E Taxation

Pdf Impact Of E Taxation On Nigeria S Revenue And Economic Growth A Pre Post Analysis Dr Leonard I Amaefule Academia Edu

E Accounts E Taxation E Gst Practical Training Course

Internet Taxation And E Retailing Law In The Global Context Business Management Books Igi Global

Introduction E Taxation

E Accounts E Taxation Training Accounting Course Training Services Sla Consultants India Delhi Id

Best E Taxation Training Institute In Noida E Accounts E Taxation Training Course Laxmi Nagar Delhi Gurgaon

You may be one of them.

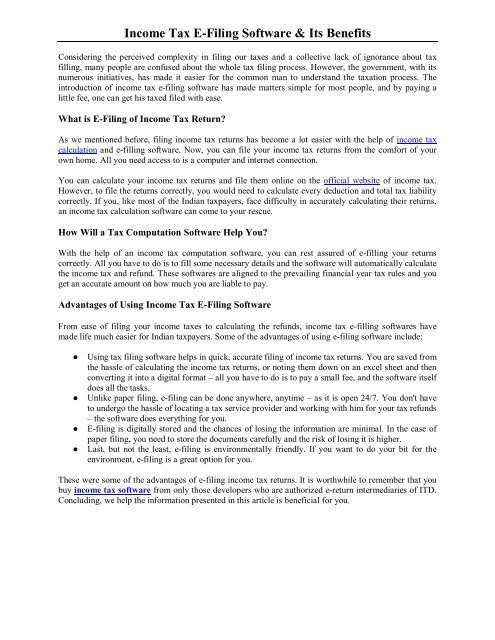

E taxation. However, don't use EFW to make federal tax deposits. Choose to pay directly from your bank account or by credit card. Guidelines for electronic W-2s and 1099s.

Challan No./ITNS 281:- Payment of TDS/TCS by Company or Non Company. Log on to e-filing portal at https://incometaxindiaefiling.gov.in. تفيدكم وزارة المالية عن وضعها برنامج ال Excel ،(يُطلب اعتماده عوضًا عن البرنامج السابق بسبب إدخال بعض التعديلات عليه)، يتضمَّن النماذج (ر5,ر6,ر7) على الموقع الخاص بها، يمكن تحويله إلى XML وتحميله بهدف تقديم النماذج المذكورة.

(This 1099-G form is for taxpayers who itemized deductions and received a refund, credit or offset). View Balances and Expectations. E-Filing Home Page, Income Tax Department, Government of India.

Qualysoft provides support using elaborate e-government solutions for electronic tax administration, automated document composition and legal database systems. E-Tax is the online portal provided by the Inland Revenue Division (IRD) for taxpayers to manage their tax accounts online. EAs must be current with their own tax returns and their taxes due must be paid up and current.

By accessing e-Tax at https://etax.ird.gov.tt in any standard web browser, taxpayers can register to view their accounts, file returns, and correspond with IRD. Before calling us, visit COVID-19 , Tax time essentials , or find answers to our Top call centre questions. New Jersey Division of Taxation, 2nd Quarter Estimated Payments Still Due on June 15, Estimated tax payments for the 2nd quarter are still due on June 15 for both Income Tax and Corporation Business Tax taxpayers.

Virginia Tax Online Services for Businesses. E-Tax is safe, secure, easy, convenient, and free. One among the question faced by nations is how to tax it.

Beginning September 8, DOR is encouraging all current customers to migrate to the new and enhanced Indiana Tax Information Management Engine, INTIME. Indiana Department of Revenue is launching a new e-services portal to manage your corporate and business tax obligations. At the other extreme, there has been specu-.

Use Sales Tax Web File to schedule payments in advance, save your bank account information for future payments, and receive instant confirmation when we receive your return. What tax administrations have to do is exploit the technology available to improve taxpayer service and at a lower cost. So taxation of e-commerce is a normal part of the accepted pattern of how our countries operate.

Lodging online with myTax is the quick, easy, safe and secure way to prepare and lodge your own tax return. E-Taxation Through Online Banking Pay your taxes to The Ministry of Finance through Fransabank Online Banking Settle your Ministry of Finance taxes directly from your bank account through Fransabank Online Banking in a secure, easy and speedy way. 2nd Quarter Estimated Payments Still Due on June 15, Estimated tax payments for the 2nd quarter are still due on June 15 for both Income Tax and Corporation Business Tax taxpayers.

