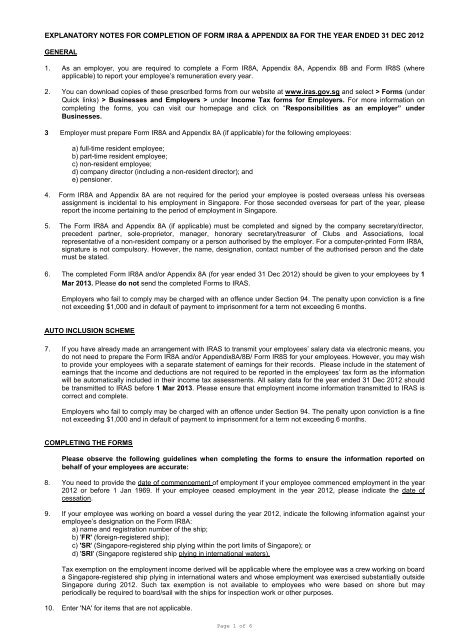

S No Items General Information Iras

Covid 19 Notes The Eip Stimulus Check Your Money Line

Pdf Computer Servers And E Commerce Profit Attribution

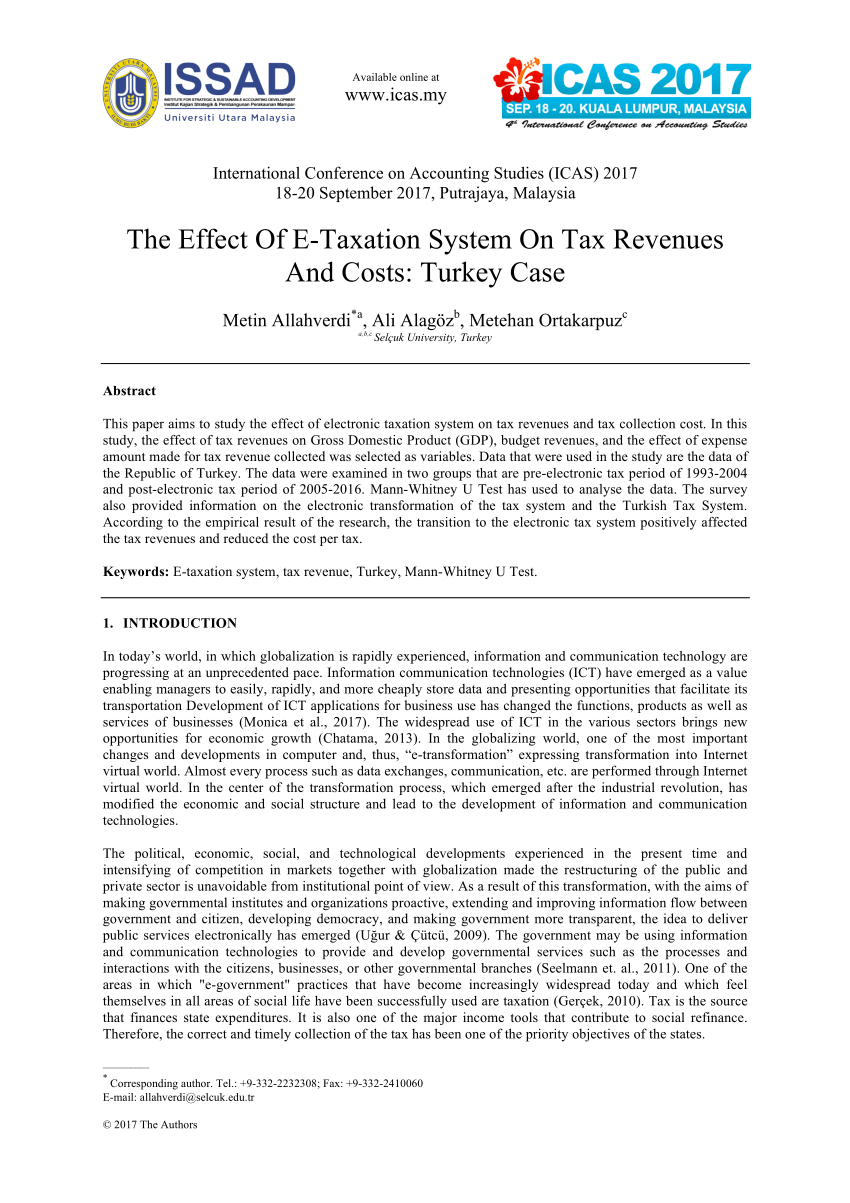

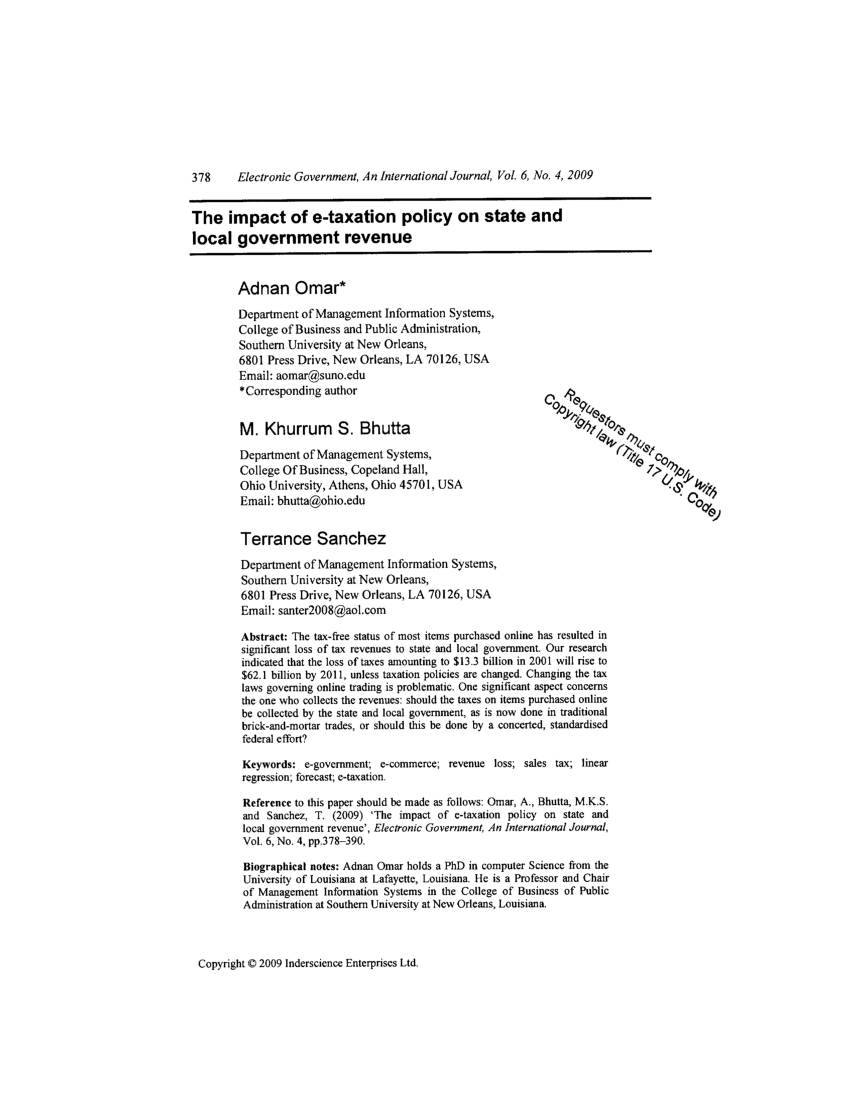

Pdf The Effect Of E Taxation System On Tax Revenues And Costs Turkey Case

/Incometaxes-9dacb2fc1d314896821b07f3933f0c4e.png)

Taxes Definition

Under Internal Revenue Code section 274(e)(4), if the recreational facility is primarily for the benefit of employees who own less than 10% of the company, a deduction is allowed.