To the extent taxes are not covered by withholdings, taxpayers must make estimated tax payments, generally quarterly. Your vehicle log book (V5C) - it must be in your name. Enrollment for tax year 21 will begin on October 1,.

Tax may be withheld from payments of income (e.g., withholding of tax from wages). An enrolled agent is the highest tax professional designation recognized by the IRS. EForms are a fast and free way to file and pay state taxes online.

3 minutes to file taxes online. Enrolled agents (EAs) must pass a three-part exam or have worked for the IRS for no less than five years in a position that requires extensive knowledge of the tax code. What is E-Taxation System?.

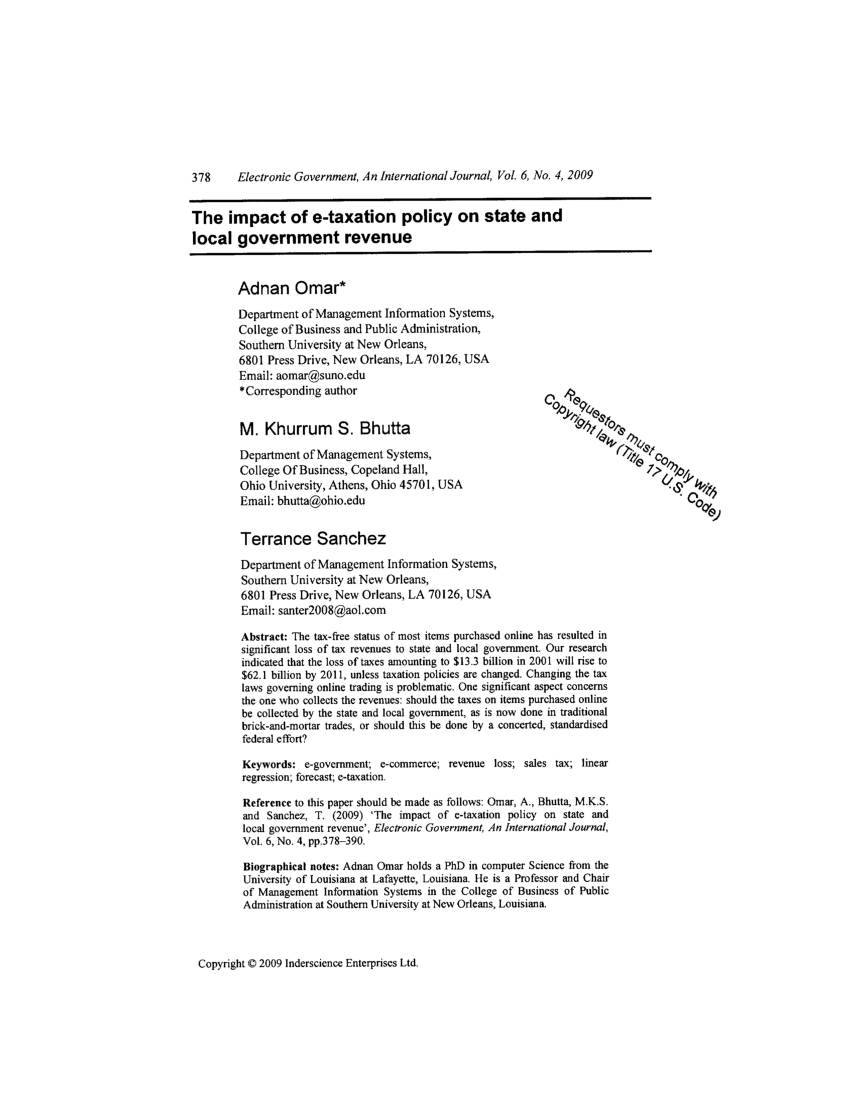

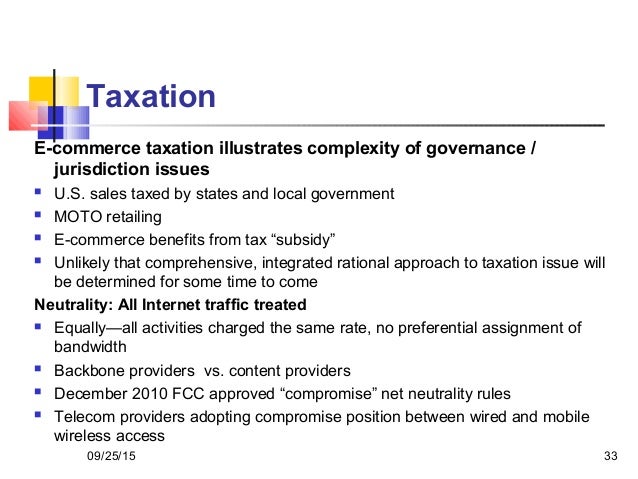

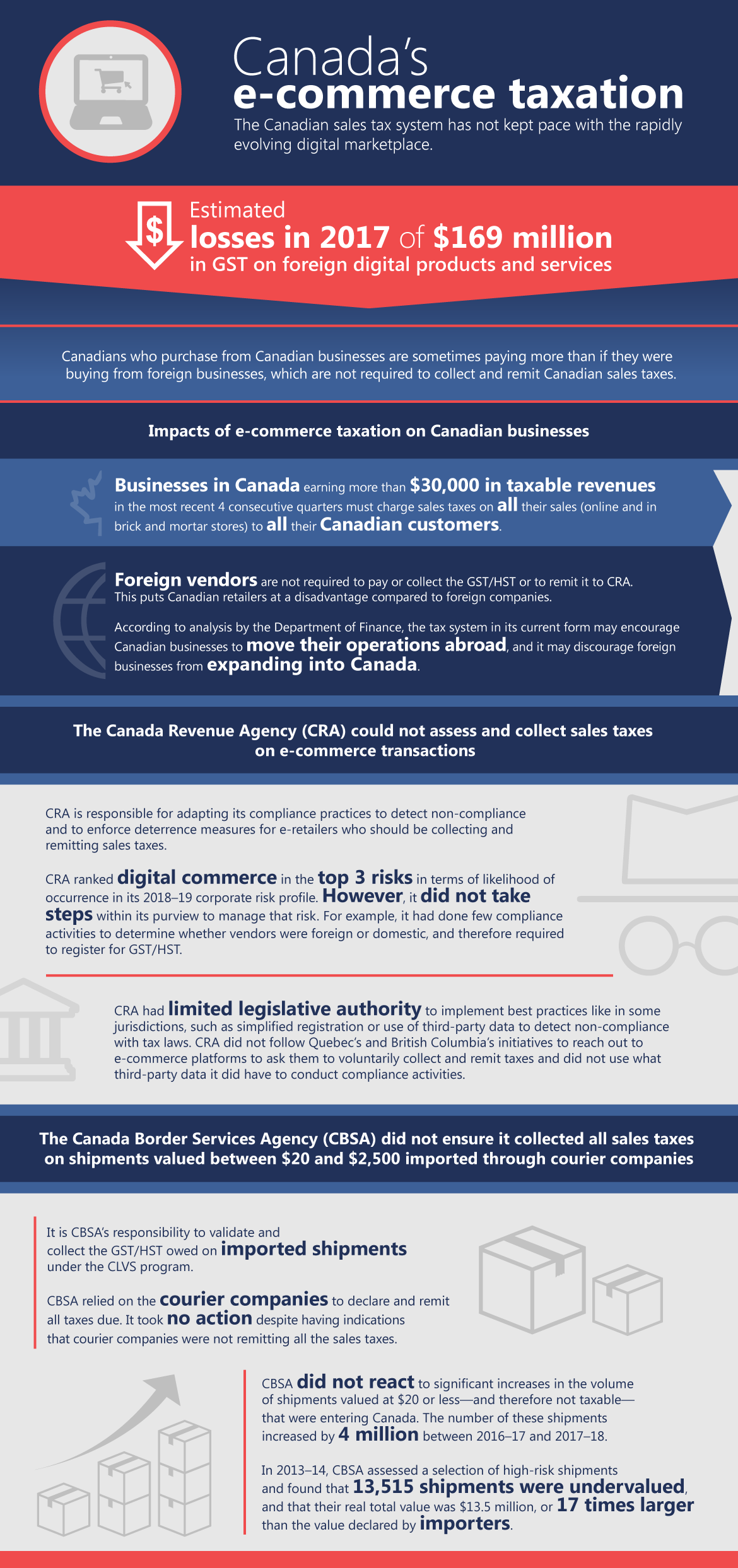

E-commerce makes many aspects of starting a business simpler, but sales tax isn't one of them. Sales Tax Increase in Central Virginia Region Beginning Oct. E-Commerce and Taxation E-commerce occurs in various forms and between various entities in the market.