/ecommerce-pros-and-cons-1141609-final-5b71f70f46e0fb0025e94192.png)

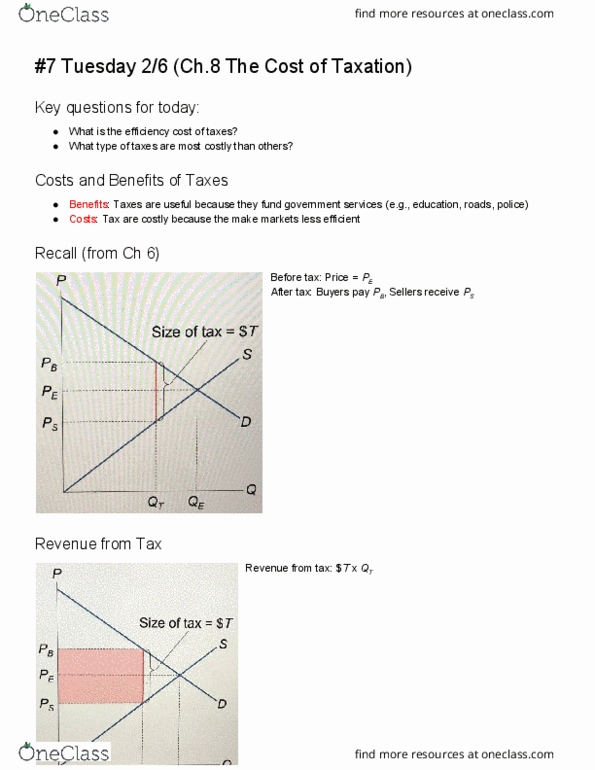

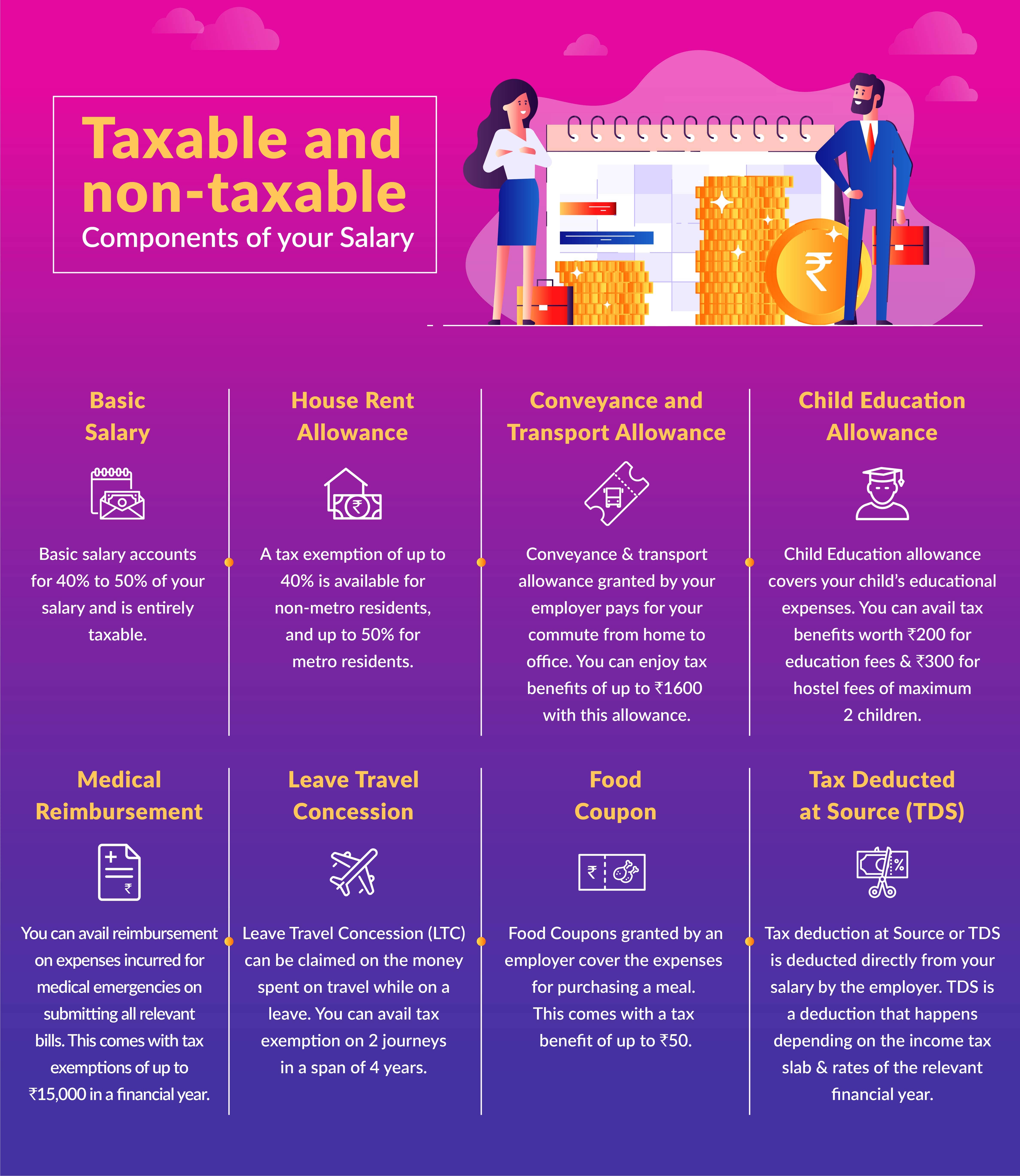

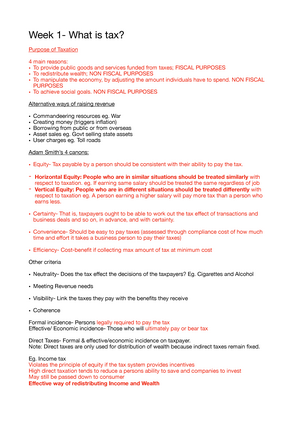

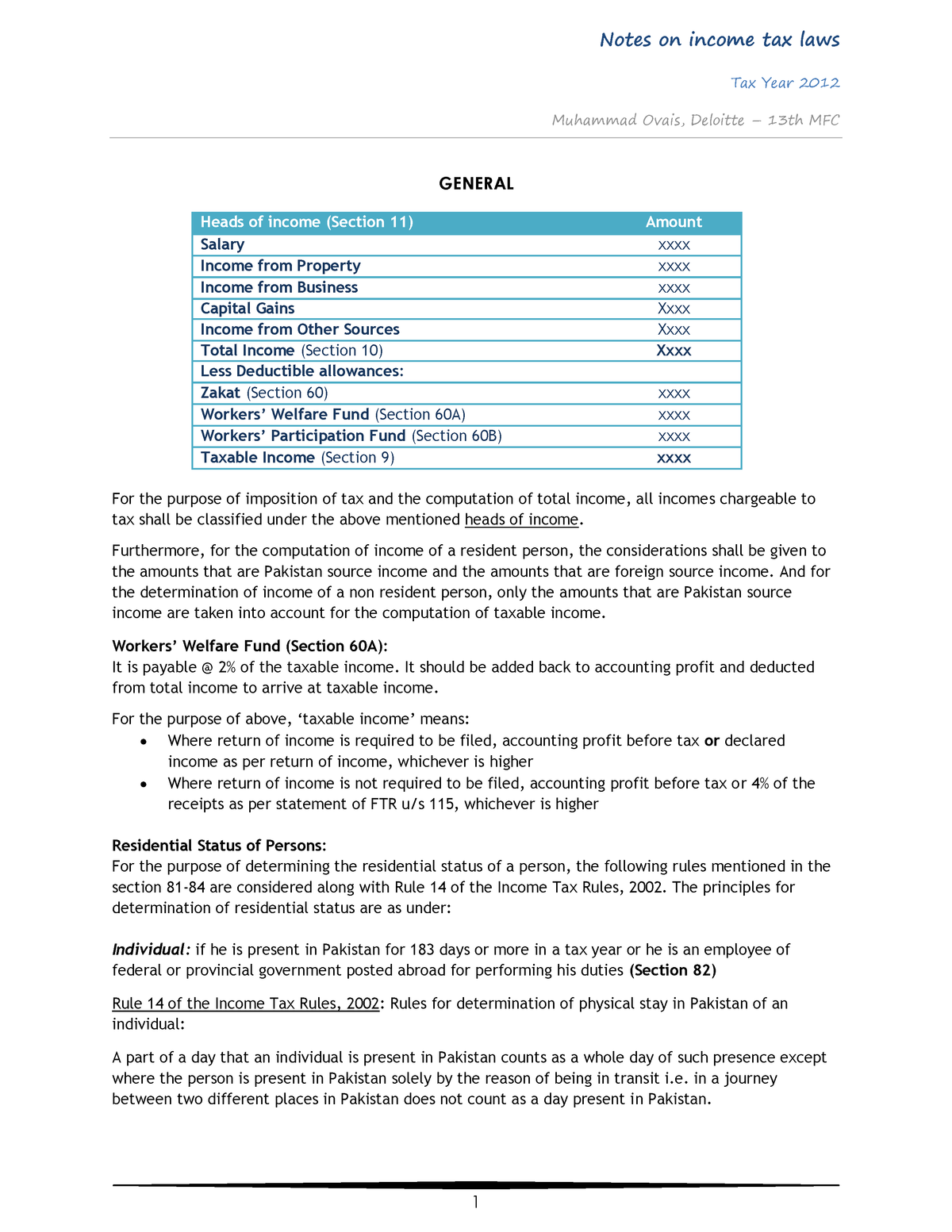

E taxation and its benefits notes. And with tax incentives aligned to encourage work, more firms and. To some (uncertain) extent, people do not pay taxes because they do not understand the tax law. NOTES SU 2 – Taxable Income of Salaried Persons.