To learn more about the differences between the GET and sales tax, please see Tax Facts 37-1, General Excise Tax (GET). Any 2nd quarter payments made after June 15 will be considered late and may be subject to interest charges. E-Taxation means trans-organizational processes with data transfer (upload and download) between the IT systems of the professionals and those of the tax authorities.

Service provider fees may. Taxation is a term for when a taxing authority, usually a government, levies or imposes a tax. Each year, around 98 per cent of all tax declarations in Estonia are filed electronically.

Select an eForm below to start filing. E-Taxation Up-to-date financial administration thanks to innovative IT systems:. It can occur when income is taxed at both the corporate level and personal level.

The tax rate is 0.15% for Insurance Commission, 0.5% for Wholesaling, Manufacturing, Producing, Wholesale Services, and Use Tax on Imports For Resale, and 4% for all others. (The new tax would be in addition to the existing tax described above.) The proposed tax would go into effect on January 1, 21. 1, Starting Thursday, Oct.

With refund options this year, you can also choose to direct deposit part or all of your refund into a myRA® account. A recent reminder (V11) or ‘last chance’ warning letter from DVLA;. Ments will adopt towards the taxation of e-commerce in this new complex environ-ment.

At one extreme, there was the view that e-commerce should in some sense be allowed to take place in a tax-free environment – either by specific legislation or by continued government inaction. Tax your car, motorcycle or other vehicle using a reference number from:. From registration of taxpayers and filing of tax returns through to complete account management, all.

This type of tax was mentioned in a 1999 report by the United Nations Development Program entitled "Globalization With a Human Face", as a type of bit tax which. Your online store is basically open for business in 50 states, each with a unique set of sales tax laws. If you haven't filed or paid taxes using eForms and need more information, see:.

New Tax on E‑Cigarettes. Challan No./ITNS 280:- Payment of Advance tax, Self-Assessment tax, Tax on Regular Assessment, Surtax, Tax on Distributed Profits of Domestic Company and Tax on Distributed income to unit holders. E-Tax is the electronic tax filing system set up by the Estonian Tax and Customs Board.

E-Tax is a free service offered by the Inland Revenue Division that allows you to manage your taxes online. The proposal also includes a one‑time tax on e‑cigarette. MyRA is a new retirement account from the United States Treasury.

Electronic Payment Guide (pdf) - for EFT details and ACH Credit. E-file's online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Definition of E-Taxation System:.

The Internal Revenue Service provides dozens of tax schedules to report income and losses from every conceivable type of business or financial activity. In 14, Income Tax Department has identified additional 22,09,464 non-filers who have done high value transactions. High call volumes may result in long wait times.

On 28 October , the European Commission adopted further measures in the area of taxation and customs to tackle the ongoing coronavirus pandemic. As the internet crosses the boundaries the main challenges are how can the basic requirements of physical presence and substantial nexus criteria of taxation can be met. E-taxation is an electronic self-service platform that enables taxpayers to file their tax returns and conduct other tax services online at their convenience irrespective of their locations once internet is available.

This system looks at how tax payment can be encouraged through simplification and increased. The Governor has proposed a new state tax on e‑cigarettes with the stated goal of reducing youth use of e‑cigarettes. Register Here Register as a Household Employer.

Documents and payment must be placed in a sealed envelope that clearly identifies a point of contact's name, email, and phone number, and all filings must include payment for the $425 expedited fee i n addition to the base filing fe e. What Is Schedule E in Taxation?. Type of taxes you can settle online:.

E-mail tax E-mail tax is a specific type of bit-tax, which would tax based on volume of email sent or received, quantified either by number of messages or data size of the messages. Double taxation is a tax principle referring to income taxes paid twice on the same source of income. The Department of Taxation’s (DOTAX) has many electronic services (e-services) that allow you to self-serve.