The most important source of government revenue is tax. •An e-Cheque is the electronic version or representation of paper cheque. One person pays the tax and another bears the burden of tax.

That difference then is the amount that can be claimed on a tax return as a tax deduction. The entire country had to chip in to build the. •It can now be used in place of paper cheques to do any and all remote transactions.

This article has been substantially updated since its original publication date, please refer to the latest article here. Calculate payroll deductions After you calculate the value of the benefit, including any taxes that may apply, add this amount to the employee's income for each pay period or. The employer is a for-profit business and forgoes the federal income tax deduction, or.

Contains all the tools & features that smart tax professionals want & appreciate. Learn more about taxation in this article. A tax is a compulsory payment made by individuals and companies to the government on the basis of certain well-established rules or criteria such as income earned, property owned, capital gains made or expenditure incurred (money spent) on domestic and imported articles.

That is, they help determine what activities the government will undertake and who will pay for them. There could have been outside elements that could have swayed Bush or Obama into extending the tax cuts but private interests were clearly involved to allow this to continue. For more information about taxable benefits in Canada, please consult the CRA's T4130 Employers’ Guide - Taxable Benefits and Allowances.

IAS 1 sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such as going concern, the accrual basis of accounting and the current/non-current distinction. Some benefits are not considered taxable benefits. The tax is not recognized as the seller’s earnings;.

Therefore principles/canons of taxation are " signposts " in the economy, which should guide the. Double taxation is a tax principle referring to income taxes paid twice on the same source of income. When taxes are imposed, certain conditions must be fulfilled and these conditions are known as principles/canons, guidelines of taxation.

Stewart, Jéanne Rauch-Zender, Amy Vetter, Jasper B. Having regard to taxation principles, i.e.the perfor-. History Income tax is today an important source of revenue for government in all the countries.

The GST/HST rates used in this guide are based on the current rates set under the Excise Tax Act and its regulations for taxable benefits provided in the 19 tax year. For accountants and attorneys alike, the taxation of benefits programs is a rich area of study and specialization. Benefit is purely a subjective matter and there is no scientific way to measure the magnitude of benefit and its money value.

If taxation is to be a mode for collecting revenues — even in a world honoring consent — then there must be some foundational rules to observe when levying a tax or collecting revenues. The plan would lower the corporate income tax rate to 21 percent and move the United States from a worldwide to a territorial system of taxation. Amalgamating of various Central and State taxes into a single tax would help mitigate the double taxation, cascading, multiplicity of taxes, classification issues, taxable event, and etc., and leading to a common national market.

There is a Canada Revenue Agency analysis found here , that determines whether a simple benefit will be deemed taxable or not. Findings from this study show that high-tax countries have been more successful in achiev-ing their social objectives than low-tax coun-tries. Interestingly, they have done so with no economic penalty.

How Does a Tax Benefit Work?. Finally, some benefits are tax free up to certain dollar limits. The Tax Cuts and Jobs Act would reform the individual income tax code by lowering tax rates on wages, investment, and business income;.

In the first instance we should always remember that any tax is governed by the law. If benefits accrued to an individual is the basis of taxation, the poor must pay higher taxes because in a welfare State the poor get more benefits than the rich from the expenditure of the Government. This approach took shape in the late 1980’s where a goods and services tax (GST) were introduced.

Both income taxes and the growth of non-wage benefits developed partially in response to one another, as well as resulting from macroeconomic changes across the American labor force and market. Accounting Finance Audit Management Computers Statistics. Firstly, If the state maintains a certain connection between the benefits conferred and the benefits derived.

A tax by which the rate increases as the taxable base amount increases. Taxes provide a stable way to pay for these projects. NOTES SU 5 – Allowable Deductions.

Except for qualified non. In this article we will discuss about the principles of taxation. In such a case the impact and incidence of tax fall on more than one person.

Presentation on Taxation 2. Income-tax was first introduced in India in 1860 by James Wilson who become Indian’s first Finance Member. In order words, the benefits received cannot be claimed as a tax deduction.

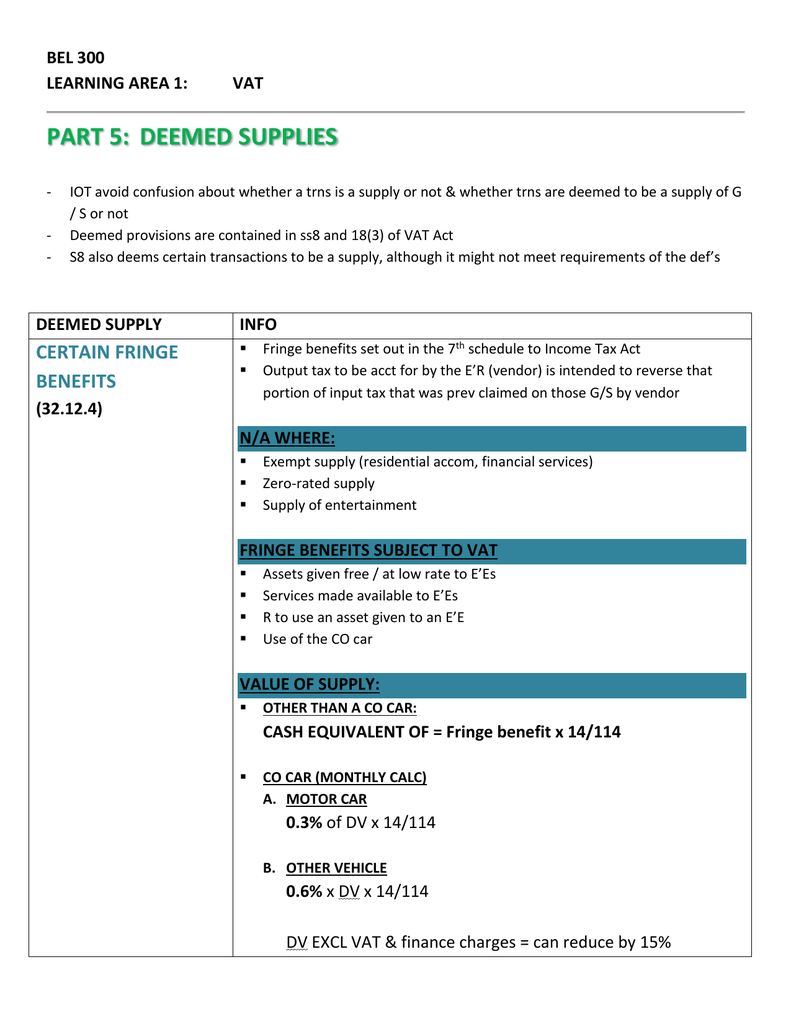

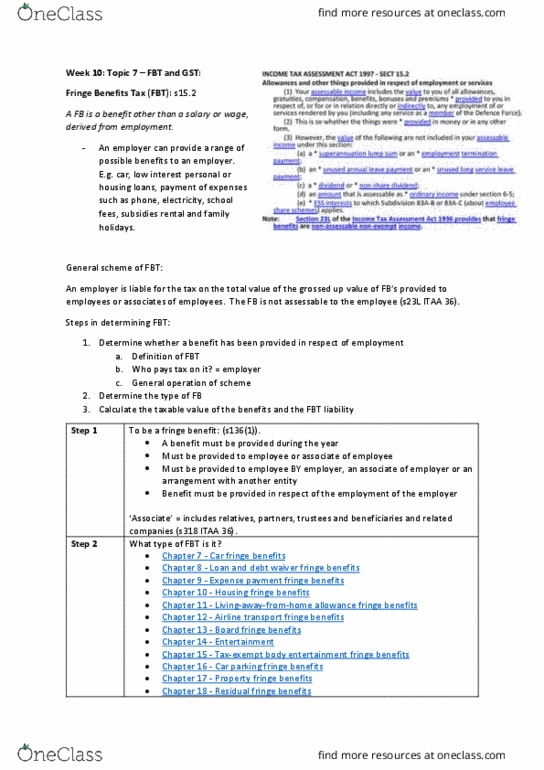

This is clearly unjust and as such an unacceptable proposition. To be workable laws need to an. NOTES SU 6 – Fringe Benefits.