Taxes Site - Michigan Taxes, tax, income tax, business tax, sales tax, tax form, 1040, w9, treasury, withholding. Taxpayers now can search for their 1099-G and 1099-INT on the Georgia Tax Center by selecting the "View your form 1099-G or 1099-INT" link under Individuals. In 13, Income Tax Department issued letters to 12,19,2 non-filers who had done high value transactions.

Commission puts forward taxation and customs measures to support access to more affordable equipment, vaccines and testing kits. E-file mandate Business tax e-file mandates for partnership, sales and corporation tax filers. It's not the "end of government" we should be talking about, but the emergence and development of "e-government".

Scroll through this webpage to learn more about what services DOTAX offers online. If you are not registered with the e-filing portal, use the 'Register. Schedule E is used to report income from rental properties, royalties, partnerships, S corporations, estates, trusts, and residual interests in REMICs.

1, , the sales and use tax rates go up by 0.7% for a total of 6%. To pay a bill, an estimated payment, an extension payment, or a payment for return that would normally be sent with a Form 7V voucher for an e-filed return for your Corporation Income Tax and/or Limited Liability Entity Tax (LLET):. Any 2nd quarter payments made after June 15 will be considered late and may be subject to interest charges.

Tax returns are subject to review and adjustment by taxing authorities, though far fewer than all returns are reviewed. Account Type TAX VEC:. Once processed, an email will be sent to the point of contact and if approved, the acknowledgement letter.

E-Tax gives the customers of the Inland Revenue Division online access to their tax accounts and related information. Register as a Tax Preparer. Our program works to guide you through the complicated filing process with ease, helping to prepare your return correctly and if a refund is due, put you on your way to receiving it.Should a tax question arise, we are always here help and are proud to offer qualified online tax support to all.

The Employer Compensation Expense Program (ECEP) established an optional Employer Compensation Expense Tax (ECET) that employers can elect to pay if they have employees that earn over $40,000 annually in wages and compensation in New York State. Information about Schedule E (Form 1040 or 1040-SR), Supplemental Income and Loss, including recent updates, related forms, and instructions on how to file. Once you log in, you can:.

Trans-organizational processes with data transfer between the IT systems of the professionals and those of the tax authorities. The excise tax is based on net earnings or income for the tax year. Register with VEC Only iFile Login.

The E-taxation is not a new system, but a rather local solution to a problem with global purview. Challan No./ITNS 2:- Payment of Securities transaction tax, Estate duty, Wealth-tax, Gift-tax, Interest-tax, Expenditure/other. Enroll in Business iFile to establish your User ID and Password Are you a new Business?.

For Individuals, the 1099-G will no longer be mailed.