Indirect Tax – In indirect tax, the burden of tax is partially or wholly borne by a person who does not directly pay the tax i.e. It can occur when income is taxed at both the corporate level and personal level. Tax Notes Talk Take A Break:.

The Tax And Its Effects On America Essay 1391 Words | 6 Pages. Introduction of GST is considered to be a significant step in the reform of indirect taxation in India. Broadening the tax base;.

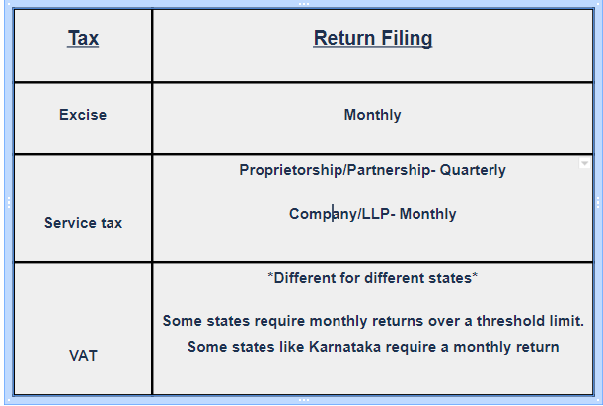

E-Taxation means trans-organizational processes with data transfer (upload and download) between. Firm/ LLP Tax incidence of a Limited Liability Partnership (LLP) depends on the residential status of the LLP,i.e., whether the control and management of its. A health savings account (HSA) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP).

It's safer than mailing your return because you're sending the tax forms straight. The tax treatment of a distribution by an S corporation with accumulated E&P depends on the balance of the corporation’s accumulated adjustments account (AAA), its E&P, the stock basis of the shareholder who received the distribution, and the order in which adjustments must be made to these account balances. A tax, as we know, is compulsory contribution made to the public authorities to meet the expenses of the government and the provisions of general benefit.

Tax incidence of a company depends on the residential status of the company,i.e., whether the company has been incorporated in India or its place of effective management lies in India. Causal benefits may not be set higher than the state expenditure in relation to the provision of the specific output.Were this relationship not observed, causal benefits would take on apartially fiscal character, and we could then identify them as amixed tax. The relationship between worker.

A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden. People who cannot understand tax rules may question the fairness of the tax system and feel that others are reaping more benefits than they are. TAX 3702 EXAM PACK 16.

NOTES SU 4 – Exempt Income. NOTES SU 3 – Gross Income. However, it is important to note that the deductions withheld depends on whether the benefit provided is cash or non-cash.

A principle of taxation which states that the burden of tax on an economic entity should be directly proportional to amount of benefits it receives from the use of public goods or services provided by government. Benefits of E-Filing According to the IRS, the biggest benefits that come with e-filing are its speed and security. There are four general rules that appear to be popular:.

Whether the taxes pay for defense, infrastructure, education, or public safety the intention is that they create a safe and stable environment in which people can live. Taxation is a term for when a taxing authority, usually a government, levies or imposes a tax. ACC 221 TAXATION LECTURE 1 INTRODUCTION 1.

In practice this does not always happen. MEANING OF TAX Tax is the principal source of revenue to government of any nation, apart from the fact that it also serves as a tool for economic stabilization and redistribution of income among economic agents. TAX 3702 Solutions PDF.

3_18_1_e ASSIGN 2 18. Taxable entities must file tax returns each year if they have any taxable income. Evidence also suggests that people are more likely to evade taxes they consider unfair.

The change in the tax law does not automatically result in these benefits being taxable to employees. The funds contributed to an account are not subject to federal income tax at the time of deposit. Now to answer the question I give below some of features that are seen in most of tax laws that I came across during my tax career.

It will be against the basic principle of the tax. * Projects that are expensive and take a long time that are highly risky. "Overall growth is also higher with lower taxes and better collection.

Tax can be defined as a compulsory levy imposed by government to individuals and organizations within a country primarily for the purpose of. As a component of income tax expense over the five-year economic life of the intellectual property. Manufacturers remit to the.

From that of the seller, it is a tax only on the value added to a product, material, or service by this stage of its manufacture or distribution. Over the past couple of years, the government is faced with shut down because of law of funds and debt but. New Zealand’s tax system has adopted a broad – base – low – rate approach to its taxation policy.

The seller only collects the tax and transmits the same to local or state authorities. It's also the name of an IRS rule requiring companies to pay taxes on income that was previously written off but is subsequently recovered. Taxes are levied in almost every country of the world, primarily to raise revenue for government expenditures, although they serve other purposes as well.

Under the benefit principle, taxes are seen as serving a function similar to that of prices in private transactions;. In short, the benefit of paying taxes is to ensure that everyone in a community enjoys the services provided by government. E-Government consists of various fast moving fields, E Taxation being a very specific one of them.

The social benefits and economic costs of taxation Tax cuts are disastrous for the well-being of a nation’s citizens. The IRS considers most individuals, married couples and corporations as taxable entities. Taxation mainly refers to the actual act in which government or its taxing authority (Such as Malawi Revenue Authority) actually collects tax from individuals and organizations.

Taxation, imposition of compulsory levies on individuals or entities by governments. From the perspective of the buyer, it is a tax on the purchase price. Simply put, taxation is the act of imposing a compulsory levy by the government or its agency on individuals and firms in other to raise money required to finance public projects.

More than 3,000 years ago, the inhabitants of ancient Egypt and Greece used to pay income tax, consumption taxes and custom duties. Examples include educational assistance programs, which are tax free up to $5250 in the 19 tax year, and transportation benefits. In Malawi, taxation is guided by several principles that are mostly highlighted in the Taxation Act and Amendments.

* * An example would be the Grand Canal in China. If this principle could be implemented, the allocation of resources through the public sector would respond directly to consumer wishes. This broadened the taxed base reducing the New Zealand government’s dependence on a growth inhibiting form of tax generation such as.

By “benefits received.” Apportionment or “ability to pay.” Consent. VAT Tax on goods and services transactions. Professional tax software for CPAs, accountants, and tax professionals.

Unlike a flexible spending account (FSA), HSA funds roll over and accumulate year to year if they are not spent. And simplifying the tax code. Essentially, the question is whether the taxpayer receives an economic advantage or benefit that can be measured in money, and whether the taxpayer is the primary.

--High tax rates and complicated tax regimes hurt growth. The tax associated with intra-entity asset transfers should be accounted for under ASC 740-10-25-3(e) and ASC 810-10-45-8. The standard requires a complete set of financial statements to comprise a statement of financial position, a statement of.

A tax imposed in such a manner that the rate decreases as the amount subject to taxation increases. In some cases, these transactions could significantly affect the consolidated financial statements. Tax Notes State Editor in Chief Jéanne Rauch-Zender talks with Amy Vetter, a keynote speaker and presenter, on how to survive – and thrive – personally and professionally despite the unique challenges presented by the.

Employee benefits that were formerly tax-free benefits under IRC 132(f) (transportation, parking, and on-site exercise facilities) are now only tax free if:. Prescott lives in Country A which has an ‘ability-to-pay’ taxation system but wants to move to Country B which has a ‘benefits received’ tax policy. E.g Income Tax, Corporate Tax, Tax on Capital gains.

Smith, and Linda Friedman | October 22. In Economics, Taxation is defined as the means through which government finances its expenditure by imposing financial charge or other levy on citizens and corporate entities. •An E-cheque work the same way a cheque does, the cheque.

The term "taxation" applies to all types of involuntary levies, from income to capital gains to.