Pdf E Taxation In Mongolia Current State Lessons Learnt And Future Challenges

Modern Financial Management With Innovative It Systems

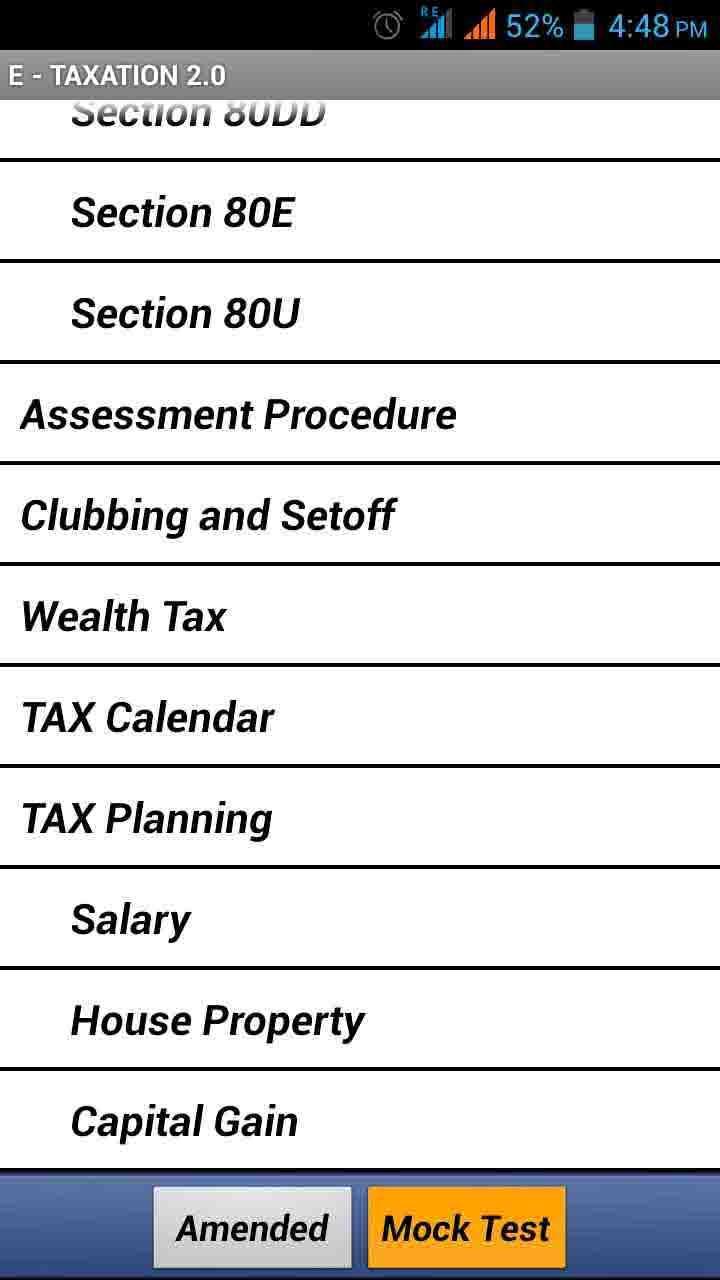

E Taxation For Android Apk Download

Pdf Taxation Of Electronic Commerce A Developing Problem

Estonian E Residence And Taxation No More Tax

Workshop On Salary Taxation E Filing Of Income Tax Return Movenpick Hotel Karachi 15 October

Auditing E Taxation Taxes Audit

Discount Accounting Course Best Taxation Training Laxmin Nagar Delhi

Webinar E Taxation Project Electronic Tax Payment Club Of Mozambique

Finance Ministry Rolls Out E Taxation System Invest Gate

Effect Of E Taxation On Revenue Generation In Anambra State

Design And Development Of An E Taxation System Semantic Scholar

Heinonline Org Hol Cgi Bin Get Pdf Cgi Handle Hein Journals Naujilj7 Section 12

Clutejournals Com Index Php Iber Article Download 34 3938

Complexity And Taxability Of E Commerce Taxation

Pdf E Taxation An Introduction To The Use Of Taxxml For Corporate Tax Reporting

Challenges Of Taxation Of E Commerce In Ethiopia Mekonnen Yonas Amazon Com Books

Report 3 Taxation Of E Commerce

Bidacus A Big Data Analytics Platform For E Customs And E Taxation European Dynamics

Latest Projects Saral Tax Book Service Provider From Ahmedabad

Pdf The Importance Of E Taxation On E Commerce And Evaluation Of Value Added Tax Applications On E Commerce In Turkey

Gst Services Income Tax By E Taxation Kokarajhar

E Taxation Accounting Hub

Fillable Online Tic Ac E Taxation 100 Questions With Answers Feb Tic Ac Fax Email Print Pdffiller

Taxation Of E Commerce Theoretical View Racolb Legal

Lebanese Ministry Of Finance Bolsters Digital Transformation With Hpe Hyper Converged 380 Ministry Scales E Taxation Service With Hyperconverged Solution

E Commerce Taxation And Cyberspace Law The Integrative Adaptation Model By Rifat Azam Dr

Prevent E Commerce Taxation From Taxing The Customer Experience

Issues In Taxation Of E Commerce In Nigeria The Gravitas Review

Webinar How To Use The E Taxation Platform Club Of Mozambique

Institute Of E Accounts Taxation Home Facebook

E Taxation By Shivam Gupta

Business E Accounting E Accounts E Taxation Courses Classes Short Term Courses Training Certificate Practical Tr Training Certificate Training Courses Train

E Taxation Training In Noida Best Taxation Income Tax Training Institute Noida Delhi Ncr Trainingclass Org