2

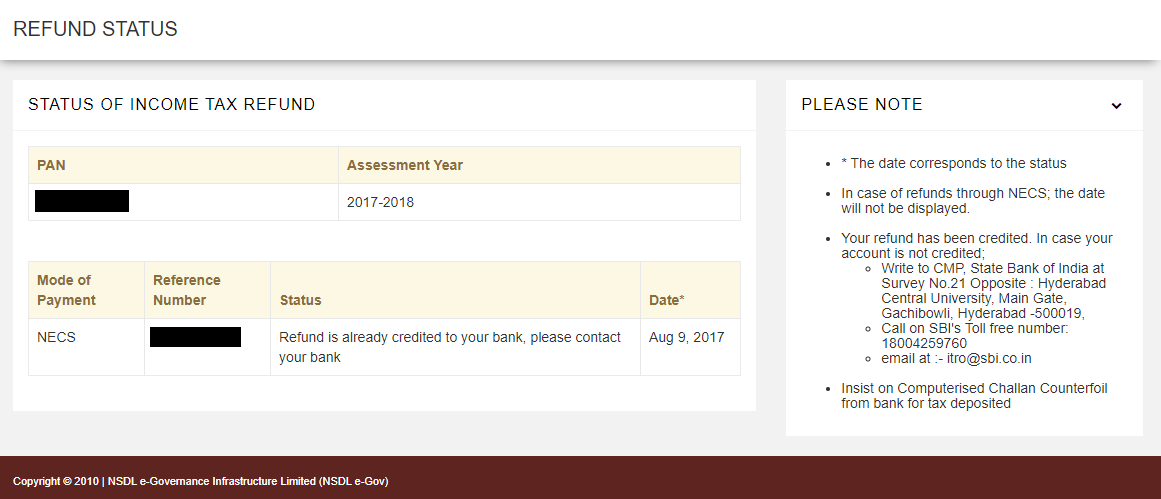

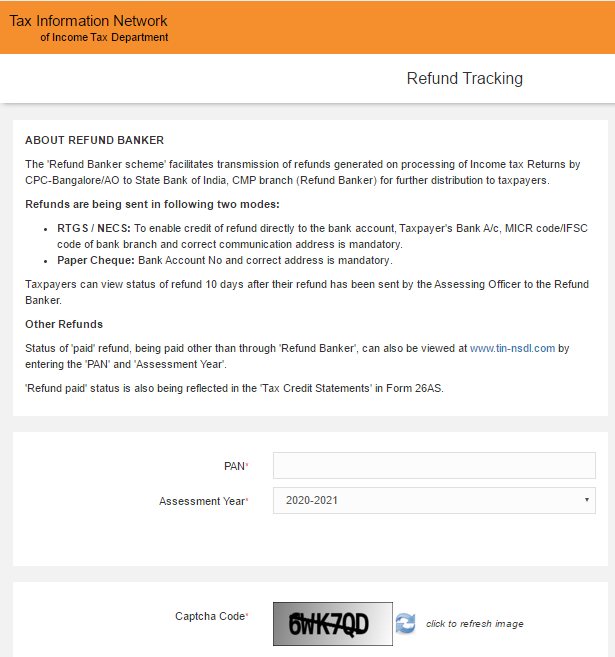

Income Tax Refund How To Check Claim Tds Refund Process Online

Tax Notes International Sm Pdf Free Download

Econ 1 Lecture Notes Spring 18 Lecture 7 Breakfast Cereal Tax Rate Sunscreen

U S Supreme Court Revisits Sales And Use Taxes In The E Commerce Age Western City Magazine

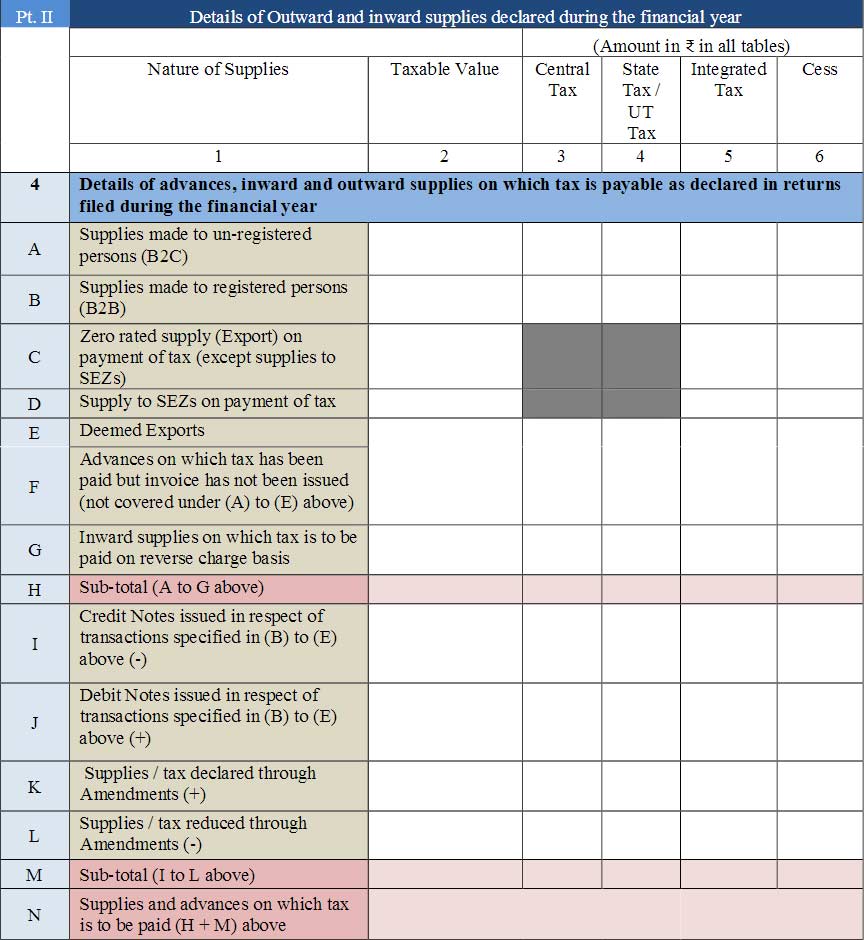

All About Gstr 9 Online Filing Procedure With Due Dates Penalty

2

Marilyn A Wethekam Discusses The False Claims Act In Conversion On False Claims Act Expansion Does It Make Sense With Tax Notes State

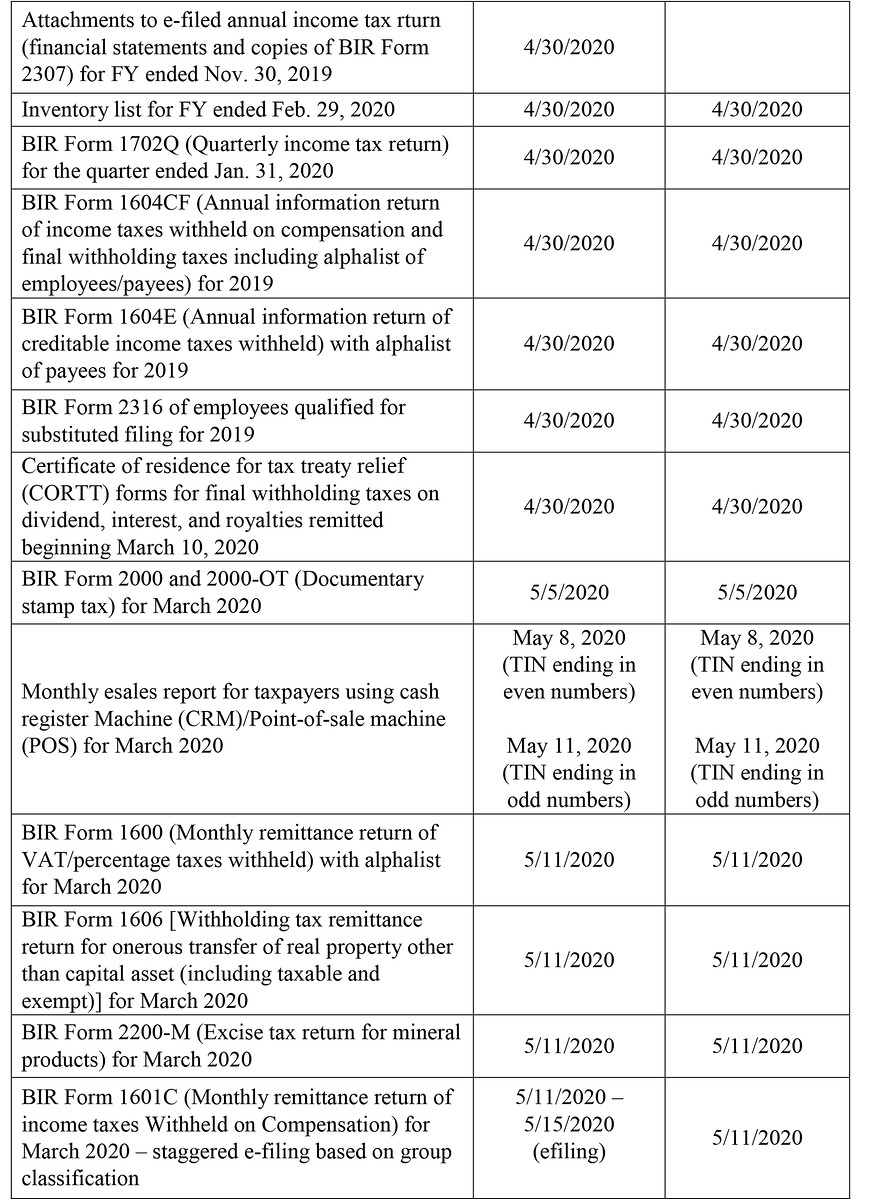

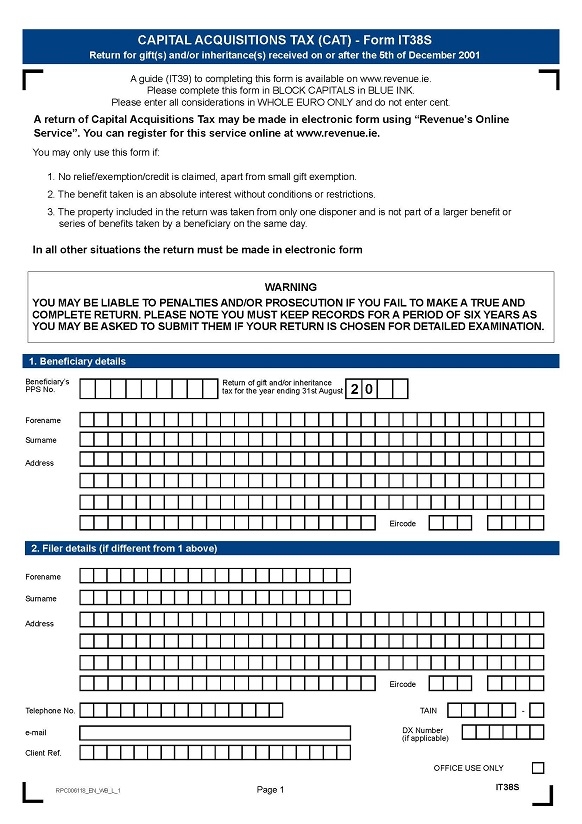

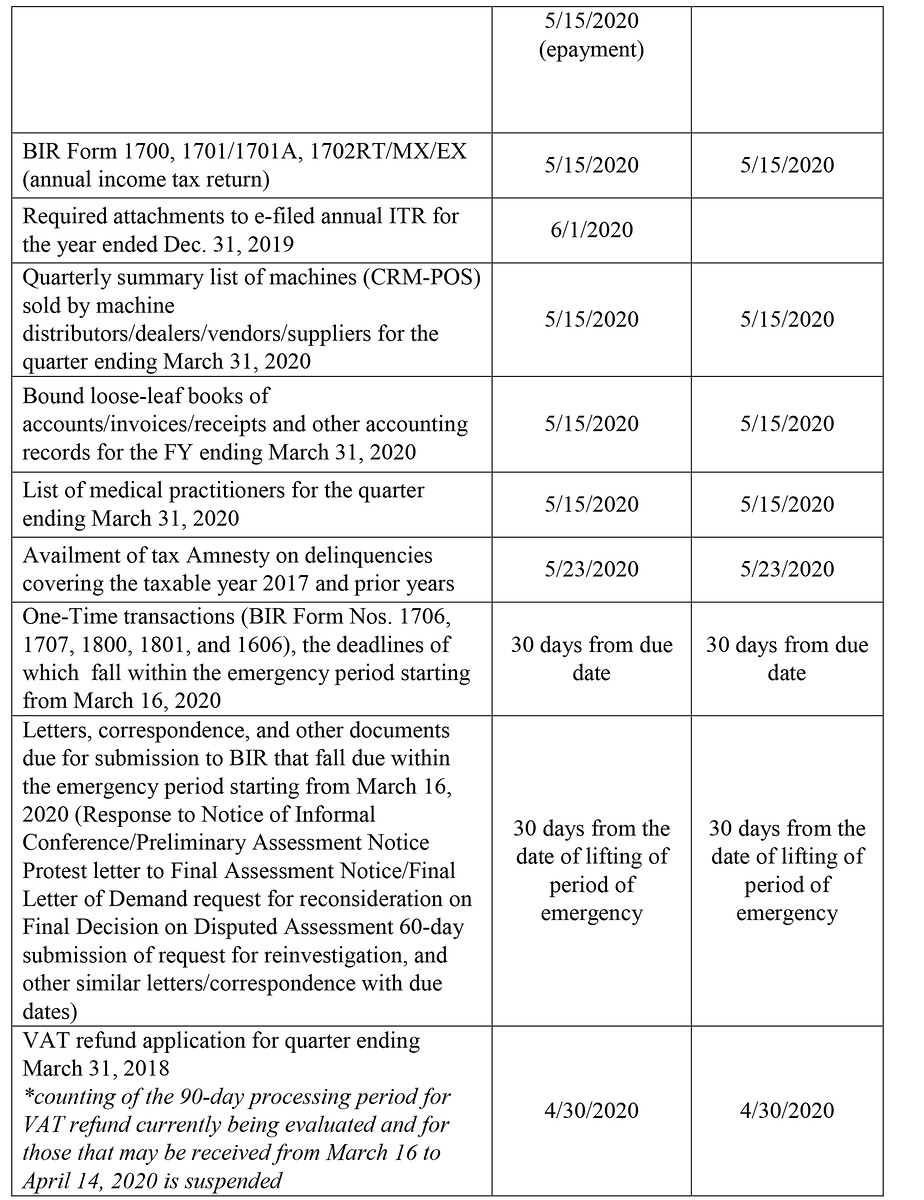

Tax Filing And Payment Guidelines During The Enhanced Community Quarantine Period Updated As Of April 1 Grant Thornton