E Taxation Adoption And Revenue Generation In Nigeria Semantic Scholar

Firs Electronic Tax Clearance Certificates In Line With The E Taxation Of Things

Http Www Univie Ac At Ri Iris07 Papers Weiss Pdf

E Taxation Diploma In Web Programming Service Provider From Navi Mumbai

Effect Of E Taxation On Revenue Generation In Anambra State

Pdf Evaluation Of E Service Quality Through Customer Satisfaction A Case Study Of Fbr E Taxation

Discount Accounting Course Sla Dehi

Pdf Design And Development Of An E Taxation System Ernest Onuiri Academia Edu

Tax Benefits Of E Commerce In China Scientific Net

Ppt Taxation Issues Involving E Commerce Powerpoint Presentation Free Download Id

E Commerce Taxation A Peer Reviewed Academic Articles Gbr

E Taxation India Home Facebook

Pdf E Tax Services And Their Evolution The Case Of Slovenia

Quick Overview Of Taxation On E Commerce Robby Bobby

Taxation Ii Notes

Join Talent Magnifier For E Account Training Course E Taxation Training Course In New Delhi Accounting Training Accounting Course Accounting

Income Tax Is Receiving Money From Friend Through E Wallet Taxable

Figure1 The Evaluation Framework For E Taxation Services Download Scientific Diagram

Design And Development Of An E Taxation System Semantic Scholar

Taxation And E Commerce The Interesting Business Of Taxing Online Businesses In Nigeria African Academic Network On Internet Policy noip

1 Taxes 03 Kpmg E Taxation Opportunities

Q Tbn 3aand9gcrlmtmmnse97ulugrwllalg1vldd55sfhponncgj79pt1rupo4a Usqp Cau

Pdf The Effect Of E Taxation System On Tax Revenues And Costs Turkey Case

About

E Taxation Accounting Hub Kolaghat Income Tax Consultants In Midnapore Justdial

E Taxation By Jin Thiranuthi

E Taxation Accounting Hub Kolaghat Income Tax Consultants In Midnapore Justdial

Fransabank E Taxation Through Online Banking

Point Of Taxation Rule 2 E Of Service Tax

E Commerce And Taxation Final Editing

Income Tax E Filing Software Its Benefits

Pdf The Impact Of E Taxation Policy On State And Local Government Revenue

Discount Accounts Taxation Course Noida Sap Tally

E Commerce Trade Taxation And Wto Moratorium On Electronic Transmissions Etrade For All

Pdf Design And Development Of An E Taxation System

E Taxation Hub Home Facebook

E Taxation

Vietnam Taxation Of E Commerce Withholding Rules Effective In 21 Global Vat Compliance

E Commerce Ppt

Solved 3 Optimal Commodity Taxation Consider An Economy W Chegg Com

International Taxation Of Electronic Commerce Westin Richard Amazon Com Books

E Commerce And Taxation Final Editing

E Taxation By Rishabh Kumar

P O D S E Taxation Associates Temporary Closed Down Durganagar Tax Consultants In Kolkata Justdial

Viet Capital Bank To Introduce E Taxation Service

The Factors Influencing Taxpayers Acceptance Of E Taxation System Business Management Book Chapter Igi Global

Part 2 How Southeast Asian E Commerce Taxes Could Pan Out On An International Scale The Asean Post

E Taxation Training Home Facebook

E Taxation Home Facebook

E Commerce And Taxation Final Editing

Income Tax What Are The Good Taxation Courses In India Quora

Tax By Manish Free E Taxation Android App For Mobile Tax Payers Users

Effect Of E Taxation On Revenue Generation In Anambra State

Buy E Commerce Taxation Prospects And Challenges Book Online At Low Prices In India E Commerce Taxation Prospects And Challenges Reviews Ratings Amazon In

E Taxation System In Mozambique The Ismaili

E Accounting Training E Taxation With Free Sap Course Accounting Training Accounting Training Courses

Oecd Recommendations On E Commerce Taxation By

Grace E Taxation Academy Home Facebook

Taxation Of E Commerce Infographic

Pdf Taxation Of Electronic Commerce A Commentary

The Nature And Procedure Of E Taxation Nova Magazine Find Your New Favorite Page