2

Taxation In The United States Wikipedia

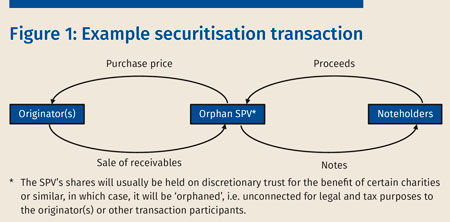

The Taxation Of Structured Finance Transactions

Income Tax Notes Compatibility Mode

2

Britain S Massive Unclaimed Benefits Failure And How To Fix It

Income Tax Deduction Exemptions Section 80c 80ccd 80d 80gg Finserv Markets

Sec Report Document 17 Avendusaudit17 Pdf

Vat In Uae Penalties For Non Compliance

Publication 970 19 Tax Benefits For Education Internal Revenue Service

Pdf The Impact Of E Taxation Policy On State And Local Government Revenue

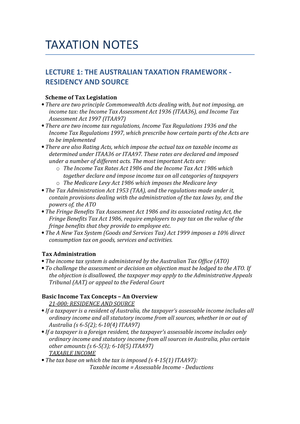

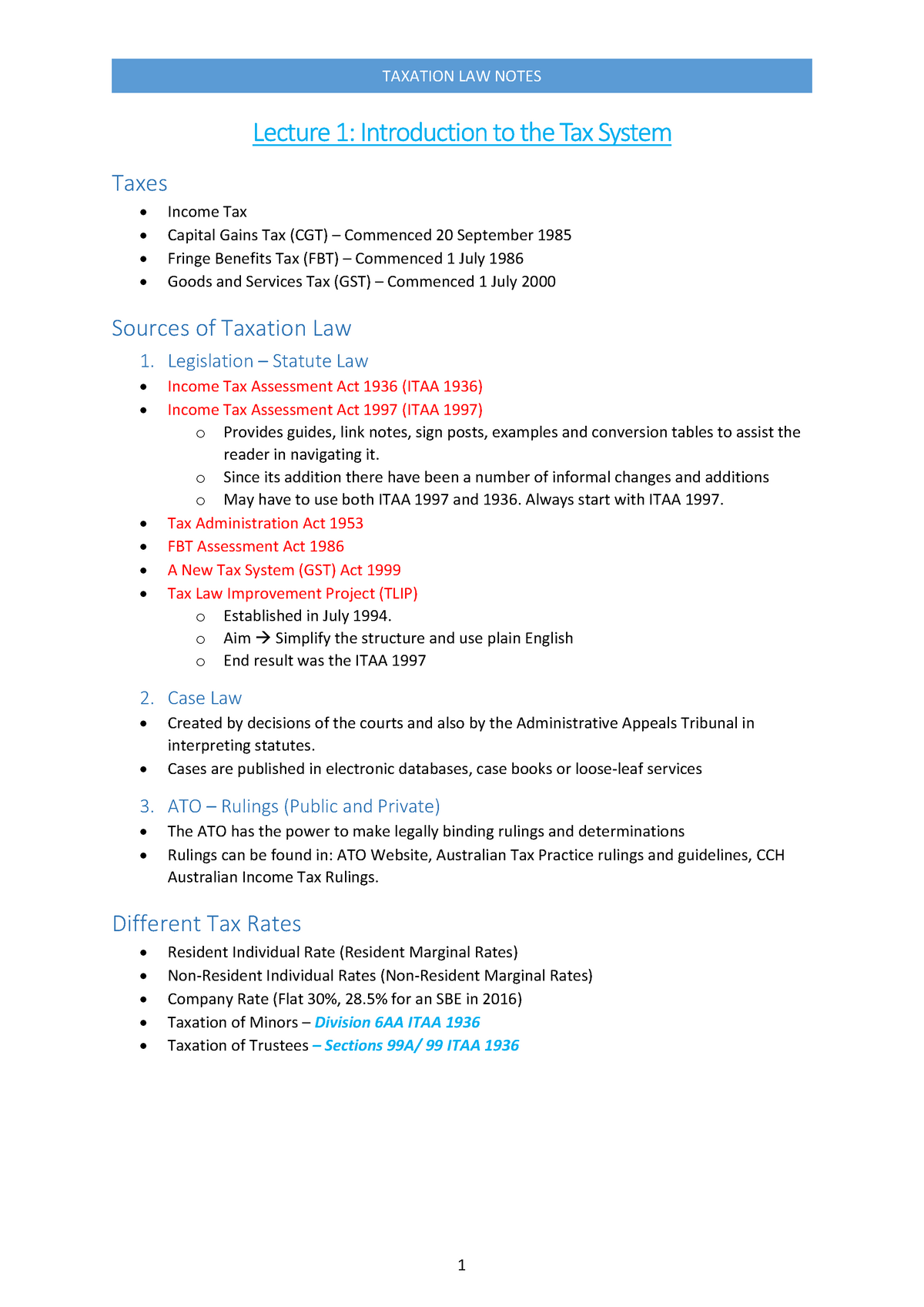

Taxation Law Notes Law352 Une Studocu

/ecommerce-pros-and-cons-1141609-final-5b71f70f46e0fb0025e94192.png)

Advantages And Disadvantages Of E Commerce Businesses

Indian Tax System Taxation Structure In India Current Policies Explainedaegon Life Blog Read All About Insurance Investing

Fud Gkowwjnj6m

Taxation Law Notes Cv4 Bachelor Of Business Uts Studocu

Happ E Tax Your New Tax Guidance App

Income Tax Refund How To Check Claim Tds Refund Process Online

Income Tax Notes Punjab University Law College

Families Have One Month To Check And Renew Tax Credits Or Benefits May Stop

Www Sec Gov Archives Edgar Data Cws Statements Pdf

Value Added Tax Wikipedia

Publication 505 Tax Withholding And Estimated Tax Internal Revenue Service

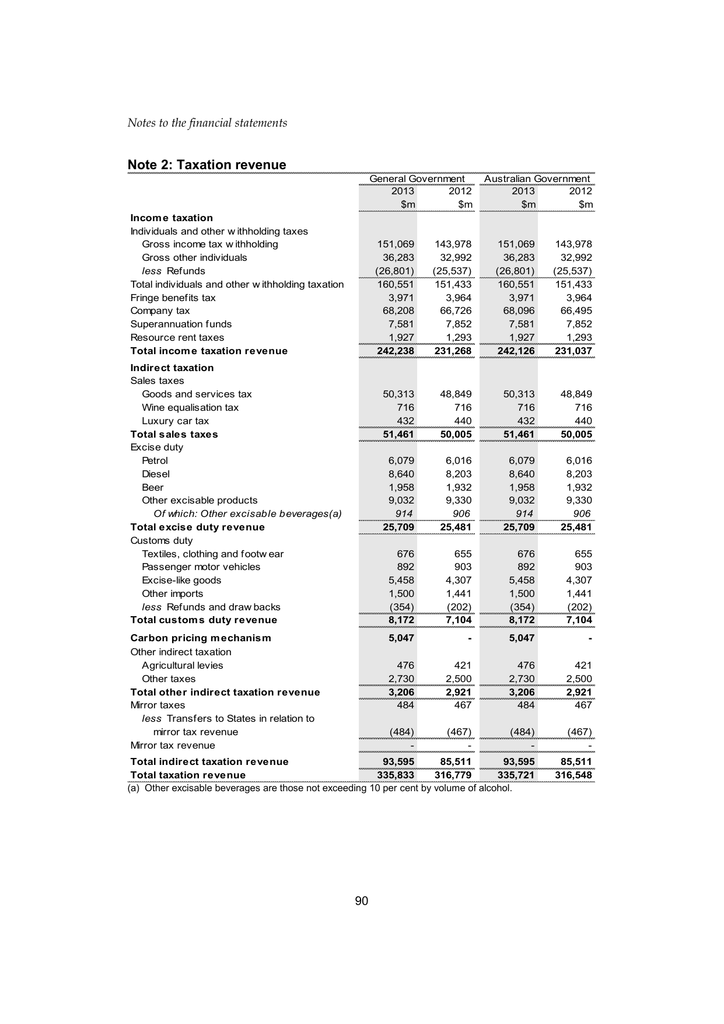

Note 2 Taxation Revenue Notes To The Financial Statements N To

Estimated Chargeable Income A Step By Step Guide To Calculating Eci

Www Aph Gov Au Binaries Library Pubs Explanmem Docs Incometaxassessmentact1922 29 v2 Pdf

Gst Gst Returns This Is How You File Your Gstr 1 The Economic Times

Itaa Education Posts Facebook

Vat Notes Part 5

Taxation Notes 1102 Massey University Studocu

How To E Verify Itr Income Tax Return

Filing Estimated Chargeable Income Eci And Paying Estimated Taxes Ace Global Accountant

How To Fill Tables 4 5 And Tables 10 11 In Gstr 9

Www Revenue Ie En Tax Professionals Documents Notes For Guidance Tca Part05 Pdf

Malaysia Personal Income Tax Guide Ya 19

The Effects Of Inheriting A Promissory Note On Your Income Taxes Finance Zacks

Pdf Is The Dual Income Tax A Real Alternative To Traditional Income Taxes

Taxation Our World In Data

Gst Benefits Know About Advantages Disadvantages Of Gst

Departmental Interpretation And Practice Notes No 39 Profits Tax Treatment Of Electronic Commerce Pdf Free Download

/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

Financial Statements Definition

Not For Profit Organizations Government And Nonprofit Accounting Lecture Notes Docsity

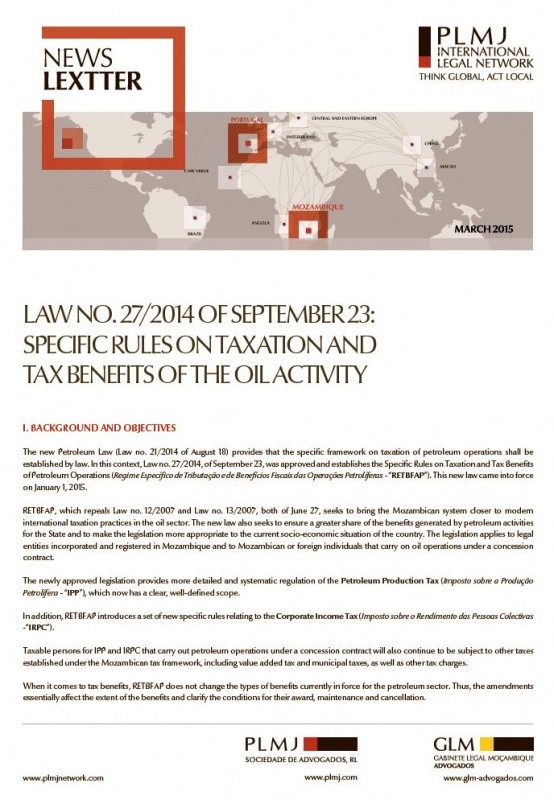

Specific Rules On Taxation And Benefits Of The Oil Activity Informative Notes Knowledge Plmj Transformative Legal Experts

Income Tax In India Wikipedia

Http Www Taxpolicycenter Org Sites Default Files Publication Professor Shay Got It Right Treasury Can Slow Inversions Pdf

Notes On Tax Planning Services By Alexagabriel Issuu

Explanatory Notes For Completion Of Form Ir8a Appendix 8a Iras

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Free Quarterly Tax Payment Calculator Acuity

Mlc301 Lecture Notes Spring 18 Lecture 10 Indirect Tax Double Taxation Fringe Benefits Tax

Page 6 Forms Ok Gov Oklahoma Digital Prairie Documents Images And Information

Http Asburylawfirm Com New Wp Content Uploads 13 04 15 Tnt 66 1 Boyle Article Pdf

Www Revenue Ie En Self Assessment And Self Employment Documents Form11 Helpsheet 15 Pdf

Basic Accounting Note For Beginners Notes

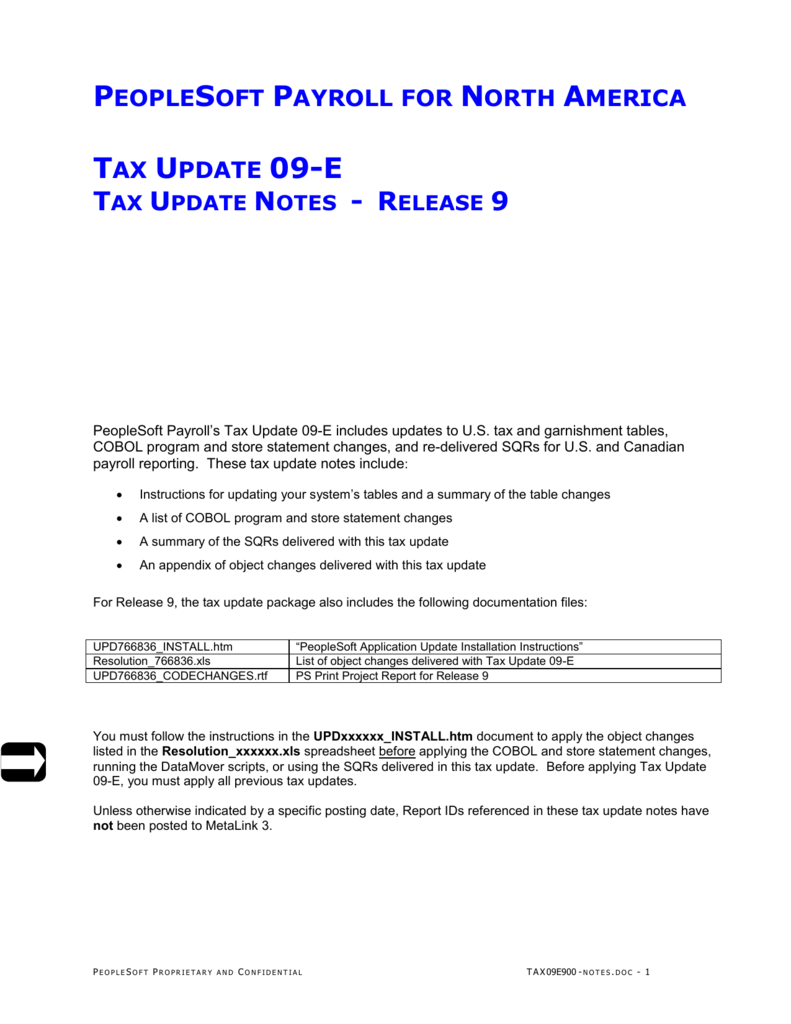

Tax09e900 Notes

Www Jstor Org Stable

2

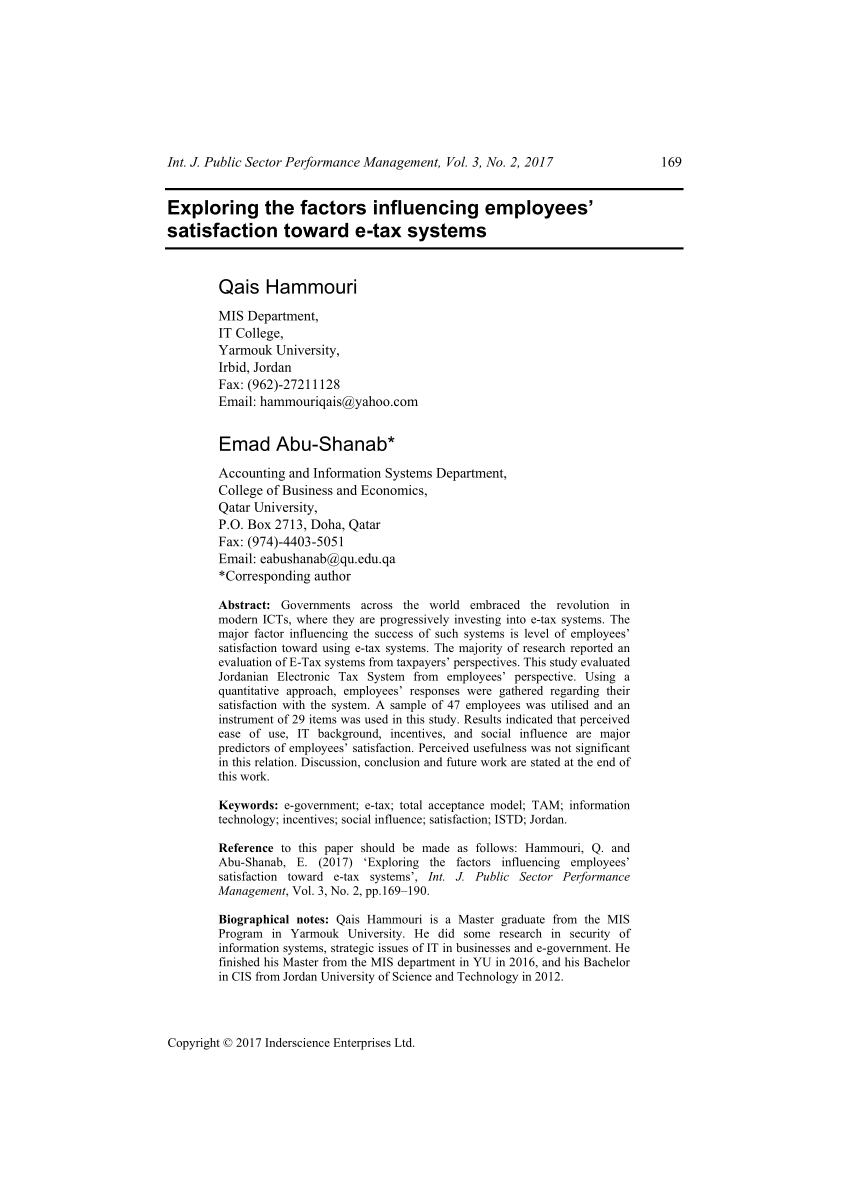

Pdf Exploring The Factors Influencing Employees Satisfaction Toward E Tax Systems

Www Ok Gov Tax Documents Lr 13 058 Pdf

Notes On Income Tax Laws Telecommunication Tc7 Studocu

Www Cityofberkeley Info Clerk City Council 18 06 June Documents 18 06 26 Item 44 Borrowing Of Funds And The Sale Aspx

Explanatory Notes For Completion Of Form Ir8a Iras

Methodology For Paying Taxes

2

Itr 1 Filing Itr 1 For Fy18 19 Asks For Interest Income Break Up From Tax Payers

Tax Incentives For Film Production Informative Notes Knowledge Plmj Transformative Legal Experts

No 39 Of 1997 Section 118 Revenue Information Note

Itr 1 For City College Lecture Notes 1 Crpc 11 Studocu

Your Bullsh T Free Guide To Self Assessment Taxes In Ireland

Www Jonesday Com Media Files Publications 1 01 Bonus Questions On The New Bonus Depreciation Rule Files 160tn0457nugentpdf Fileattachment 160tn0457nugent Pdf

Www Parisschoolofeconomics Eu Img Pdf Victor Pouliquen Digital Transformations Pdf

Taxation Ii Notes

Www Brookings Edu Wp Content Uploads 16 06 tax Pdf

Taxation Our World In Data

E Cigarette Taxation Pre Pregnancy And Pre Natal Smoking And Birth Outcomes Vox Cepr Policy Portal

Income Tax Department Asks Taxpayers To E Verify Deposits Post Note Ban The Economic Times

Taxation Our World In Data

Indian Trusts Act Objectives Registration Taxation

Tax Filing And Payment Guidelines During The Enhanced Community Quarantine Period Updated As Of April 1 Grant Thornton

Oecd Ilibrary Home

Www Hodgsonruss Com Media Publication 129 12 10 The Multistate Tax Quandary For Professional Athletes Pdf

Fin 502 Textbook Notes Summer 13 Chapter 8 Human Resources Trust Law Government Communications Headquarters

Taxation Of Companies Taxation Managment Lecture Notes Docsity

Mountainscholar Org Bitstream Handle 0055 Agws3 0508 11 Pdf Sequence 1 Isallowed Y

Pdf The Benefit And Sacrifice Principles Of Taxation A Synthesis